RIVIAN (#RIVIAN) weekly special report based on 1 Lot Calculation:

INDUSTRY: ELECTRIC VEHICLES (EV)

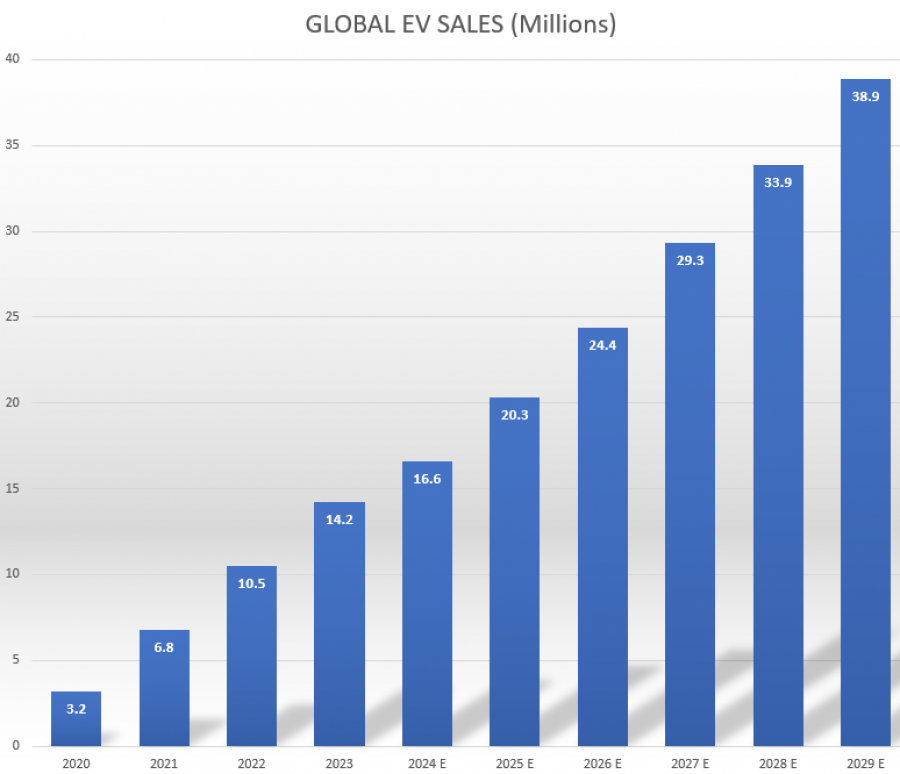

- EV SALES GROWTH (2019 – 2023): 50% OF AN AVERAGE ANNUAL GROWTH RATE. The market managed to increase sales of EVs by 50% a year on average in the perod of 5 years between 2019 to 2023. Only in 2023, the EV sales globally rose by 35%. (DATA SOURCE: EV-VOLUMES.COM)

Please note that past performance does not guarantee future results.

- EXCPECTATIONS: EV SALES GROWTH (2024- 2028): 19% OF AN AVERAGE ANNUAL GROWTH RATE. The market could be expected to increase sales by 19% on average per year for the next 5 years including 2024. Only in 2024, the EV sales are expected to grow by 17%. (DATA SOURCE: EV-VOLUMES.COM)

DATA SOURCE: EV-VOLUMES.COM

RIVIAN: THE COMPANY

- RIVIAN produces electric Sport Utility Vehicles (SUV) and PickUp trucks. They also deliver Vans (Rivian EDV) for Amazon. For the time being, Rivian is delivering the R1T PickUp and the R1S SUV. They will soon start delivering more advanced SUVs, R2 and R3.

- CAR DELIVERY: Rivian delivered 13,790 vehicles in Q2 of 2024, up from the 13,588 it deliverd in Q1 of 2024. The company is expected to produce 57,000 vehicles in 2024, similar to 2023’s 57,232.

- PRODUCTION CAPACITY: Rivian maintans production capacity of 150,00 vehicles a year. This is expected to expand to 215,000 by the end of 2026.

- FIRST GROSS PROFIT EXPECTED: Q4 2024. During its first “Investor Day”, Rivian gave an insight into the company’s future. Rivian reaffirmed it expects its first gross profit in Q4 2024.

RIVIAN: EVENTS AND ANALYSIS

- EVENT (Tuesday, August 6, Aftermarket): Q2 EARNINGS REPORT. Rivian is expected to print 1.042 billion dollars in revenue for Q2 of 2024. The Rivian’s annual revenue has been growing since 2021. In 2021, Rivian had a revenue figure of 55 million dollars, while already in 2023 the company raked in 4.43 billion dollars in revenue. They have beat quarterly earnings estimates 5 times over the past 8 quarters, and it has beat quarterly revenue estimates 6 times over the past 8 quarters.

Please note that past performance does not guarantee future results.

- RIVIAN EDV: VANS. Around 20% of current revenue comes from selling the Rivian EDV to Amazon. Earlier, Amazon announced a partnership with Rivian to bring 100,000 electric delivery vehicles on the road by 2030.

- AMAZON: THE LARGEST SHAREHOLDER OF RIVIAN WITH 16.6% OF STAKE IN THE COMPANY. Amazon has remained a supporter of Rivian, which is positive for the rest of the shareholders, having in mind that Amazon is one of largest company in the world with annual revenue of more than 500 billion dollars.

RIVIAN: NEWS

- RIVIAN AND VOLKSWAGEN ANNOUNCED PLANS FOR JOINT VENTURE (June 25, 2024). The German Volkswagen said it will invest 5 billion dollars in Rivian. They will work on the next generation software- defined vehicle platforms. Both Rivian and Volkswagen will be using the new platforms in their future electric vehicles.

RIVIAN: STOCK PRICE ACTION

- THE STOCK HAS TRADED AROUND 91% BELOW ITS ALL- TIME HIGH OF $179.47 (2021). Rivian was last trading around $16, and if a full recovery follows to its all- time highs, the stock could see an upside of around 1000%. Rivian hit an all-time low of $7.77 on April 14, 2024. The price could decline further.

- ANALYSTS OPINION: Canaccord forecasts $30. BNP Paribas forecasts $25. Piper Sandler forecasts $21. Wedbus forecasts $20.

#RIVIAN, July 12, 2024

Current Price: 16.30

|

RIVIAN |

Weekly |

|

Trend direction |

|

|

40 |

|

|

30 |

|

|

22 |

|

|

12 |

|

|

10 |

|

|

9 |

Example of calculation based on weekly trend direction for 1 Lot1

|

RIVIAN |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

23,700 |

13,700 |

5,700 |

-4,300 |

-6,300 |

-7,300 |

|

Profit or loss in €2 |

21,786 |

12,594 |

5,240 |

-3,953 |

-5,791 |

-6,710 |

|

Profit or loss in £2 |

18,330 |

10,596 |

4,408 |

-3,326 |

-4,872 |

-5,646 |

|

Profit or loss in C$2 |

32,277 |

18,658 |

7,763 |

-5,856 |

-8,580 |

-9,942 |

1. 1.00 lot is equivalent of 1000 units

2. Calculations for exchange rate used as of 09:30 (GMT+1) 12/07/2024

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.