TREND EXPECTATIONS: UP

STOCKS: ALIBABA, NIO, XPENG, BAIDU, WEIBO

WHAT HAPPENED?: China main stock index HANG SENG recovered by around 18% after hitting its lowest rate since 2016.

The China’s stock market recovered earlier this week in a sign that the worst may be over for the battered Chinese stocks. The stock markets recovered on promises by the Central Government that they will help the capital markets in China, along with the stock markets, and that they will soon end the process of regulation within the Tech Sector that has put big negative pressure on large tech companies such as Alibaba.

- Central Government Promised to Support the Stock and Capital Markets in China

The Central Government will provide market-friendly policies and keep the capital market running smoothly, something that can come in the form stimulus. A few weeks ago, when the Chinese stocks also fell considerably, the Chinese state fund said that they themselves will buy the falling stocks.

- Central Government to Support China Stocks That Trade on Foreign Stock Exchanges

Some Chinese stocks that trade on the US Stock Exchange faced risks of delisting after the US Security and Exchange Commission (SEC) complained that those companies did not comply with the US accounting rules. That has put a lot of Chinese stock under negative pressure, losing much of their market value. However, China’s Vice Premier Liu He said that they are having positive talks with the US SEC, trying to overcome those issues, reducing the risk of delisting.

- Central Government Clarified That Will Soon End Regulation (Crackdown) of Big Tech Industry

Meanwhile, the Central Government said that all the efforts to regulate the Big Tech industry in China will soon be over, meaning that the uncertainties and risks related to it will be eliminated, leaving room for investors to regain confidence and invest back in the most valuable and attractive companies in China.

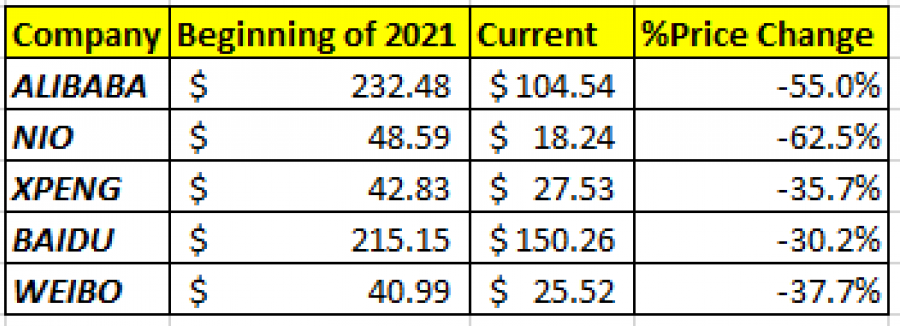

WHY DOES IT MATTER?: Due to the above mentioned issues the Chinese stock collectively have fallen significantly since the beginning of 2021. Table I below illustrates how big impact the above described issues have had on some Chinese stocks.

Table I: Selected China stock that have fallen since the beginning of 2021

Data Source: Bloomberg

SELECTED CHINESE STOCK TRADING ON THE US STOCK EXCHANGE

- ALIBABA (#ALIBABA) Current Price: $102

ALIBABA is the largest e- commerce company in China and the second largest in the world, behind Amazon. The Bloomberg Consensus maintained a Price Target of $169.57 a share.

Example of calculation based on weekly trend direction for 1.00 Lot1

|

ALIBABA |

||||||

|

Pivot Points |

||||||

|

Levels |

169 |

140 |

125 |

80 |

75 |

70 |

|

Profit or loss in $ |

67,000.00 |

38,000.00 |

23,000.00 |

-22,000.00 |

-27,000.00 |

-32,000.00 |

|

Profit or loss in €2 |

60,670.82 |

34,410.32 |

20,827.30 |

-19,921.76 |

-24,449.43 |

-28,977.11 |

|

Profit or loss in £2 |

50,857.75 |

28,844.69 |

17,458.63 |

-16,699.56 |

-20,494.91 |

-24,290.27 |

|

Profit or loss in C$2 |

84,805.92 |

48,098.88 |

29,112.48 |

-27,846.72 |

-34,175.52 |

-40,504.32 |

- 1.00 lot is equivalent of 1000 units

- NIO (#NIO) Current Price: $18.10

NIO is one of the largest Electric Vehicle maker and big competitor to Tesla in China. The company has already rolled out more than 5 modes to conquer bigger global market share. The Bloomberg Consensus maintained a Price Target of $50 a share.

Example of calculation based on weekly trend direction for 1.00 Lot1

|

NIO |

||||||

|

Pivot Points |

||||||

|

Levels |

50.00 |

35.00 |

25.00 |

14.00 |

12.50 |

11.00 |

|

Profit or loss in $ |

31,900.00 |

16,900.00 |

6,900.00 |

-4,100.00 |

-5,600.00 |

-7,100.00 |

|

Profit or loss in €2 |

28,886.55 |

15,303.54 |

6,248.19 |

-3,712.69 |

-5,070.99 |

-6,429.30 |

|

Profit or loss in £2 |

24,214.36 |

12,828.30 |

5,237.59 |

-3,112.19 |

-4,250.80 |

-5,389.40 |

|

Profit or loss in C$2 |

40,377.74 |

21,391.34 |

8,733.74 |

-5,189.62 |

-7,088.26 |

-8,986.90 |

- 1.00 lot is equivalent of 1000 units

- XPENG (#XPENG) Current Price: 25.50

XPENG is also a competing Electric Vehicle maker in the US, which slowly but surely takes the lead in China in terms so monthly car delivery data. The Bloomberg Consensus maintained a Price Target of $61.75 a share.

Example of calculation based on weekly trend direction for 1.00 Lot1

|

XPENG |

||||||

|

Pivot Points |

||||||

|

Levels |

61.75 |

45.00 |

34.00 |

18.00 |

16.50 |

15.00 |

|

Profit or loss in $ |

181,250.00 |

97,500.00 |

42,500.00 |

-37,500.00 |

-45,000.00 |

-52,500.00 |

|

Profit or loss in €2 |

164,128.15 |

88,289.63 |

38,485.22 |

-33,957.55 |

-40,749.06 |

-47,540.57 |

|

Profit or loss in £2 |

137,581.60 |

74,009.41 |

32,260.51 |

-28,465.16 |

-34,158.19 |

-39,851.22 |

|

Profit or loss in C$2 |

229,419.00 |

123,411.60 |

53,794.80 |

-47,466.00 |

-56,959.20 |

-66,452.40 |

- 1.00 lot is equivalent of 5000 units

- BAIDU (#BAIDU) Current Price: $141

BAIDU is the largest Internet search engine in China, competing with Google globally. The Bloomberg Consensus maintained a Price Target of $218.64 a share.

Example of calculation based on weekly trend direction for 1.00 Lot1

|

BAIDU |

||||||

|

Pivot Points |

||||||

|

Levels |

218 |

200 |

180 |

110 |

100 |

90 |

|

Profit or loss in $ |

7,700.00 |

5,900.00 |

3,900.00 |

-3,100.00 |

-4,100.00 |

-5,100.00 |

|

Profit or loss in €2 |

6,972.62 |

5,342.65 |

3,531.59 |

-2,807.16 |

-3,712.69 |

-4,618.23 |

|

Profit or loss in £2 |

5,844.85 |

4,478.52 |

2,960.38 |

-2,353.12 |

-3,112.19 |

-3,871.26 |

|

Profit or loss in C$2 |

9,746.35 |

7,467.98 |

4,936.46 |

-3,923.86 |

-5,189.62 |

-6,455.38 |

- 1.00 lot is equivalent of 100 units

- WEIBO (#WEIBO) Current Price: $22.80

WEIBO is one of the largest social media platforms in China, competing with Twitter or Facebook globally. The Bloomberg Consensus maintained a Price Target of $38.63 a share.

Example of calculation based on weekly trend direction for 1.00 Lot1

|

|

||||||

|

Pivot Points |

||||||

|

Levels |

38.60 |

35.00 |

30.00 |

18.50 |

16.50 |

15.00 |

|

Profit or loss in $ |

15,800.00 |

12,200.00 |

7,200.00 |

-4,300.00 |

-6,300.00 |

-7,800.00 |

|

Profit or loss in €2 |

14,307.45 |

11,047.52 |

6,519.85 |

-3,893.80 |

-5,704.87 |

-7,063.17 |

|

Profit or loss in £2 |

11,993.32 |

9,260.66 |

5,465.31 |

-3,264.00 |

-4,782.15 |

-5,920.75 |

|

Profit or loss in C$2 |

19,999.01 |

15,442.27 |

9,113.47 |

-5,442.77 |

-7,974.29 |

-9,872.93 |

1. 1.00 lot is equivalent of 1000 units

2. Calculations for exchange rate used as of 09:00 (GMT) 17/03/2022

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Client Manager regarding their use.

- You may wish to consider closing your position in profit, even if it is lower than suggested one

- Trailing stop technique can protect the profit – Ask your Client Manager for more detail