Date: January 28, 2022

Metals: Gold, Silver, Palladium, Platinum, Copper

Energy Products: Crude Oil, Brent Oil, Gasoline, Heating Oil

- COMMON FOR COMMODITIES (GOLD, SILVER, OTHER TO BENEFIT TOO): Inflation Hedge.

Inflation in the US rose to the highest in 40 years (7.00%), while the Eurozone inflation rose to 5.00% (its highest since 1991). Inflation in the UK rose to its highest since 1992 (5.4%). In times of high inflation, commodity and energy markets tend to rise as investors buy safe-haven assets such as Gold and Silver to protect their wealth from losing value. Goldman Sachs raised Gold price target from 2000 to 2150. On the other hand, demand for energy products inflates up as business sectors buy more today as they are not sure if tomorrow will be enough. That per se inflates up prices.

- RISING INVESTMENTS IN GLOBAL INFRASTRUCTURE (COPPER, OIL):

The US passed a bill worth 1 trillion dollars to improve infrastructure, while ongoing investments in China only to improve (China grew by 8.1% in 2021). Copper and oil demand in particular to rise.

- IMPROVEMENTS IN GLOBAL CAR INDUSTRY AS CHIP SHORTAGES EXPECTED TO EASE (PALLADIUM, PLATINUM, COPPER)

Analysts believe that the chip shortage saga could end in 2022 and therefore some car manufacturers are now stocking up more Platinum and Palladium while still cheaper so to better prepare for eventual increase in car production rate. Meanwhile, Toyota said that they will produce record 11 million cars in 2022, sending a signal that chip supply issues are about to go away.

- OPEC+ FAILS TO INCREASE OIL SUPPLY ACCORDING TO ITS POLICY DUE TO LACK OF CAPACITY (OIL, GASOLINE, HEATING OIL).

Evidence continues to mount that OPEC and Russia don't have the capacity to continue to add oil according to their policy. They have not invested enough in oil maintenance capex for a number of years. With stronger demand coming, this situation could lead to a structural undersupply going forward. Oil prices move in positive correlation with other petroleum products such as Gasoline and Heating Oil.

- GOLDMAN SACHS: 10-YEAR COMMODITY SUPERCYCLE STARTS WITH MASSIVE INVESTMENTS IN GREEN ENERGY (COPPER, PLATINUM, SILVER)

Supercycles occur after a long period of depression. That was the case in the 2000s after the depression of the 1980s and 1990s. Goldman Sachs says that the biggest beneficiary of the ongoing commodity supercycle are metals, which he has compared to oil in the 2000s thanks mainly to green energy investments. They said that clean energy transition is massive, with nearly all of the world's nations pursuing clean energy goals at the same time, making copper one of the most important commodities of this cycle. COPPER and PLATINUM USE IN GREEN ENERGY: Because COPPER is a highly efficient conduit, it is used in renewable energy systems to generate power from solar, hydro, thermal and wind energy across the world. Copper helps reduce CO2 emissions and lowers the amount energy needed to produce electricity. PLATINUM: The ability to use hydrogen to generate power is garnering a lot of attention as nations worldwide look to create more green energy. Platinum is a critical component used to septate water into hydrogen and oxygen molecules. The hydrogen is then used to power fuel cells.

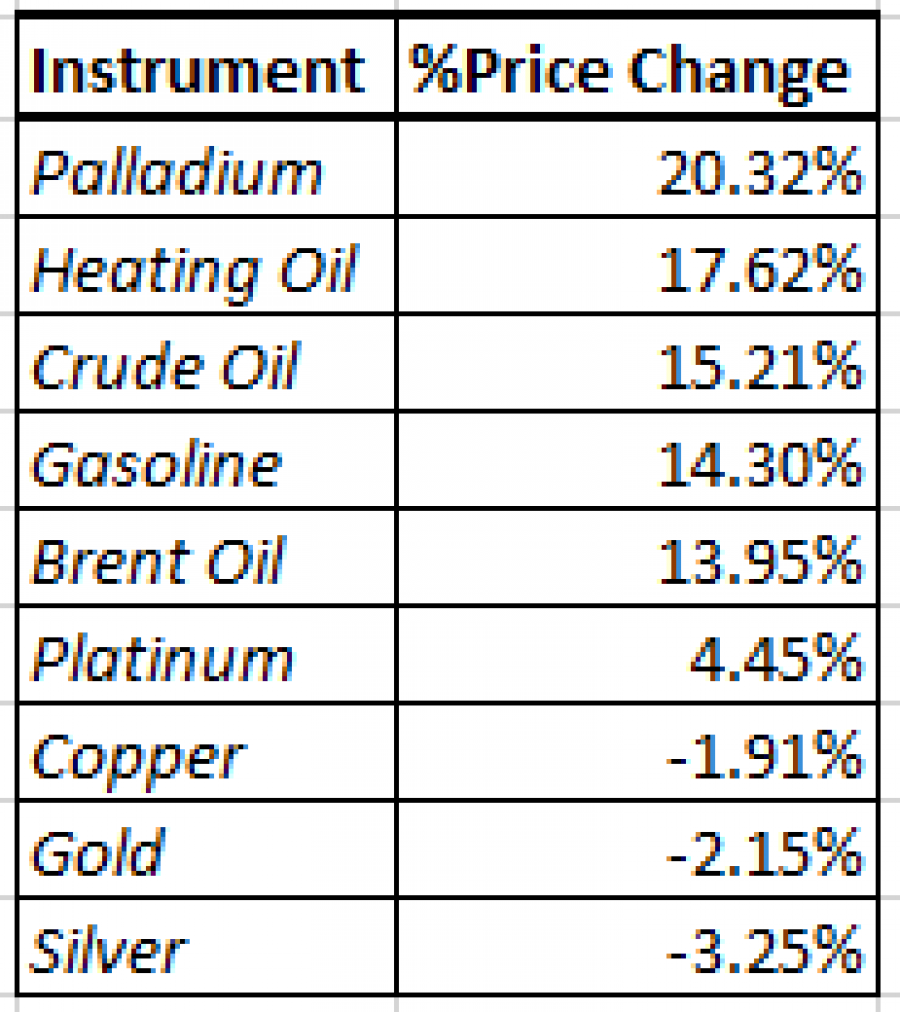

COMMODITY MARKET: METAL AND ENERGY MARKET PERFORMANCE SINCE THE BEGINNING OF 2022

Data Source: Fortrade MetaTrade4