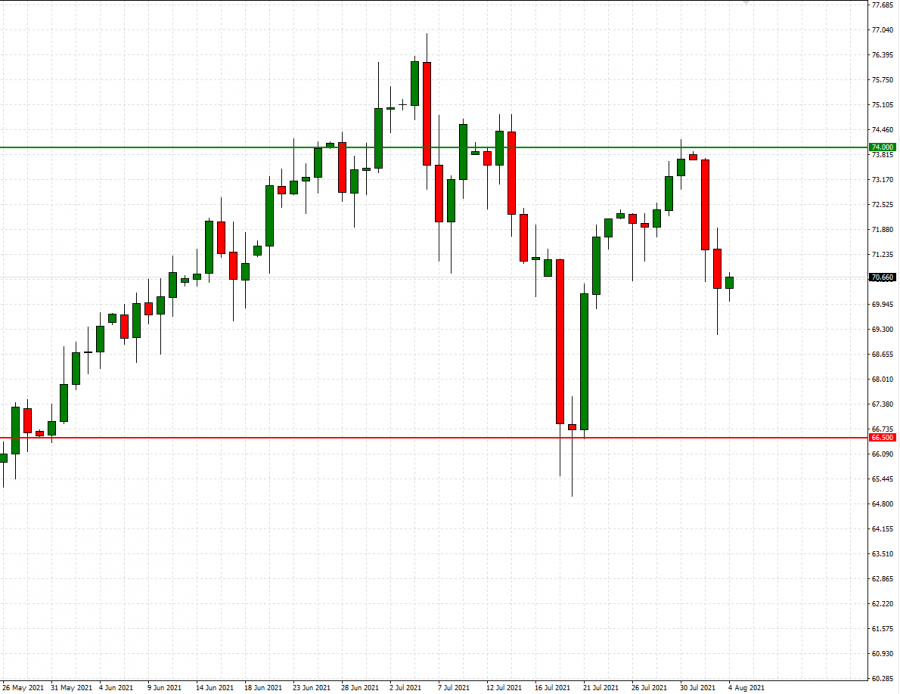

TRADING RANGE: $66.50-$74.00

- MARKET OVERVIEW:

Crude oil has traded around the mark of $70 supported by several positive developments, but its short term upside seemed still under pressure due to rising Covid-19 cases across the world. The points below explain why short term Crude oil could continue to trade in a range between $66.50 and $74.00 a barrel. The anchor value stands at $70.

- POSITIVE ARGUMENTS TO SUPPORT THE OIL PRICES:

VACCINATION PROCESS EXPANDS GLOBALLY WITH 4.21 BILLION DOSES BEING ADMINISTERED SO FAR AT AN AVERAGE DAILY RATE OF 41.9 MILLION DOSES. The expanding vaccination process keeps chances high that more and more countries will reopen, which could increase travelling and therefore fuel consumption could rise. This tends to support oil prices.

US INFRASTRUCTURE BIPARTISAN BILL OF APPROXIMATELY 1 TRILLION DOLLARS HAS BEEN INTRODUCED TO THE US SENATE: Voting will be conducted some time later in the week (August 2-8).

RISING MIDDLE EAST TENSIONS: The U.S. and the U.K. formally blamed Iran for a deadly attack on an Israel-linked oil tanker off Oman (Thursday), warning of an “appropriate response.” “There is no justification for this attack, which follows a pattern of attacks and other belligerent behavior,” Secretary of State Antony Blinken said in a statement Sunday. The standoff comes as the two nations are seeking to revive a nuclear accord that, if successful, may pave the way for an end to U.S. sanctions on official Iranian oil flows.

EXPECTED SUPPLY DEFICIT AT LEAST UNTIL THE END OF 2021. An average supply deficit of about 1 million barrels a day will still persist for the rest of the year, according to OPEC+ data. Forecasters such as Goldman Sachs Group Inc., UBS Group AG and Julius Baer Group Ltd. expect the oil market to tighten. That could send prices back to the two-year high above $77 a barrel seen last week, or even higher.

- NEGATIVE ARGUMENTS TO PRESSURE THE OIL PRICES:

RENEWED LOCKDOWN AND RESTRICTION FEARS DUE TO THE DELTA STRAIN: The latest outbreak in China (the second largest oil consumer in the world after the U.S), caused local authorities in Beijing to advise the citizens to not leave the city. Cases were discovered in several regions as well as in Beijing. In other parts of Asia, Thailand and Indonesia also reported a high number of cases. ISRAEL: Israel's coronavirus cabinet announced earlier this week that starting August 20, the country will revive its full green pass system. Starting Sunday, masks will be mandatory in all indoor and outdoor gatherings and even fully vaccinated parents responsible for caring for a child in quarantine will be demanded to isolate as well (for children 12 and under). Israel reported nearly 4K new cases over the previous 24 hours it announced on Tuesday, the biggest daily jump in new cases since March. The body responsible for generating its COVID policies just admitted that a lockdown in September is no longer a remote possibility. The number of cases has been also rising in many part in Europe, including the UK, Spain, France, Italy and Germany, questioning the efficacy of the Covid-19 vaccines.

Graph: Crude Oil, Daily

Current Price: 70.64

|

Crude Oil |

Weekly |

|

Resistance |

74.00 |

|

Support |

66.50 |

Example of calculation based on UPTREND ($74) direction for 1.00 Lot*

|

Resistance |

Support |

|

|

Profit or loss in $ |

3,360.00 |

-4,140.00 |

|

Profit or loss in €** |

2,834.49 |

-3,492.49 |

|

Profit or loss in £** |

2,412.49 |

-2,972.54 |

|

Profit or loss in C$** |

4,207.73 |

-5,184.52 |

Example of calculation based on DOWNTREND ($66.50) direction for 1.00 Lot*

|

Resistance |

Support |

|

|

Profit or loss in $ |

-3,360.00 |

4,140.00 |

|

Profit or loss in €** |

-2,834.49 |

3,492.49 |

|

Profit or loss in £** |

-2,412.49 |

2,972.54 |

|

Profit or loss in C$** |

-4,207.73 |

5,184.52 |

* 1.00 lot is equivalent of 1000 units

** Calculations for exchange rate used as of 9:30 a.m. (GMT+1) 04/08/2021

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Client Manager regarding their use.

*** You may wish to consider closing your position in profit, even if it is lower than suggested one

**** Trailing stop technique can protect the profit – Ask your Client Manager for more details