Next Rollover Date: June 12, 2022

ROLLOVER REPORT ON CRUDE OIL

-

WHAT IS A CONTRACT ROLLOVER: A roll over is a procedure when futures contracts on certain instrument switch from the front month contract, that is close to expiration, to another contract in a further-out month.

-

EXAMPLE: For example, a crude oil futures contract at $20 with a June expiry, would close before it expires and then it enters into a new crude oil contract at rate $21, which expires at a later date (July for example).

-

WHAT IS A GAP: When one contract switches to another, differences in prices tend to occur, because different contracts hold different prices for the same underlying instrument. If prices did not change over time, the difference in our example would be 1 dollar ($21 (July) minus $20 (June)). Therefore, empty space appears on the trading charts when a rollover takes place. After the rollover, your instrument will hold a price of $21 rather than $20. The empty space between 21 and 20 is called a GAP.

-

HOW OFTEN ROLLOVERS TAKE PLACE: Rollovers occur once a month during a weekend time. Rollover dates are available on Fortrade Official Website. Next Rollover is expected to occur on June 12, 2022.

ANALYSIS (FINDINGS) ON CRUDE OIL

-

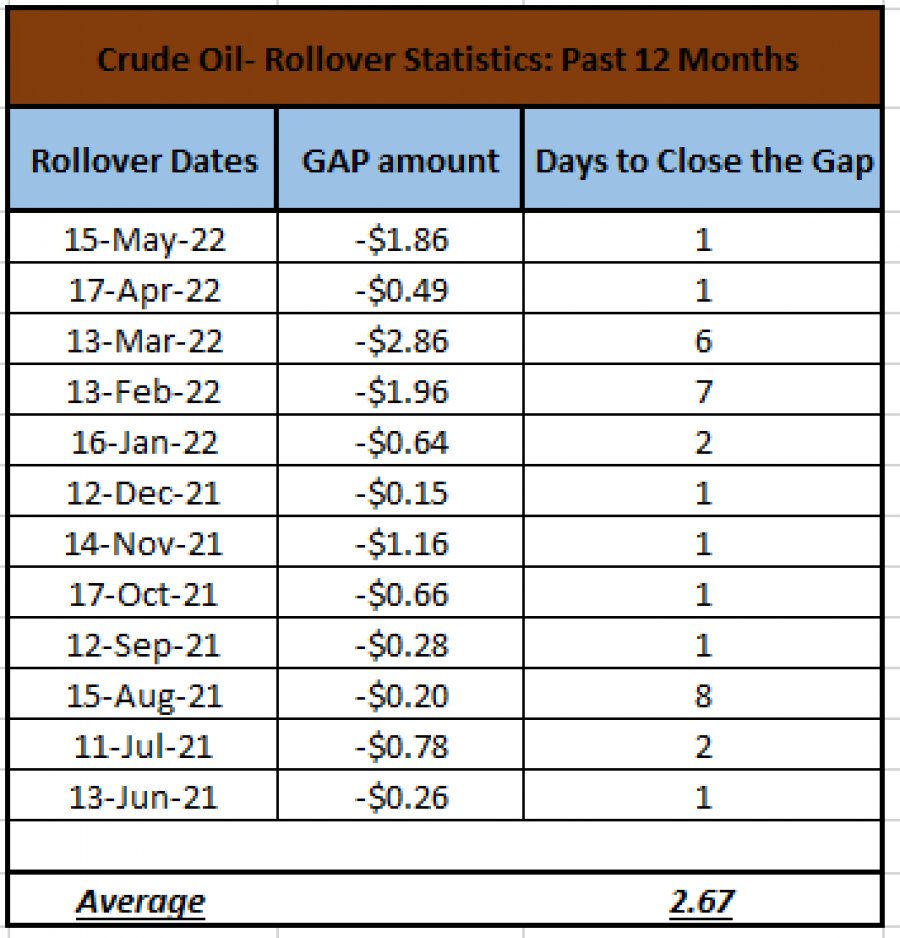

Based on a sample of 12 months (last 12 months) the Fortrade’s Reaserch Department found that the gaps on Crude Oil tend to close on average in 2.67 days. In other words, the new contract price (July’s $21 in our example) may converge back towards its previous contract’s price (June’s $20) in an average of 2.67 days.

SOURCE I: Fortrade.com/recent- rollovers/

SOURCE II: Fortrade MetaTrader 4

Please note that past performance does not guarantee future results.

-

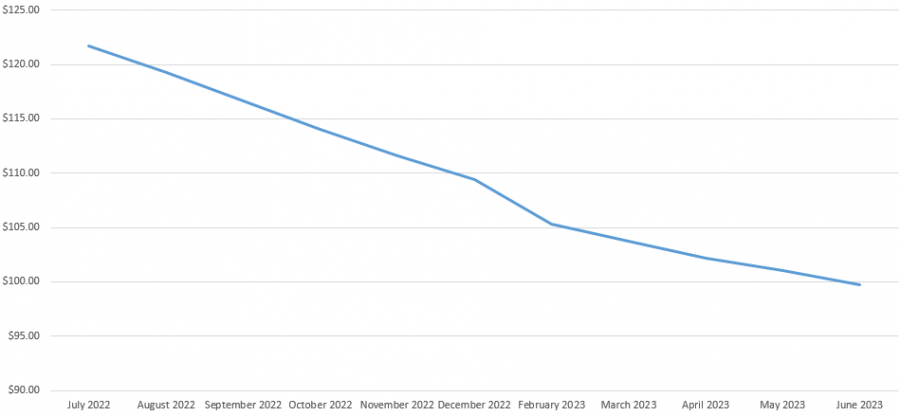

BACKWARDATION: Backwardation is market structure indicative of trading sentiment in favour of oil prices being lower in the future compared to current prices. Table (I) depicts the term- structure of the futures market for Crude oil from July 2022 to June 2023. The table shows that the coming rollovers could bring more negative gaps. The gap for July contract (Current) is not available since it is a currently active contract.

Table (I): Crude Oil Futures Contract Price as of June 10, 2022.

SOURCE: CMEGROUP.COM (Data as of June 10, 2022)

NOTE: Prices are subject to change due to daily volatility

Chart 1: Term- Structure of the Futures Market for Crude Oil Contracts from July 2022 to June 2023

SOURCE: CMEGROUP.COM

SUMMARY: The findings in this report suggest that gaps from Crude Oil Contract Rollovers tend to close on average in 2.67 days. In addition, the current research found that the upcoming rollovers might provide high gaps. According to Table (I), the price difference between August and July contract (as of June 10, 2022) was -$2.43. Supposedly, if the market conditions did not change, there may be a negative gap of $2.43 when the rollover takes place on June 12, 2022. The gap, according to findings in this report, could happen to close up in 2.67 days.

Please note that past performance does not guarantee future results.