EVENT: US INFLATION (CPI) FOR NOVEMBER (EXPECTED: 6.8%).

TIME: 13:30 GMT

Gold Price Reaction to High US Inflation

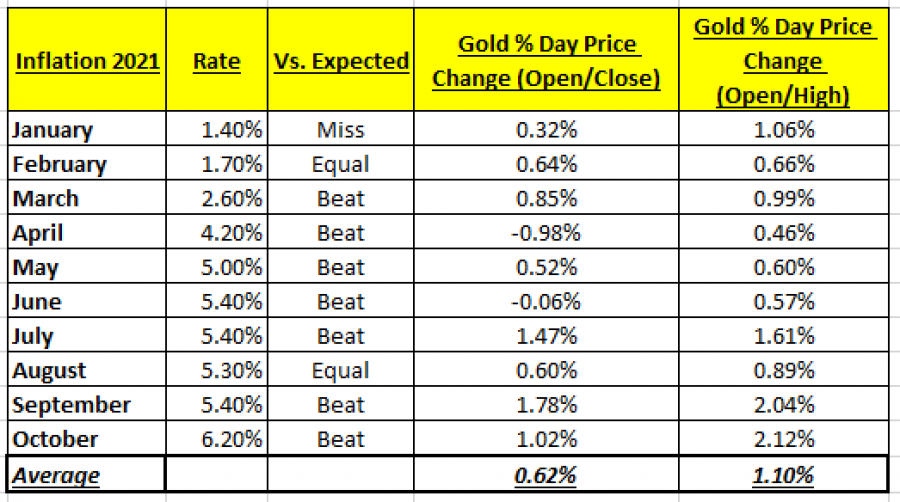

Gold is considered a safe-haven instrument, which is used by investors to protect their wealth against rising inflation. In other words, demand for Gold rises as Inflation rates rise, and with higher demand, a higher Gold price comes. Table 1 below shows what has been Gold’s reaction on the day the inflation is released.

Table 1: Gold Price Reaction to US Inflation in 2021 on Data Release Day

US Inflation

Inflation in the US continued to rise in 2021, expected in November to hit its highest rate since 1982 (exp. 6.8%). Inflation started to more seriously rise in the beginning of 2021, when it stood below 2.00%. The chart below, shows the US Inflation trend in 2021.

Scenario 1: UP

According to our 2021 statistics, Gold could rise in value due to high inflation. Our findings in Table 1 show that Gold tends to rise on Inflation Release Day, on average closing the day up 0.62%, accompanied by an intraday average increase of 1.10%.

Current Price: 1770

|

GOLD |

|

|

Trend direction |

|

|

1808 |

|

|

1798 |

|

|

1789 |

|

|

1753 |

|

|

1743 |

|

|

1735 |

Example of calculation based on trend direction for 1.00 Lot*

|

GOLD |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

3,800.00 |

2,800.00 |

1,900.00 |

-1,700.00 |

-2,700.00 |

-3,500.00 |

|

Profit or loss in €** |

3,369.75 |

2,482.97 |

1,684.88 |

-1,507.52 |

-2,394.30 |

-3,103.72 |

|

Profit or loss in £** |

2,878.79 |

2,121.21 |

1,439.39 |

-1,287.88 |

-2,045.45 |

-2,651.52 |

|

Profit or loss in C$** |

4,832.65 |

3,560.90 |

2,416.33 |

-2,161.98 |

-3,433.73 |

-4,451.13 |

* 1.00 lot is equivalent of 100 units

** Calculations for exchange rate used as of 10:20 (GMT) 10/12/2021

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Client Manager regarding their use.

Scenario 2: DOWN

High inflation could increase speculations that the US Federal Reserve will soon act more aggressively to curb high inflation by faster stimulus tapering or higher interest rates. The Fed interest rate currently stands at 0.00% - 0.25%, but with high inflation and Fed determined to reduce inflation, the interest rate could be expected to rise already starting 2022, which short-term tends to be negative for Gold.

Current Price: 1770

|

GOLD |

|

|

Trend direction |

|

|

1808 |

|

|

1798 |

|

|

1789 |

|

|

1753 |

|

|

1743 |

|

|

1735 |

Example of calculation based on trend direction for 1.00 Lot*

|

GOLD |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

-3,800.00 |

-2,800.00 |

-1,900.00 |

1,700.00 |

2,700.00 |

3,500.00 |

|

Profit or loss in €** |

-3,369.75 |

-2,482.97 |

-1,684.88 |

1,507.52 |

2,394.30 |

3,103.72 |

|

Profit or loss in £** |

-2,878.79 |

-2,121.21 |

-1,439.39 |

1,287.88 |

2,045.45 |

2,651.52 |

|

Profit or loss in C$** |

-4,832.65 |

-3,560.90 |

-2,416.33 |

2,161.98 |

3,433.73 |

4,451.13 |

* 1.00 lot is equivalent of 100 units

** Calculations for exchange rate used as of 10:20 (GMT) 10/12/2021

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Client Manager regarding their use.

*** You may wish to consider closing your position in profit, even if it is lower than suggested one

**** Trailing stop technique can protect the profit – Ask your Client Manager for more details