WEEKLY TREND: UP

Fundamental Overview:

- NOVAVAX is a U.S. producer of novel, next-generation vaccines designed to prevent life-threatening infectious diseases, such as the influenza virus and the Coronavirus.

- NOVAVAX RECENT PRICE ACTION: Novavax has lost around 47% since late September, when it tested its lowest rate since January 2021 ($121.35). Novavax came under pressure after an article published in the US said that Novavax might have vaccine manufacturing problems. The company however denied the report.

- EVENT: Q3 EARNINGS RESULTS (CONFIRMED: THURSDAY, NOVEMBER 4. AFTERMARKET)

- OTHER EVENTS TO WATCH: Novavax said it expects to complete multiple rolling regulatory submissions within the next couple of weeks in key markets, including the UK, Europe, Canada, Australia and New Zealand. They also said they will apply for emergency use authorization (EUA) of its coronavirus vaccine candidate in the US before the end of this year

- UK (OCTOBER 27): NOVAVAX SUBMITTED APPLICATION FOR COVID-19 VACCINE AUTHORIZATION IN THE U.K.

- E.U. (Q4 ’21): NOVAVAX is expected to submit an authorization request for its COVID-19 vaccine to the European Medicines Agency (EMA) in the fourth quarter of 2021 (Q4’21). Novavax already has an agreement in place to supply up to 100 million doses to the European Union with an option for another 100 million doses through 2023.

- CANADA, AUSTRALIA, NEW ZEALAND (Q4’21): NOVAVAX is expected to submit an authorization request for its COVID-19 vaccine in Canada, Australia and New Zealand in the fourth quarter of 2021, too.

- U.S.A (Q4 ’21): NOVAVAX TO SEEK AN EMERGENCY USE AUTHORIZATION FROM THE U.S. FOOD AND DRUG ADMISISTRATION (FDA) BY THE END OF THE YEAR. PREVENT-19, Novavax' study to assess the safety and efficacy of the company's recombinant nanoparticle protein vaccine, NVX-CoV2373 with Matrix-M™ adjuvant, demonstrated 90% overall efficacy and 100% protection against moderate and severe disease.

- INDIA (Q4’ 21): The company already applied for Emergency Use Authorization for its COVID-19 vaccine in India. During the fourth quarter, the company’s vaccine is expected to enter India, the second-most populated country in the world.

- COVID-19 VACCINE SALES TO STAY STRONG: Novavax is still expected to rake in around 5 billion dollars of revenue in 2022. They have been also working on booster shots, which should enter the market in 2022, and could help them make bigger revenues.

- IMMUNITY FROM VACCINE WANES WITH TIME: According to Pfizer and Moderna researches, the immunity after the second dose wanes within a few months, which means that vaccination process should roll over in order to keep the pandemic under control. Therefore, Novavax could be still expected to sell COVID-19 vaccines and to make money from it. In addition, the COVID-19 vaccine is still the best weapon to the fight the COVID-19 pandemic.

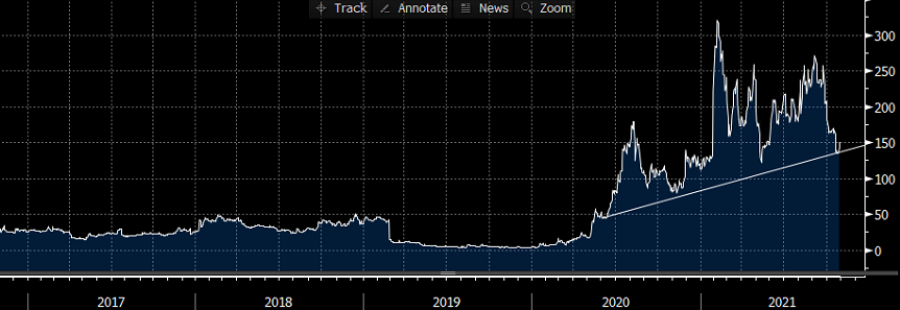

- STOCK PRICE: NOVAVAX reached an all-time high of $331.68 in February 2021. NOVAVAX traded last around $147, upside of 125% to its all-time high reached recently.

Graph: Novavax

Current Price: 147

|

NOVAVAX |

Weekly |

|

Trend direction |

|

|

210 |

|

|

190 |

|

|

173 |

|

|

123 |

|

|

110 |

|

|

100 |

Example of calculation based on weekly trend direction for 1.00 Lot*

|

NOVAVAX |

||||||

|

Profit or loss in $** |

31,500.00 |

21,500.00 |

13,000.00 |

-12,000.00 |

-18,500.00 |

-23,500.00 |

|

Profit or loss in € |

27,035.61 |

18,452.88 |

11,157.55 |

-10,299.28 |

-15,878.06 |

-20,169.42 |

|

Profit or loss in £** |

22,847.78 |

15,594.51 |

9,429.24 |

-8,703.91 |

-13,418.53 |

-17,045.17 |

|

Profit or loss in C$** |

38,872.89 |

26,532.29 |

16,042.78 |

-14,808.72 |

-22,830.11 |

-29,000.41 |

* 1.00 lot is equivalent of 500 units

** Calculations for exchange rate used as of 12:20 (GMT+1) 29/10/2021

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Client Manager regarding their use.

*** You may wish to consider closing your position in profit, even if it is lower than suggested one

**** Trailing stop technique can protect the profit – Ask your Client Manager for more details