WEEKLY TREND: UP

Fundamental Overview:

- INFLATION HEDGE: Amid rising inflation, investors turn to base and precious metals to hedge their wealth against rising inflation, which tends to eat away at their wealth. Inflation in the US showed a persistent increase of more than 5.00%, which tells the market participants that inflation increase is not transitory.

Technical Overview:

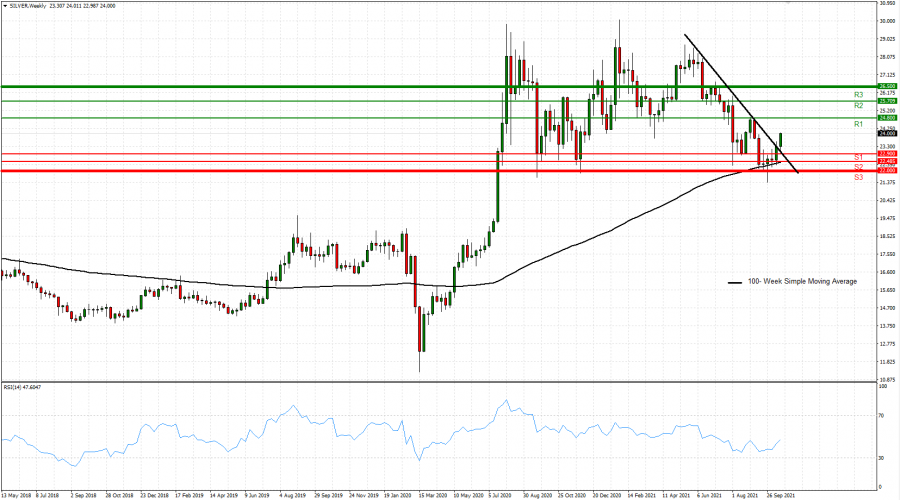

- SILVER RECENT PRICE ACTION: Silver has recently fallen to its lowest rate since July 2020 (21.399), to quickly move back above the mark of 22.00, confirming that the mark of 22.00 remains to be its long term support. Since the beginning of September, Silver has lost more than 10.0%.

- LONG TERM SUPPORT RESPECTED: Despite the most recent sell-off, Silver managed to stay above its long term support line of 22.00. In addition, Silver has also managed to stay above the 100-Week Simple Moving Average.

- 14-WEEK RELATIVE STRENGTH INDEX (RSI): The 14-Week RSI has fallen recently close to the oversold threshold of 30, the lowest since May 2020. This has signaled a potential upward correction.

- RESISTANCE AND SUPPORT LEVELS: If Silver manages to stay above the 100-Week Simple Moving Average and speculators gather up to trade on 14-Week RSI oversold signal, then it might be expected the prices to start recovering, targeting Resistance 1 of 24.800 and Resistance 2 of 25.700. Resistance 3 stands at 26.500. If, however, the prices fail to stay above the 100-Week Simple Moving Average, then it might be expected Silver to fall and target Support 1 of 22.900 through to Support 3 of 22.000 again.

Graph: Silver, Weekly

Current Price: 23.800

|

SILVER |

Weekly |

|

Trend direction |

|

|

26.500 |

|

|

25.700 |

|

|

24.800 |

|

|

22.900 |

|

|

22.485 |

|

|

22.000 |

Example of calculation based on weekly trend direction for 1.00 Lot*

|

SILVER |

||||||

|

Profit or loss in $** |

27,000.00 |

19,000.00 |

10,000.00 |

-9,000.00 |

-13,150.00 |

-18,000.00 |

|

Profit or loss in € |

23,169.01 |

16,304.11 |

8,581.11 |

-7,723.00 |

-11,284.16 |

-15,446.00 |

|

Profit or loss in £** |

19,592.19 |

13,787.10 |

7,256.37 |

-6,530.73 |

-9,542.12 |

-13,061.46 |

|

Profit or loss in C$** |

33,271.29 |

23,413.13 |

12,322.70 |

-11,090.43 |

-16,204.35 |

-22,180.86 |

* 1.00 lot is equivalent of 10000 units

** Calculations for exchange rate used as of 13:45 (GMT+1) 19/10/2021

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Client Manager regarding their use.

*** You may wish to consider closing your position in profit, even if it is lower than suggested one

**** Trailing stop technique can protect the profit – Ask your Client Manager for more details