Crude Oil weekly special report based on 1.00 Lot Calculation:

TECHNICAL ANALYSIS:

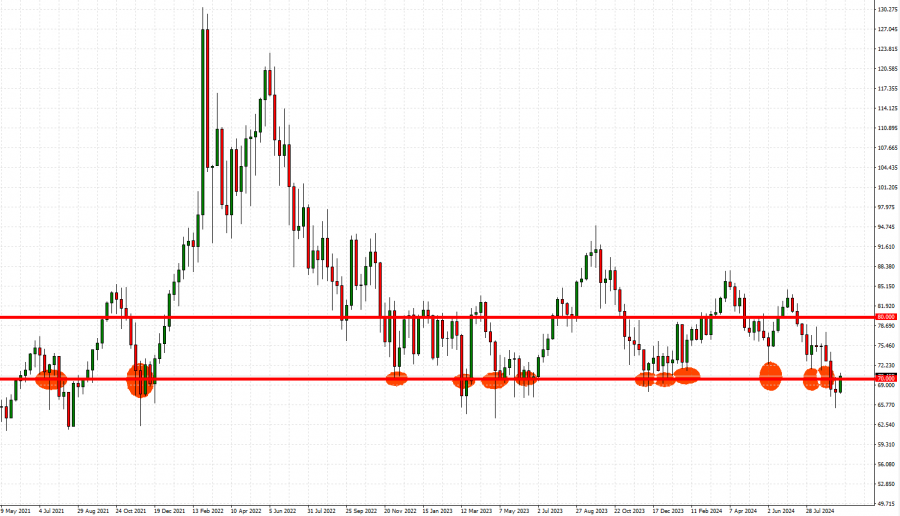

- CRUDE OIL PRICES HAVE TESTED THEIR LOWEST LEVELS IN 16 MONTHS ON SEPTEMBER 10 ($65.255). Crude oil has managed to re-test the level of 70 meanwhile, marking an increase of 7.27% over the past one and a half week.

- CRUDE OIL PRICES HAVE TESTED THE MARK OF $70 (OR NEAR) 12 TIMES SINCE 2021. This is the 13th time that the Crude Oil prices are testing levels near the mark of $70.

GRAPH (Daily): July 2021 – September 2024

Please note that past performance does not guarantee future results

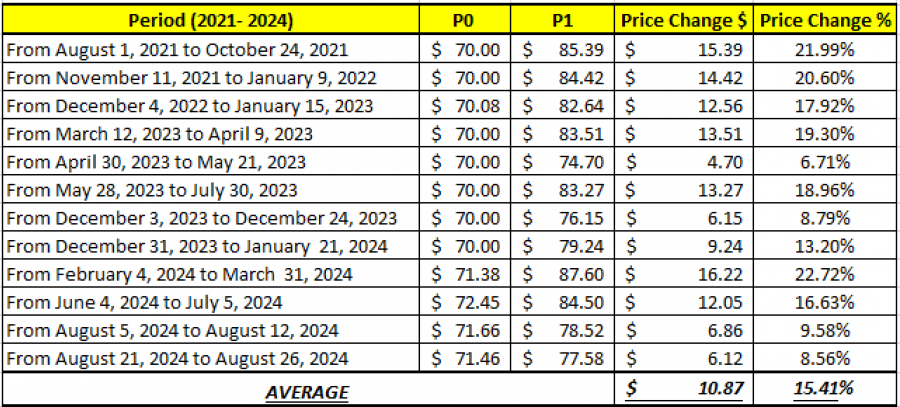

- 2021- 2024 STATISTICS: CRUDE OIL TENDS TO RECOVER BY AROUND 15% AFTER TESTING THE MARK OF $70 OR NEAR IT.

DATA SOURCE: Fortrade MetaTrader 4

Please note that past performance does not guarantee future results

CENTRAL BANKS: INTEREST RATE CUT DECISION

- BREAKING (SEPTEMBER 18): FEDERAL RESERVE ANNOUNCED ITS FIRST INTEREST RATE CUT SINCE 2020. US Federal Reserve decided to cut its benchmark interest rate by 0.50% points on September 18, to 5.00% from the previous 5.50%. The bank expects to cut rates two more times in 2024 to slash its benchmark rate to 4.5% by the end of 2024. The bank expects rates to fall to 3.5% in 2025 and further down to 2.9% in 2026.

- LOWER INTEREST RATE ENVIRONMENT HELPS ECONOMIC ACTIVITY TO RISE. When the US economy, the largest oil consumer in the world, rises stronger than expected, this could also increase demand for oil in general. Therefore, lowering interest rates by the US Fed could put upward pressure on oil prices.

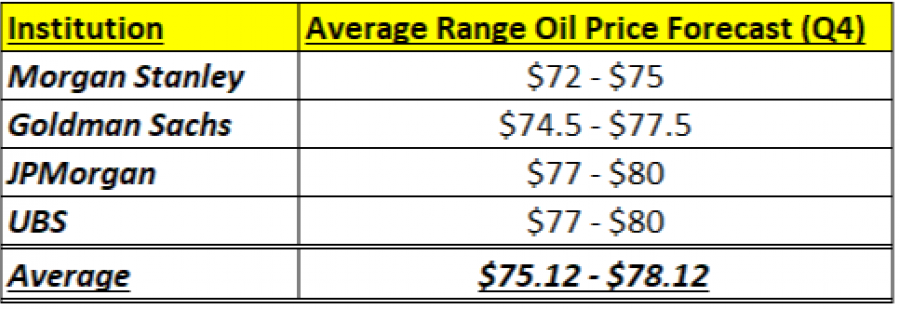

ANALYST OPINION:

- INVESTMENTS BANKS IN THE USA EXPECT HIGHER OIL PRICES. The table below shows that big banks on Waal Street such as Morgan Stanley, Goldman Sachs, JPMorgan and UBS, expected Crude Oil to return into the channel between 70 and 80, target an average price range of $75.12 and $78.12. However, the price could decline.

Sources: Reuters, Bloomberg, Oilprice.com, CNBC

Please note that past performance does not guarantee future results

Crude Oil, September 19, 2024

Current Price: 70.00

|

Crude Oil |

Weekly |

|

Trend direction |

|

|

80.00 |

|

|

78.00 |

|

|

75.00 |

|

|

66.00 |

|

|

65.50 |

|

|

65.00 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

Crude Oil |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

10,000 |

8,000 |

5,000 |

-4,000 |

-4,500 |

-5,000 |

|

Profit or loss in €2 |

8,971 |

7,177 |

4,486 |

-3,589 |

-4,037 |

-4,486 |

|

Profit or loss in £2 |

7,548 |

6,038 |

3,774 |

-3,019 |

-3,396 |

-3,774 |

|

Profit or loss in C$2 |

13,556 |

10,845 |

6,778 |

-5,422 |

-6,100 |

-6,778 |

1. 1.00 lot is equivalent of 1000 units

2. Calculations for exchange rate used as of 11:40 (GMT+1) 19/09/2024

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than the suggested one.

- Trailing stop technique could protect the profit.