GOLD weekly special report based on 1.00 Lot Calculation:

CENTRAL BANKS: INTEREST RATE CUT DECISION

- BREAKING (SEPTEMBER 18): FEDERAL RESERVE ANNOUNCED ITS FIRST INTEREST RATE CUT SINCE 2020. US Federal Reserve decided to cut its benchmark interest rate by 0.50% points on September 18, to 5.00% from the previous 5.50%. The bank expects to cut rates two more times in 2024 to slash its benchmark rate to 4.5% by the end of 2024. The bank expects rates to fall to 3.5% in 2025 and further down to 2.9% in 2026.

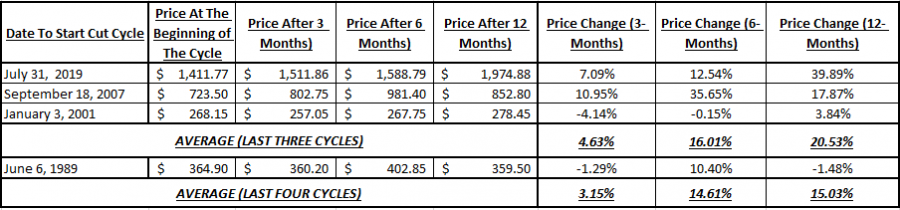

STATISTICS: GOLD HAS RISEN ON AVERAGE WITHIN THE FIRST 3, 6 AND 12 MONTHS AFTER A RATE CUT CYCLE BEGAN IN THE USA

- LAST THREE RATE CUT CYCLES (AVERAGE): The table below shows that Gold would rise by around 4.60% on average within the first three months after a rate cut cycle began in the USA. Gold rose around 16% on average within the first 6 months and around 20% within the first 12 months.

- LAST FOUR RATE CUT CYCLES (AVERAGE): The table below shows that Gold would rise by around 3.15% on average within the first three months after a rate cut cycle began. Gold rose around 14.60% on average within the first 6 months and around 15% within the first 12 months.

Data Source: Bloomberg Terminal

Please note that past performance does not guarantee future results

EVENTS:

- THURSDAY, SEPTEMBER 19 AT 13:30 GMT+1: US WEEKLY INITIAL JOBLESS CLAIMS. Initial jobless claims came in higher than expected last week (230K vs. 227K exp.), sparking concerns over the progress with the US labor market. If the number comes in higher than expected on Thursday, then Gold could be expected to rise in value. However, it could also decline.

- THURSDAY, SEPTEMBER 26 AT 13:30 GMT+1: US GROSS DOMESTIC PRODUCT (GDP) (Q2). The final rating is expected to show a growth rate of 3% for the second quarter, confirming what we got with the second reading a month ago. If a lower rate than expected is printed, then Gold could be expected to rise in value. However, it could also decline.

- FRIDAY, SEPTEMBER 27 AT 13:30 GMT+1: US PCE PRICE INDEX (AUGUST). Personal Consumption Expenditure (PCE) price index is a relavant inflation indicator that is preferred by the US Federal Reserve. For July, data showed a decline to 2.5% from the previous 2.6%. If data continues showing a declining trend for August, then Gold could be expected to rise in value. However, it could also decline.

FEARS OVER RECESSION HAS RECENTLY INCREASED DEMAND FOR THE SAFE- HAVEN GOLD:

- US INFLATION FALLS TO ITS LOWEST SINCE FEBRUARY 2021: US Inflation fell in August to 2.5% from July’s 2.9%. Many analysts have been worried that such a big decline in inflation could mean a significant slowdown in economic activity, sparking renewed fears over potential economic recession.

- WEAKER THAN EXPECTED EMPLOYMENT MARKET IN THE USA: Most recent data in the US showed that unemployment is still high at 4.2%, while Nonfarm Payrolls (NFP) data for August showed fewer jobs than expected in August. The NFP has missed analysts’ expectations for two months in a row, increasing chances for aggressive interest rate cuts by the US Fed as fears over a potential recession have risen.

- WEAKER THAN EXPECTED MANUFACTURING ACTIVITY IN THE USA: The US Manufactuing PMI has remained in the contraction territory, below 50, for five months in a row, with August data missing analysts expectations yet again (47.2 vs. 47.5 expected).

ANALYST OPINION:

- Citigroup targets $3,000; Bank of America targets $3,000; Goldmans Sachs targets $2,700; Morgan Stanley targets $2,650.

GOLD, September 19, 2024

Current Price: 2575

|

GOLD |

Weekly |

|

Trend direction |

|

|

3000 |

|

|

2800 |

|

|

2630 |

|

|

2525 |

|

|

2500 |

|

|

2480 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

Pivot Points |

||||||

|

Profit or loss in $ |

42,500 |

22,500 |

5,500 |

-5,000 |

-7,500 |

-9,500 |

|

Profit or loss in €2 |

38,129 |

20,186 |

4,934 |

-4,486 |

-6,729 |

-8,523 |

|

Profit or loss in £2 |

32,077 |

16,982 |

4,151 |

-3,774 |

-5,661 |

-7,170 |

|

Profit or loss in C$2 |

57,614 |

30,501 |

7,456 |

-6,778 |

-10,167 |

-12,878 |

1. 1.00 lot is equivalent of 100 units

2. Calculations for exchange rate used as of 09:00 (GMT+1) 19/09/2024

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.