GOLD weekly special report based on 1.00 Lot Calculation:

GEOPOLITICS: US – CHINA TRADE WAR

- FRIDAY, APRIL 11: CHINA RETALIATES AGAIN, RAISING TARIFFS ON US GOODS TO 125%: China has raised tariffs once again, now to 125%, up from 84%.

- WEDNESDAY, APRIL 9: US RAISED TARIFFS ON CHINESE GOODS TO 145%: The tariffs on China have been raised to 145%.

- WEDNESDAY, APRIL 9: CHINA RETALIATES, RAISING TARIFFS ON US GOODS TO 84%. China raised tariffs on U.S. goods to 84%, retaliating against Trump’s tariff increase on China to 104%.

- TUESDAY, APRIL 8: US RAISED TARIFFS ON CHINESE GOODS TO 104%.

- FRIDAY, APRIL 4: CHINA RETALIATES, RAISING TARIFFS ON US GOODS TO 34%.

- WEDNESDAY, APRIL 2: US RAISED TARIFFS ON CHINESE GOODS TO 54%.

US PRESIDENT DONALD TRUMP AND GOLD DURING TRUMP’S FIRST PRESIDENCY

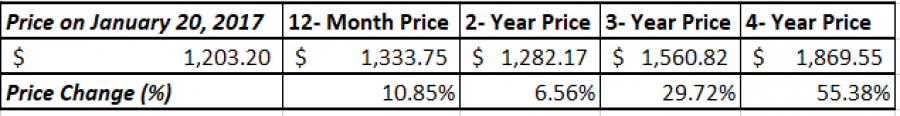

- STATISTICS: GOLD ROSE 10.85% DURING TRUMP’S FIRST YEAR OF PRESIDENCY (JANUARY 20, 2017 – JANUARY 20, 2018). In addition, Gold rose 55.38% during the entire first presidential term of Donald Trump (January 20, 2017 – January 20, 2021).

Data Source: MetaTrader 4 Platform

Please note that past performance does not guarantee future results

ANALYSTS’ OPINION:

- GOLDMAN SACHS RAISED GOLD PRICE TARGET TO $3,700, FROM $3,300 WITH A TARGET RANGE OF $3,650 AND $3,950. UNDER EXTREME SCENARIOS, GOLD COULD RISE TO $4,500 BY THE END OF 2025. However, it could also move in the opposite direction.

- MORGAN STANLEY SET A GOLD PRICE TARGET AT $3,400.

- UBS RAISED GOLD PRICE TARGET TO $3,500 FROM $3,200.

- DEUTSCHE BANK RAISED ITS GOLD PRICE TARGET TO $3,350 (Q4, 2025) and $3,700 (2026).

- BANK OF AMERICA RAISED ITS PRICE TARGET AT $3,350. IF INVESTMENT DEMAND RISES JUST 10%, GOLD COULD RISE TO $3,500. However, it could also move in the opposite direction.

Source: Reuters, Bloomberg, CNBC

EVENTS:

- WEDNESDAY, APRIL 16, AT 18:15 GMT+1: FED CHAIRMAN JEROME POWELL SPEAKS: The chairman of the FED will hold a press conference at the Economic Club of Chicago concerning the topic of the Economic Outlook.

- THURSDAY, APRIL 17, AT 13:30 GMT+1: US INITIAL JOBLESS CLAIMS: A higher-than-expected rating should be positive for gold, because it will motivate the FED to cut interest rates more aggressively. This data measures the number of individuals who have filled for unemployment insurance for the first time during the past week. The previous number stands at 223K, which is higher from the report before which stands at 219K.

- WEDNESDAY, APRIL 30, AT 13:30 GMT+1: US GROSS DOMESTIC PRODUCT (GDP) (Q1): The U.S. will publish its Q1 GDP data, a broad measure of overall economic performance. (PREVIOUS:2.4%)

GOLD, April 16, 2025

Current Price: 3,300

|

GOLD |

Weekly |

|

Trend direction |

|

|

3,700 |

|

|

3,500 |

|

|

3,400 |

|

|

3,210 |

|

|

3,200 |

|

|

3,190 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

GOLD |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

40,000 |

20,000 |

10,000 |

-9,000 |

-10,000 |

-11,000 |

|

Profit or loss in €2 |

35,216 |

17,608 |

8,804 |

-7,924 |

-8,804 |

-9,684 |

|

Profit or loss in £2 |

30,159 |

15,080 |

7,540 |

-6,786 |

-7,540 |

-8,294 |

|

Profit or loss in C$2 |

55,648 |

27,824 |

13,912 |

-12,521 |

-13,912 |

-15,303 |

1. 1.00 lot is equivalent of 100 units

2. Calculations for exchange rate used as of 10:30 (GMT+1) 16/04/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.