AMAZON (#AMAZON) weekly special report based on 1 Lot Calculation:

AMAZON: THE COMPANY

Amazon is an American multinational technology company focusing on e-commerce, cloud computing, online advertising, digital streaming, and artificial intelligence. It has been referred to as "one of the most influential economic and cultural forces in the world.

STOCK INDEX PARTICIPATION: Amazon stock is a part of NASDAQ 100 (USA 100) index, S&P500 (USA500) and DOW 30 (USA30) index.

AMAZON: ARTIFICIAL INTELLIGENCE

- One of Amazon’s biggest focuses is in cloud computing, where the company’s Amazon Web Services is a market leader with 34% of market share, ahead of Microsoft Azure (24%), Google Cloud (10%) and Alibaba Cloud (5%).

- The Cloud industry is expected to grow at a compounded annual growth rate at 17.9% until 2028, to $791.49B, with Amazon Web Services set to maintain dominance. AWS is heavily focused on AI and aims to serve customers' every AI need, offering them chips and a fully managed LLM service called Amazon Bedrock, as well as a variety of AI apps.

- Innovations in Amazon Web Services. AWS continues to innovate with its Graviton4 processor, which delivers significant performance and efficiency improvements, and the Olympus AI model, a generative AI capable of processing images, videos, and text to enhance multimedia search capabilities. Collaborations like the quantum technologies project with Telefónica Germany highlight AWS's focus on the future of networking and 6G.

AMAZON: ANALYSIS AND EVENTS

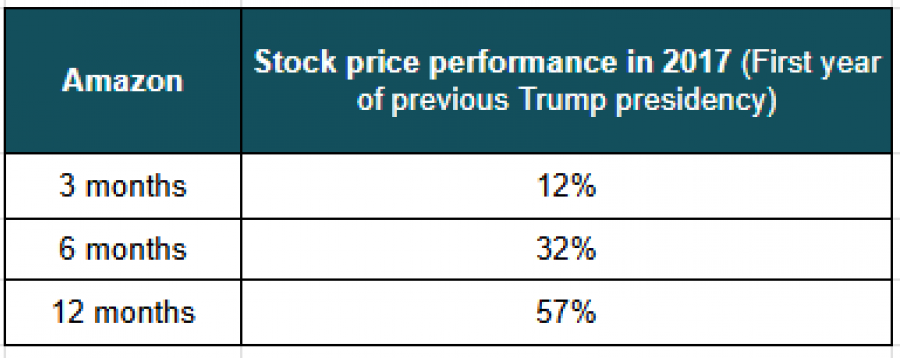

- EVENT: TRUMP TAKING THE OFFICE ON JANUARY 20 - GAINS DRIVEN BY TRUMP POLICIES. Previous Trump’s presidency brought tax cuts, deregulation, and corporate growth, creating a favorable environment for many tech companies. Similar expectations are building for the upcoming year, with potential policy shifts poised to favor corporate expansion and market stability.

Please note that past performance does not guarantee future results.

During the first year of Donald Trump’s presidency in 2017, Amazon’s stock performed exceptionally well, starting the year at approximately $750 per share, Amazon’s stock rose by around 57%, closing around $1,169 by year-end, significantly outperforming major indices like the S&P 500 and Nasdaq.

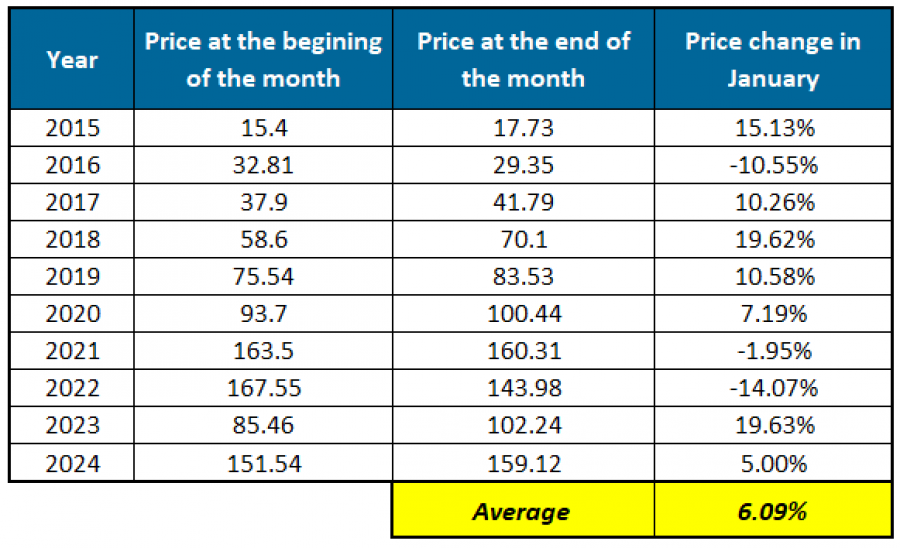

- EVENT: SEASONAL PERFORMANCE (January). Amazon stock is showing mostly positive performance in January over the past decade, with an average price increase of 6.08%. January has often marked strong starts for Amazon's stock, such as the impressive 19.63% gain in 2023.

Historical Stock Performance in January

Please note that past performance does not guarantee future results.

AMAZON: PRICE ACTION

- THE STOCK HIT THE HIGHEST LEVEL SINCE 2022 STOCK SPLIT OF $233.14 ON DECEMBER 18, 2024.

- ANALYSTS OPINION: JP Morgan forecasts $280, Trust Securities forecasts $270. Citi forecasts $275

#AMAZON, December 26, 2024

Current Price: 225

|

Amazon |

Weekly |

|

Trend direction |

|

|

300 |

|

|

275 |

|

|

255 |

|

|

205 |

|

|

200 |

|

|

195 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

Amazon |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

7,500 |

5,000 |

3,000 |

-2,000 |

-2,500 |

-3,000 |

|

Profit or loss in €² |

7,210 |

4,806 |

2,884 |

-1,923 |

-2,403 |

-2,884 |

|

Profit or loss in £² |

5,974 |

3,983 |

2,390 |

-1,593 |

-1,991 |

-2,390 |

|

Profit or loss in C$² |

10,809 |

7,206 |

4,323 |

-2,882 |

-3,603 |

-4,323 |

- 1.00 lot is equivalent of 100 units

- Calculations for exchange rate used as of 10:15 (GMT) 26/12/2024.

There is a possibility to use Stop-Loss and Take-Profit

- You may wish to consider closing your position in profit, even if it is lower than the suggested one.

- Trailing stop technique could protect the profit