AMAZON (#AMAZON) weekly special report based on 1 Lot Calculation:

AMAZON: THE COMPANY

- Amazon is an American multinational technology company focusing on e-commerce, cloud computing, online advertising, digital streaming, and artificial intelligence. It has been referred to as "one of the most influential economic and cultural forces in the world. Amazon Web Services is a market leader with 34% of market share, ahead of Microsoft Azure (24%), Google Cloud (10%) and Alibaba Cloud (5%). The Cloud industry is expected to grow at a compounded annual growth rate at 17.9% until 2028, to $791.49B, with Amazon Web Services set to maintain dominance.

- STOCK INDEX PARTICIPATION: Amazon stock is a part of NASDAQ 100 (USA 100) index, S&P500 (USA500) and DOW 30 (USA30) index.

AMAZON: EVENTS

- EVENT (FRIDAY, FEBRUARY 6, AFTERMARKET): Q4 EARNINGS REPORT. AMAZON expects to publish $187.3B in revenues, up 10% from the same period last year ($169.9B). The company is expected to release $19.12 B in Net Income up 74% from the same period last year ($10.97B).

- STATISTIC (LAST 8 QUARTERS): HISTORICAL PERFORMANCE SHOWS THAT AMAZON TENDS TO BEAT ANALYSTS’ EXPECTATIONS. Amazon has beat both revenue and Earnings Per Share (EPS) estimates 7 times over the past 8 quarters.

- LAST TIME (Q3 EARNINGS RELEASED on October 17, 2024): Amazon's Q3 results exceeded expectations, with revenues up 11% to $158.87B and Net income up 70% to $ 15.42B year-over-year. The stock price was up 6% the day after the results were released.

AMAZON: COMPANY NEWS

- AMAZON AND QUALCOMM ANNOUNCED AUTO TECHNOLOGY COLLABORATION to enhance in-vehicle experiences by combining Qualcomm's automotive expertise with Amazon's AI services and cloud capabilities. The partnership will focus on integrating advanced AI technologies, such as Alexa Custom Assistant, with Qualcomm's Snapdragon® Digital Cockpit Platform

- AMAZON POTENTIAL BUYER OF TIKTOK? Morgan Stanley views Amazon as a potential buyer for TikTok, with reports suggesting the January 19 divestiture deadline may be extended. China’s openness to a divestiture adds to the possibility. TikTok could strengthen Amazon’s social shopping, ad network, and online ad competition, leveraging its strong financial position. Morgan Stanley rates Amazon Overweight with a $280 price target.

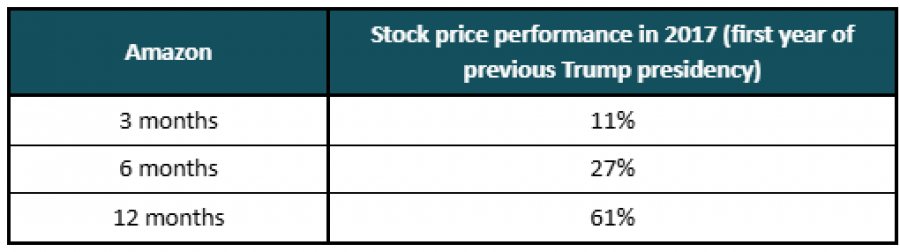

AMAZON: HOW DOES THE STOCK PERFORM UNDER DONALD TRUMP AS PRESIDENT OF THE USA

- HISTORICAL PERFORMANCE: THE STOCK ROSE 61% DURING THE FIRST YEAR OF TRUMP’S FIRST PRESIDENTIAL TERM (JANUARY 20, 2017 – JANUARY 20, 2018). Starting at approximately $813 per share on the day of Trump’s inauguration, the stock price surged by about 61% to $1,307 within a year.

Source: MT4

*Price changes were calculated after the inauguration

Please note that past performance does not guarantee future results

AMAZON: PRICE ACTION

- THE STOCK HIT THE HIGHEST LEVEL SINCE 2022 STOCK SPLIT OF $236.25 ON JANUARY 24, 2025.

- ANALYSTS OPINION: JP Morgan forecasts $280, Morgan Stanley forecasts $280. Citi forecasts $275

#AMAZON, January 31, 2025

Current Price: 235.0

|

Amazon |

Weekly |

|

Trend direction |

|

|

300 |

|

|

280 |

|

|

260 |

|

|

215 |

|

|

210 |

|

|

205 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

Amazon |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

6,500 |

4,500 |

2,500 |

-2,000 |

-2,500 |

-3,000 |

|

Profit or loss in €² |

6,257 |

4,332 |

2,406 |

-1,925 |

-2,406 |

-2,888 |

|

Profit or loss in £² |

5,233 |

3,623 |

2,013 |

-1,610 |

-2,013 |

-2,415 |

|

Profit or loss in C$² |

9,402 |

6,509 |

3,616 |

-2,893 |

-3,616 |

-4,340 |

- 1.00 lot is equivalent of 100 units

- Calculations for exchange rate used as of 8:30 (GMT) 31/01/2025

There is a possibility to use Stop-Loss and Take-Profit

- You may wish to consider closing your position in profit, even if it is lower than the suggested one.

- Trailing stop technique could protect the profit