ARM HOLDINGS (#ARM) weekly special report based on 1 Lot Calculation:

ARTIFICIAL INTELLIGENCE

- AI: ACCORDING TO THE INTERNATIONAL DATA CORPORATION, COMPANIES WILL SPEND $500 BILLION BY 2027, WHICH COULD SEE DEMAND FOR ARM’S CPU PRODUCTS: ARM designs chip architecture for all the major companies, and is the most dominant chip designer in the world. ARM designs chips for Apple, Amazon, Nvidia and AMD just to name a few.

- ARM IN THE CHIP INDUSTRY: As a chip designer, ARM plays an integral role in the artificial intelligence space, as all companies that develop and sell artificial intelligence chips are likely using a chip architecture designed by ARM. While ARM is more focused on Central Processing Units (CPU) chips, its dominance is colossal. According to reports, 30 billion chips worldwide used ARM technology.

ARM: THE COMPANY

- ARM is not a chipmaker itself. Rather, the company is responsible for coming up with the “architectures” — or overall designs, including components and programming language instructions that other companies use to build chips. Today, 99% of smartphones use ARM processors.

ARM: EVENTS AND ANALYSIS

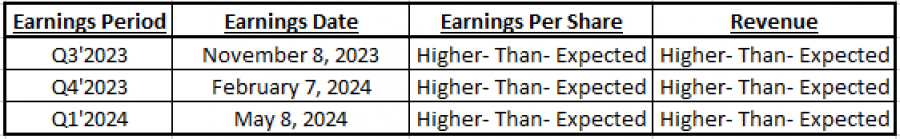

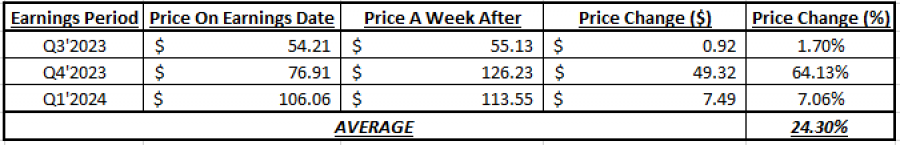

- EVENT (CONFIRMED: WEDNESDAY, JULY 31, AFTERMARKET): Q2 EARNINGS RESULTS. The company is expected to print 904 million dollars in revenue for Q2, accompanied by a net income of 358 million dollars. ARM has beat earnings and revenue estimates three times over the past three quarterly earnings releases. The company went public in September 2023, and has only published earnings for Q3 of 2023, Q4 of 2023 and Q1 of 2024.

SOURCE: BLOOMBERG PLATFORM

Please note that past performance does not guarantee future performance.

- ARM ROSE 24.30% ON AVERAGE IN ONE WEEK AFTER THE EARNINGS REPORT GOT RELEASED

DATA SOURCE: META TRADER 4 PLATFORM

Please note that past performance does not guarantee future performance.

ARM AND NVIDIA

- ARM AND NVIDIA, HISTORICALLY, MOVE IN THE SAME DIRECTION: Nvidia and ARM have historically exhibited strong correlation in price action, with a correlation coefficient of 0.74. This is primarily because both companies operate in the chip production space, as Nvidia depends on ARM for their chip designs.

#ARM, July 19, 2024

Current Price:160

|

ARM |

Weekly |

|

Trend direction |

|

|

230 |

|

|

200 |

|

|

187 |

|

|

135 |

|

|

125 |

|

|

115 |

Example of calculation based on weekly trend direction for 1 Lot1

|

ARM |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

70,000 |

40,000 |

27,000 |

-25,000 |

-35,000 |

-45,000 |

|

Profit or loss in €2 |

64,352 |

36,773 |

24,822 |

-22,983 |

-32,176 |

-41,369 |

|

Profit or loss in £2 |

54,203 |

30,973 |

20,907 |

-19,358 |

-27,102 |

-34,845 |

|

Profit or loss in C$2 |

96,016 |

54,866 |

37,035 |

-34,292 |

-48,008 |

-61,725 |

1. 1.00 lot is equivalent of 1000 units

2. Calculations for exchange rate used as of 10:00 (GMT+1) 19/07/2024

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.