BOEING (#BOEING) weekly special report based on 1 Lot Calculation:

AEROSPACE & DEFENSE MARKET INDUSTRY

- GLOBAL AEROSPACE AND DEFENSE MARKET SIZE: According to Price Waterhouse Cooper (PwC), the Aerospace and Defense industry is currently worth around $760b as of the end of 2023, growing from $748.6b in 2022.

- THE MARKET: GROWTH IN AEROSPACE AND DEFENSE EXPECTED TO CONTINUE: According to analysts, the market is forecasted to grow to $1388b by 2030, representing a compounded annual growth rate of 8.2%.

BOEING

- THE COMPANY: The Boeing Co. is an aerospace company, which engages in the manufacture of commercial jetliners and defense, space, and security systems.

- MARKET SHARE (DEFENSE INDUSTRY): Boeing is the 2nd largest company in the sector with around 9% of the market share. The biggest aerospace and defense company is Raytheon Technologies (9.06%), followed by Boeing (9.00%) and Lockheed Martin (8.91%) respectively.

BOEING: EVENTS

- EVENT (TUESDAY, JANUARY 28, PREMARKET): Q4 EARNINGS REPORT. The company is expected to report $16.7 billion in revenue and net loss of -$923.9 million. Its net loss for Q4, however, seems to be much lower compared to Q3’s net loss of $6.17 billion dollars.

- STATISTIC (LAST 8 QUARTERS): Boeing has beaten revenue estimates 5 times over the past 8 quarters.

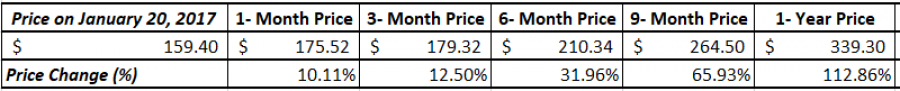

BOEING: HOW DOES THE STOCK PERFORM UNDER DONALD TRUMP AS PRESIDENT OF THE USA

- HISTORICAL PERFORMANCE: THE STOCK ROSE 112.86% DURING THE FIRST YEAR OF TRUMP’S FIRST PRESIDENTIAL TERM (JANUARY 20, 2017 – JANUARY 20, 2018).

Data Source: Bloomberg Terminal; Meta Trader 4 Platform;

Please note that past performance does not guarantee future results

BOEING: PRICE ACTION

- THE STOCK HIT AN ALL TIME HIGH OF $445.61 ON MARCH 1, 2019. Boeing was last trading around $175, and if a full recovery follows recent all- time highs, the stock could see an upside of around 155%. However, the price could decline further.

- ANALYSTS OPINION: Deutsche Bank forecasts $215, Barclays forecasts $210, Citigroup forecasts $209. Goldman Sachs forecasts $200.

#BOEING, January 22, 2025

Current Price: 175

|

BOEING |

Weekly |

|

Trend direction |

|

|

250 |

|

|

220 |

|

|

190 |

|

|

160 |

|

|

155 |

|

|

150 |

Example of calculation based on weekly trend direction for 1 Lot1

|

BOEING |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

75,000 |

45,000 |

15,000 |

-15,000 |

-20,000 |

-25,000 |

|

Profit or loss in €2 |

71,750 |

43,050 |

14,350 |

-14,350 |

-19,133 |

-23,917 |

|

Profit or loss in £2 |

60,629 |

36,377 |

12,126 |

-12,126 |

-16,168 |

-20,210 |

|

Profit or loss in C$2 |

107,301 |

64,381 |

21,460 |

-21,460 |

-28,614 |

-35,767 |

- 1.00 lot is equivalent of 1 000 units

- Calculations for exchange rate used as of 10:40 (GMT) 22/1/2025

There is a possibility to use Stop-Loss and Take-Profit

- You may wish to consider closing your position in profit, even if it is lower than the suggested one.

- Trailing stop technique could protect the profit