CHARGEPOINT (#CHARGEPOINT) weekly special report based On 1.00 Lot Calculation:

ELECTRIC VEHICLE CHARGING STATION SECTOR:

- MARKET SIZE ($18.1 Billion): The global electric vehicle charging station market was $18.1 billion in 2022. The market has grown at ~64.45% from 2021 at $11b to $18.1b in 2022.

- MARKET GROWTH POTENTIAL (TO INCREASE TO $120.60B BY 2028, AT A COMPOUNDED ANNUAL GROWTH RATE OF ~31.12%): Global Electric Vehicle Charging Station sector value is expected to grow at a strong compounded annual growth rate of 31.12% between 2022 and 2028 to reach US$120.6 billion in 2028.

CHARGEPOINT

- THE COMPANY: ChargePoint is an American holding company focusing on electric vehicle charging solutions. It is one of the largest chagring station companies in the United States. ChargePoint operates in both North America and Europe. ChargePoint is compatible with a variety of EVs from brands like BMW, Tesla, Toyota, Honda, Volvo, Volkswagen, and plenty more.

- CHARGEPOINT IS THE LARGEST ELECTRIC VEHICLE CHARGING NETWORK WITH 65% MARKET SHARE IN THE U.S.A. AND 25% IN EUROPE: ChargePoint dominates the global markets in electric vehicle charging technologies, holding the largest market share on the planet. According to the company, ChargePoint has initiated over 3m charging sessions, saving drivers 3.5 million gallons of gasoline.

- 50% OF TOTAL U.S. VEHICLE SALES TO BE ELECTRIC VEHICLES BY 2023: President Joe Biden wants half of all new passenger vehicle sales in the U.S. to be electric vehicles by 2030. The International Energy Agency said that 60% of new vehicle sales globally will be Electric Vehicles.

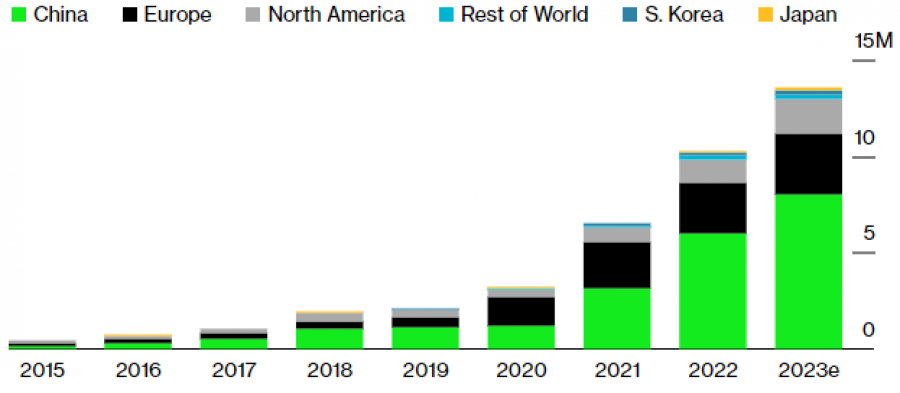

- TABLE I: ELECTRIC VEHICLES AND PLUG- IN HYBRIDS SALES TO JUMP 32% IN 2023 TO A NEW RECORD OF AROUND 13.6 MILLION (Source: Bloomberg). In North America only, the EV sales are expected to rise by 50% from 1.2 to 1.8 million EV sold.

Table I: Global EV and Plug-In Hybrid Sales

Source: Bloomberg

CHARGEPOINT (ANALYSIS AND EVENTS)

- EVENT: Q4 2023 EARNINGS (CONFIRMED MARCH 2, 2023 AFTER-MARKET): Chargepoint will report its Q4 2023 earnings report on March 2, 2023. Chargepoint is expected to report $165.7m in revenue, which would which would be a quarter-on-quarter growth of 32%, while year-on-year growth would be 105%. This would be its highest ever quarterly revenue. The company is also set to report its highest ever annual revenue figure, with markets forecasting $480.3m, which would be a 99% increase on the 2022 annual revenue.

- ANALYST OPINION: Credit Suisse price target is $22. Cowen is targeting $20. Jefferies is targeting $18. The Consensus Bloomberg price target is at $20.85.

- PRICE ACTION: THE STOCK HAS HAD A DOWNWARD CORRECTION OF AROUND 83% FROM ITS ALL-TIME HIGH OF $46.48 reached in December 2020. The stock fell after that to its lowest rate ever $7.94. Chargepoint was last trading around $11.25, and if full recovery follows recent all- time highs, the stock could see an upside of around ~309%. However, the stock may continue to decline.

Charge Point, February 13, 2023

Current Price:11.25

|

ChargePoint |

Weekly |

|

Trend direction |

|

|

22.00 |

|

|

18.00 |

|

|

14.50 |

|

|

9.00 |

|

|

8.00 |

|

|

7.00 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

ChargePoint |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

53,750.00 |

33,750.00 |

16,250.00 |

-11,250.00 |

-16,250.00 |

-21,250.00 |

|

Profit or loss in €2 |

49,672.39 |

31,189.64 |

15,017.24 |

-10,396.55 |

-15,017.24 |

-19,637.92 |

|

Profit or loss in £2 |

43,628.25 |

27,394.48 |

13,189.94 |

-9,131.49 |

-13,189.94 |

-17,248.38 |

|

Profit or loss in C$2 |

73,436.48 |

46,111.28 |

22,201.73 |

-15,370.43 |

-22,201.73 |

-29,033.03 |

- 1.00 lot is equivalent of 5000 units

- Calculations for exchange rate used as of 10:55 (GMT) 13/02/2023

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Senior Account ManagerClient Manager regarding their use.

- You may wish to consider closing your position in profit, even if it is lower than suggested one

- Trailing stop technique can protect the profit – Ask your Senior Account ManagerClient Manager for more detail