CHIPOTLE (#CHIPOTLE) weekly special report based On 1.00 Lot Calculation:

US FAST FOOD MARKET

- As of 2024, the fast-food industry in the U.S. is valued at approximately $367 billion. Over the next five years, the market is projected to expand at an average annual rate of about 2.5% to 3%. The largest companies in the sector are McDonalds, Subway, and KFC (Source: Yahoo Finance).

CHIPOTLE MEXICAN GRILL: THE COMPANY

- Chipotle Mexican Grill is an international chain of fast-casual restaurants specializing in bowls, tacos, and Mission burritos made to order in front of the customer. Fast-casual restaurants combine elements of fast food and casual dining. Chipotle has a market share of approximately 10% within the U.S. fast-casual dining segment. It was one of the first chains of fast casual dining establishments and as of March 2023, it has 3,200 restaurants. The company achieved 40 million reward members due to the company's investments in digital sales strategies.

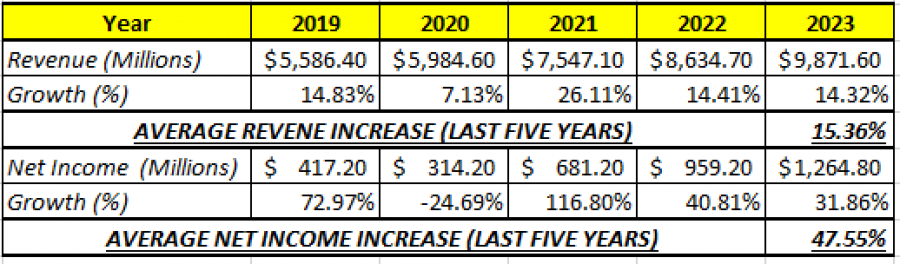

CHIPOTLE MEXICAN GRILL: REVENUE AND NET INCOME (LAST FIVE YEARS)

- The table below shows that Chipotle’s annual revenue has grown 15.36% on average over the past five years, while the company’s net income has grown on average 47.55% annually over the past 5 years.

Table I: Chipotle’s Revenue and Earnings Growth (Last Five Years)

DATA SOURCE: Bloomberg

CHIPOTLE: ANALYSIS AND EVENTS

- EVENT: Q2 EARNINGS, July 24th, 2024 (AFTERMARKET). Total revenue in the first quarter was $2.7 billion, an increase of 14.1% compared to the first quarter of 2023. Digital sales represented 36.5% of total food and beverage revenue.

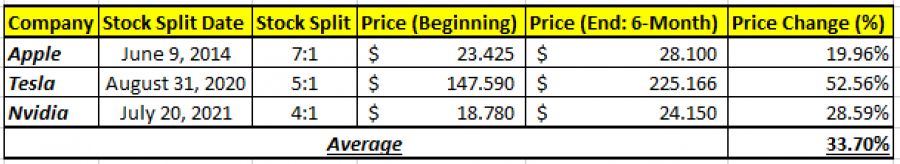

- EVENT: CHIPOTLE STOCK SPLIT 50 TO 1 COMPLETED ON WEDNESDAY (JUNE 26): Chipotle Mexican Grill, announced a 50-for-one split of its common stock on March 19, 2024. This is the first stock split for the company and one of the biggest stock splits in New York Stock Exchange history. As a reason for this, the company said it wants to make its stocks more accessible to employees and a broader range of investors.

STOCK SPLIT PERFORMANCE (HISTORICAL DATA)

● STOCK PERFORMANCE AFTER STOCK SPLIT (SOURCES: YahooFinance, Bloomberg, Fortrade MT4):

Please note that past performance of other companies does not guarantee future results of Chipotle.

- ANALYST OPINION: Trust Securities’s price target is $70.4. Oppenheimer is targeting $69.7. Goldman Sachs targets $74.6, while Wolfe Research targets $69.0.

- STOCK PRICE ACTION: Chipotle stock made its all-time high of adjusted $69.1 on June 18, 2024. The stock price currently trades around $65.40 (5.36% below its record high).

CHIPOTLE, June 26, 2024

Current Price: 65.40

|

Chipotle |

Weekly |

|

Trend direction |

|

|

100.00 |

|

|

85.00 |

|

|

72.00 |

|

|

59.00 |

|

|

58.00 |

|

|

56.00 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

Chipotle |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

173,000.00 |

98,000.00 |

33,000.00 |

-32,000.00 |

-37,000.00 |

-47,000.00 |

|

Profit or loss in €² |

161,766.91 |

91,636.74 |

30,857.27 |

-29,922.20 |

-34,597.55 |

-43,948.23 |

|

Profit or loss in £² |

136,550.56 |

77,352.34 |

26,047.22 |

-25,257.91 |

-29,204.45 |

-37,097.55 |

|

Profit or loss in C$² |

236,439.10 |

133,936.60 |

45,101.10 |

-43,734.40 |

-50,567.90 |

-64,234.90 |

- 1.00 lot is equivalent of 5000 units

- Calculations for exchange rate used as of 11:50 (GMT) 26/06/2024

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Senior Account ManagerClient Manager regarding their use.

- You may wish to consider closing your position in profit, even if it is lower than suggested one

- Trailing stop technique can protect the profit – Ask your Senior Account ManagerClient Manager for more detail