COCOA (#COCOA) Weekly Special Report based on 1 Lot Calculation:

TECHNICAL REVIEW

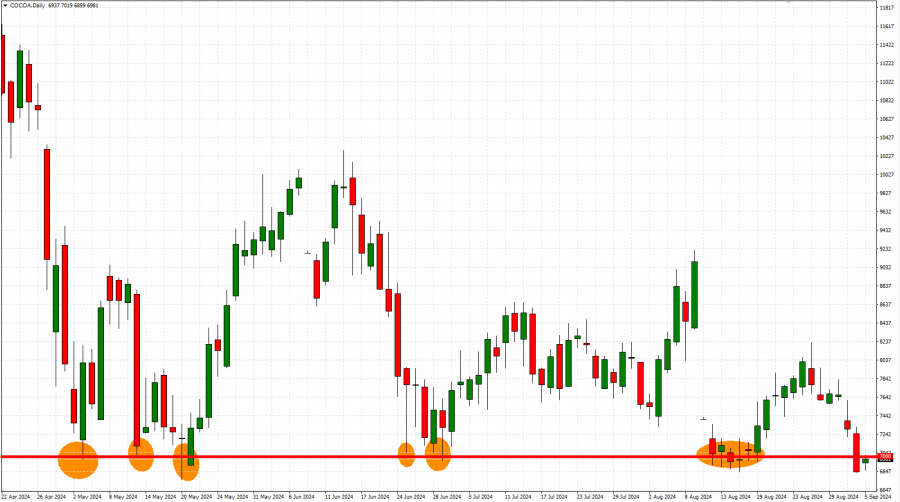

- COCOA PRICES TESTED THEIR LOWEST LEVELS IN MORE THAN 3 MONTHS ON SEPTEMBER 4 ($6831). Cocoa was trading around the mark of $7000 on September 5.

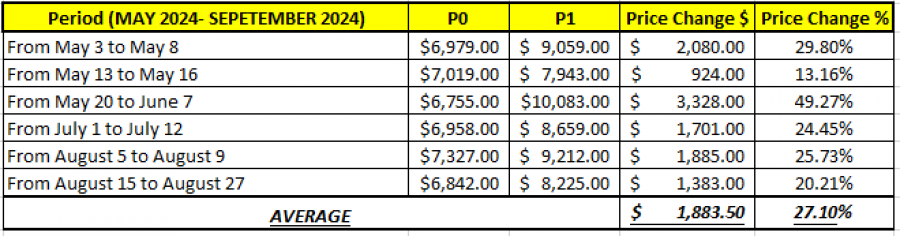

- COCOA PRICES HAVE TESTED THE MARK OF $7000 (OR NEAR) 6 TIMES SINCE MAY 2024. This is the 7th time that the Cocoa prices are testing levels near the mark of $7000.

GRAPH (DAILY): APRIL 2024 - SEPTEMBER 2024

- 2024 STATISTICS: COCOA TENDS TO RECOVER BY AROUND 27% AFTER TESTING THE MARK OF $7000 OR NEAR IT.

DATA SOURCE: Fortrade MetaTrader 4

Please note that past performance does not guarantee future results

KEY FUNDAMENTALS:

- TOP COCOA PRODUCERS (tonnes): 1. Ivory Coast - 2.200m, 2. Ghana - 1.100m, 3. Indonesia - 0.667m, 4. Ecuador - 0.337m, 5. Cameroon - 0.300m.

- SUPPLY DISRUPTIONS: Ghana and Ivory Coast, which produce over 60% of the world's cocoa, are facing severe harvest problems.

- CONSUMER TRENDS: Traditional consumer markets for cocoa include Europe, North America, and South America, where consumption has shown stagnation in recent years.

NEWS AND EVENTS

- JULY 2024 MONTHLY COCOA MARKET REVIEW BY THE INTERNATIONAL COCOA ORGANIZATION (ICCO): THE IVORY COAST CONTINUED WITH FALLING COCOA SHIPMENTS. According to the ICCO, on the supply side, news agency data reveal that arrivals at ports in the Ivory Coast were down by 26.5% as compared with the same period of the previous season and reached 1.679 million tonnes by 11 August. In Ghana, no current data on cocoa purchases were available. On the demand side, European and North American grindings, as published by the European Cocoa Association and National Confectioners Association for the second quarter of 2024, were up year-on-year by 4% and 2% respectively.

- MARKET DEFICIT: Earlier in their quarterly report, the ICCO specified that current market deficit amounts to 439,00o million tonnes, up from previous estimates of 374,000 million tonnes.

- NEWS (AUGUST 26): GHANA STRUGGLES TO SECURE FUNDING OF COCOA MARKET NEXT SEASON. According to Bloomberg, Ghana’s cocoa regulator, known as Cocobod, is still in talks with foreign lenders to raise a syndicated loan to fund the next season’s crop. Negotiations are ongoing, but it will not bring in more than $600 million out of an initial target of $1.5 billion.

COCOA (#COCOA) SEPTEMBER 5, 2024

Current Price: 6,900

|

Cocoa |

Weekly |

|

Trend direction |

|

|

12,000 |

|

|

10,000 |

|

|

8,000 |

|

|

6,000 |

|

|

5,800 |

|

|

5,600 |

Example of calculation based on weekly trend direction for 1 Lot1

|

Cocoa |

||||||

|

|

||||||

|

Profit or loss in $ |

51,000 |

31,000 |

11,000 |

-9,000 |

-11,000 |

-13,000 |

|

Profit or loss in €² |

50,446 |

30,663 |

10,881 |

-8,902 |

-10,881 |

-12,859 |

|

Profit or loss in £² |

38,735 |

23,545 |

8,355 |

-6,836 |

-8,355 |

-9,874 |

|

Profit or loss in C$² |

68,873 |

41,864 |

14,855 |

-12,154 |

-14,855 |

-17,556 |

- 1.00 lot is equivalent of 10 units

- Calculations for exchange rate used as of 13:30 (GMT+1) 5/9/2024

There is a possibility to use of Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one

- Trailing stop technique could protect the profit.