COCOA (#COCOA) Weekly Special Report based on 1 Lot Calculation:

TECHNICAL REVIEW

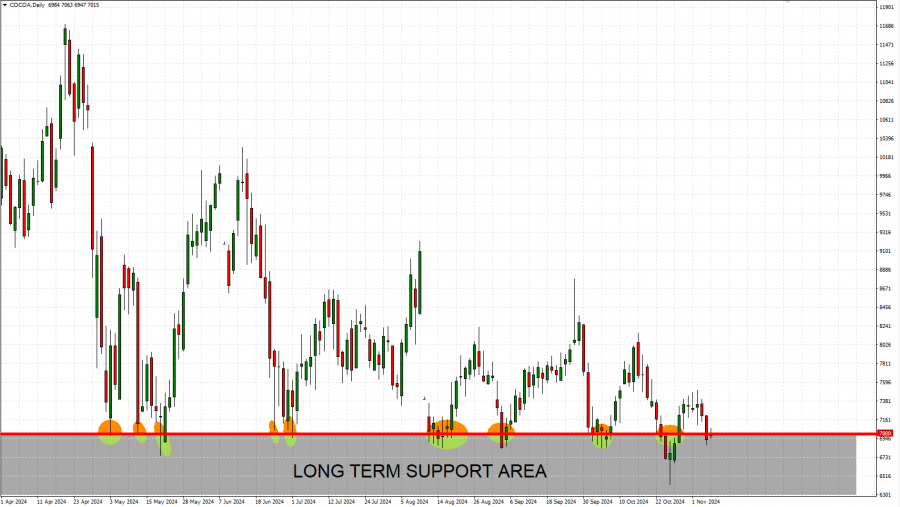

- COCOA HAS TESTED ITS LOWEST LEVEL SINCE MARCH 2024 (6419).

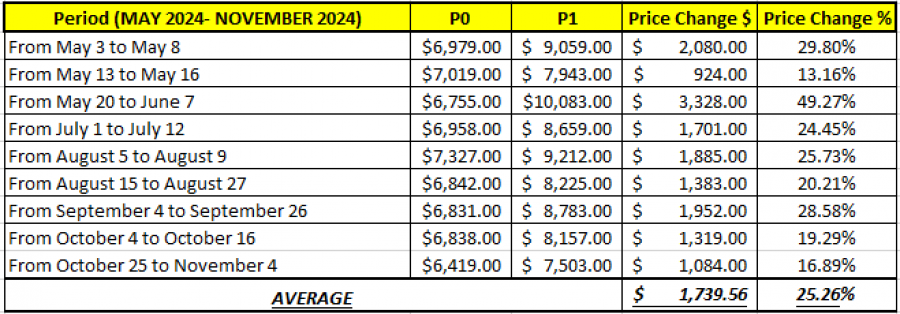

- COCOA PRICES HAVE TESTED THE MARK OF $7000 (OR NEAR) 9 TIMES SINCE MAY 2024. This is the 10th time that the Cocoa prices are testing levels near the mark of $7000.

GRAPH (DAILY): APRIL 2024 - OCTOBER 2024

- 2024 STATISTICS: COCOA TENDS TO RECOVER BY AROUND 25% AFTER TESTING THE MARK OF $7000 OR NEAR IT.

DATA SOURCE: Fortrade MetaTrader 4

Please note that past performance does not guarantee future results

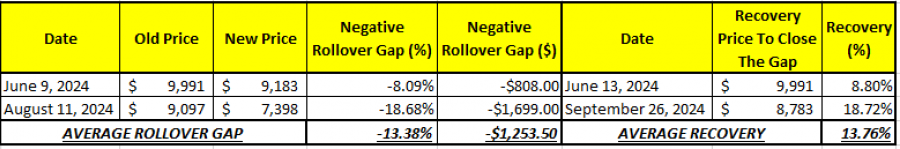

RECENT DEVELOPMENTS: CONTRACT ROLLOVER ON Fortrade Meta Trader 4 Platform

- JUNE 9, 2024: COCOA CONTRACT ROLLOVER (FULLY CLOSED). The new contract traded down by around 8% at $9,183 after the rollover and it managed to recover to previous contract’s price of $9,991 within the following 4 days (June 13), marking an increase of around 8.8% (Source: MetaTrader 4 Platform).

- AUGUST 11, 2024: COCOA CONTRACT ROLLOVER (96.55% CLOSED). The new contract traded down by around 18% after the rollover, fluctuating slightly above the mark of $7,000. Meanwhile, the Cocoa price managed to recover to $8,783 (September 26), marking an increase of 18.72% from the contract’s new price of $7,398 (Source: MetaTrader 4 Platform).

DATA SOURCE: Fortrade MetaTrader 4

Please note that past performance does not guarantee future results

- EVENT (NEXT ROLLOVER): NOVEMBER 10, 2024.

COCOA (#COCOA) November 7, 2024

Current Price: 7000

|

Cocoa |

Weekly |

|

Trend direction |

|

|

10000 |

|

|

9000 |

|

|

8000 |

|

|

6400 |

|

|

6200 |

|

|

6000 |

Example of calculation based on weekly trend direction for 1 Lot1

|

Cocoa |

||||||

|

|

||||||

|

Profit or loss in $ |

30,000 |

20,000 |

10,000 |

-6,000 |

-8,000 |

-10,000 |

|

Profit or loss in €² |

27,898 |

18,599 |

9,299 |

-5,580 |

-7,439 |

-9,299 |

|

Profit or loss in £² |

23,256 |

15,504 |

7,752 |

-4,651 |

-6,202 |

-7,752 |

|

Profit or loss in C$² |

41,656 |

27,770 |

13,885 |

-8,331 |

-11,108 |

-13,885 |

- 1.00 lot is equivalent of 10 units

- Calculations for exchange rate used as of 10:48 (GMT) 07/11/2024

There is a possibility to use of Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one

- Trailing stop technique could protect the profit.