Date: December 3, 2024

MARKET TREND EXPECTATIONS: UP

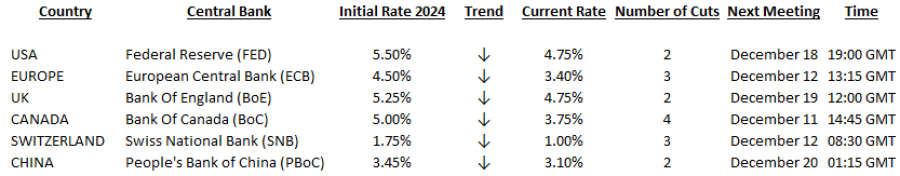

CENTRAL BANKS’ MONETARY POLICY SHIFT TO PROCEED IN DECEMBER: Interest Rate Cut Cycles Have Begun Earlier In 2024

Data Source: Bloomberg Terminal

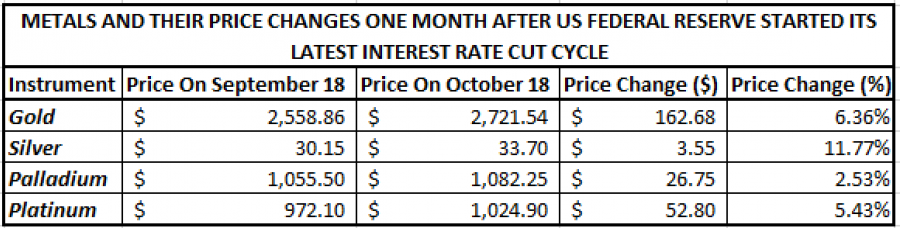

METALS: The commodity prices depend heavily on Central Banks’ interest rates, especially US Federal Reserve rates. When interest rates fall in the US, the commodity prices denominated in US Dollars (Gold, Silver, Palladium, Platinum) become lower as lower interest rates push the value of the US dollar down. Lower prices, naturally, increase demand for the commodity, causing higher prices thereafter. Therefore, with lower interest rates in 2024, especially in the US, one could expect higher commodity prices going forward.

US FEDERAL RESERVE STARTED ITS INTEREST RATE CUT CYCLE ON SEPTEMBER 18 AND METALS ROSE WITHIN THE NEXT ONE MONTH:

Data Source: MetaTrader 4 Platform

Please note that past performance does not guarantee future results

SELECTED COMMODITY MARKET: METALS

-

GOLD

Current Price: $2640

Example of calculation based on weekly trend direction for 1.00 Lot1

|

GOLD |

||||||

|

Pivot Points |

||||||

|

Levels |

3000 |

2900 |

2700 |

2590 |

2570 |

2550 |

|

Profit or loss in $ |

36,000 |

26,000 |

6,000 |

-5,000 |

-7,000 |

-9,000 |

|

Profit or loss in €2 |

34,226 |

24,719 |

5,704 |

-4,754 |

-6,655 |

-8,557 |

|

Profit or loss in £2 |

28,347 |

20,473 |

4,724 |

-3,937 |

-5,512 |

-7,087 |

|

Profit or loss in C$2 |

50,529 |

36,493 |

8,422 |

-7,018 |

-9,825 |

-12,632 |

-

1.00 lot is equivalent of 100 units

-

SILVER

Current Price: $30.80

Example of calculation based on weekly trend direction for 1.00 Lot1

|

SILVER |

||||||

|

Pivot Points |

||||||

|

Levels |

49.80 |

40.00 |

32.50 |

29.50 |

29.00 |

28.50 |

|

Profit or loss in $ |

190,000 |

92,000 |

17,000 |

-13,000 |

-18,000 |

-23,000 |

|

Profit or loss in €2 |

180,521 |

87,410 |

16,152 |

-12,351 |

-17,102 |

-21,853 |

|

Profit or loss in £2 |

149,868 |

72,568 |

13,409 |

-10,254 |

-14,198 |

-18,142 |

|

Profit or loss in C$2 |

266,390 |

128,989 |

23,835 |

-18,227 |

-25,237 |

-32,247 |

-

1.00 lot is equivalent of 10.000 units

-

PALLADIUM

Current Price: $990

Example of calculation based on weekly trend direction for 1.00 Lot1

|

PALLADIUM |

||||||

|

Pivot Points |

||||||

|

Levels |

1250 |

1150 |

1060 |

930 |

915 |

900 |

|

Profit or loss in $ |

26,000 |

16,000 |

7,000 |

-6,000 |

-7,500 |

-9,000 |

|

Profit or loss in €2 |

24,703 |

15,202 |

6,651 |

-5,701 |

-7,126 |

-8,551 |

|

Profit or loss in £2 |

20,508 |

12,620 |

5,521 |

-4,733 |

-5,916 |

-7,099 |

|

Profit or loss in C$2 |

36,453 |

22,433 |

9,814 |

-8,412 |

-10,515 |

-12,618 |

-

1.00 lot is equivalent of 100 units

-

PLATINUM

Current Price: $955

Example of calculation based on weekly trend direction for 1.00 Lot1

|

PLATINUM |

||||||

|

Pivot Points |

||||||

|

Levels |

1100 |

1050 |

1000 |

920 |

910 |

900 |

|

Profit or loss in $ |

14,500 |

9,500 |

4,500 |

-3,500 |

-4,500 |

-5,500 |

|

Profit or loss in €2 |

13,777 |

9,026 |

4,275 |

-3,325 |

-4,275 |

-5,226 |

|

Profit or loss in £2 |

11,437 |

7,493 |

3,550 |

-2,761 |

-3,550 |

-4,338 |

|

Profit or loss in C$2 |

20,330 |

13,319 |

6,309 |

-4,907 |

-6,309 |

-7,711 |

-

1.00 lot is equivalent of 100 units

-

Calculations for exchange rate used as of 11:00 (GMT) 03/12/2024

There is a possibility to use Stop-Loss and Take-Profit.

-

You may wish to consider closing your position in profit, even if it is lower than suggested one.

-

Trailing stop technique could protect the profit.