Copper Weekly Special Report based on 1 Lot Calculation:

GEOPOLITICS: US COPPER TARIFF FEARS SENT PRICES HIGH:

- BREAKING (MARCH 26): COPPER PRICE HIT A NEW ALL-TIME HIGH ($5.3702) ON REPORTS THAT US PRESIDENT TRUMP COULD IMPLEMENT COPPER IMPORT TARIFFS WITHIN WEEKS (AHEAD OF PREVIOUS SCHEDULE). Estimates have shown that the USA has imported 500,000 tons of copper over the past period, up from 70,000 tons monthly normally. This massive amount of copper being transported to the U.S. could push copper prices to record highs and potentially leave top consumer China and the rest of the world critically short of copper supplies. (Source: Bloomberg and Reuters)

- POTENTIAL U.S. TARIFFS ON COPPER: There are reports that U.S. President Donald Trump could implement copper tariffs within weeks (ahead of the previous schedule). The U.S. relies on imports for 45% of its copper consumption, and a 25% tariff could disrupt supply chains.

EVENTS (CHINA):

- THURSDAY, APRIL 10 AT 02:30 GMT+1: CHINA INFLATION (CPI) (MARCH) (PREVIOUS: -0.7%). Stronger-than-expected CPI data could signal an expanding Chinese economy and industrial activity.

- SATURDAY, APRIL 12 AT 08:10 GMT+1: CHINA EXPORT/IMPORT (MARCH) (EXPORT PREVIOUS: +2.3%, IMPORT PREVIOUS: -8.4%) Stronger-than-expected import and export data could indicate rising domestic demand and industrial activity in China, the world's largest consumer of copper.

- WEDNESDAY, APRIL 16 AT 03:00 GMT+1: CHINA INDUSTRIAL PRODUCTION (MARCH). (PREVIOUS: +5.9%). Stronger-than-expected industrial data could indicate rising domestic demand and industrial activity in China, the world's largest consumer of copper.

- WEDNESDAY, APRIL 16 AT 03:00 GMT+1: CHINA GROSS DOMESTIC PRODUCT (GDP) (Q1). (PREVIOUS: +5.4%). Stronger-than-expected gross domestic product (GDP) data could indicate rising economic activity in China, the world's largest consumer of copper.

EVENTS (USA):

- THURSDAY, APRIL 10 AT 13:30 GMT+1: US INFLATION (CPI) (MARCH) (PREVIOUS: 2.8%). A smaller-than-expected number could be supportive for copper because then the FED could be encouraged to lower interest rate cuts. This index measures the change in the price of the goods and services from the perspective of the consumer. Inflation in February came in at 2.8%, which was lower than analysts’ expectations of 2.9%.

ANALYSTS OPINION:

- GOLDMAN SACHS SEES COPPER PRICE BETWEEN $5 and $5.50: Goldman Sachs expects a deficit of 180.000 tons in 2025 and 250.000 tons in 2026.

TECHNICAL ANALYSIS

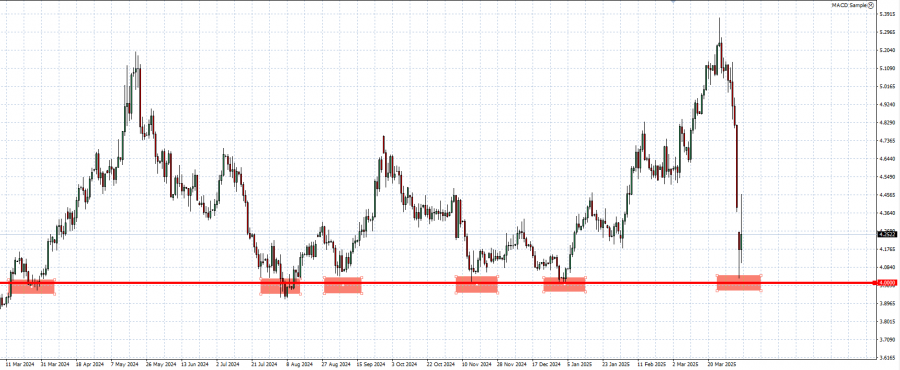

- STRONG SUPPORT AT $4: Copper has tested the support level of $4 six times since march 2024.

GRAPH (DAILY): March 2024 – April 2025

Please note that past performance does not guarantee future results

COPPER, April 7, 2025

Current Price: 4.2000

|

COPPER |

Weekly |

|

Trend direction |

|

|

5.2500 |

|

|

5.0000 |

|

|

4.7500 |

|

|

3.7000 |

|

|

3.6000 |

|

|

3.5000 |

Example of calculation based on weekly trend direction for 1.00 Lot1

COPPER

|

Pivot Points |

||||||

|

Profit or loss in $ |

10,500 |

8,000 |

5,500 |

-5,000 |

-6,000 |

-7,000 |

|

Profit or loss in €2 |

9,569 |

7,291 |

5,013 |

-4,557 |

-5,468 |

-6,380 |

|

Profit or loss in £2 |

8,188 |

6,239 |

4,289 |

-3,899 |

-4,679 |

-5,459 |

|

Profit or loss in C$2 |

14,970 |

11,406 |

7,842 |

-7,129 |

-8,555 |

-9,980 |

- 1.00 lot is equivalent of 10 000 units

- Calculations for exchange rate used as of 13:30 (GMT+1) 07/04/2025

There is a possibility to use Stop-Loss and Take-Profit

- You may wish to consider closing your position in profit, even if it is lower than the suggested one.

- Trailing stop technique could protect the profit