Crude Oil weekly special report based on 1.00 Lot Calculation:

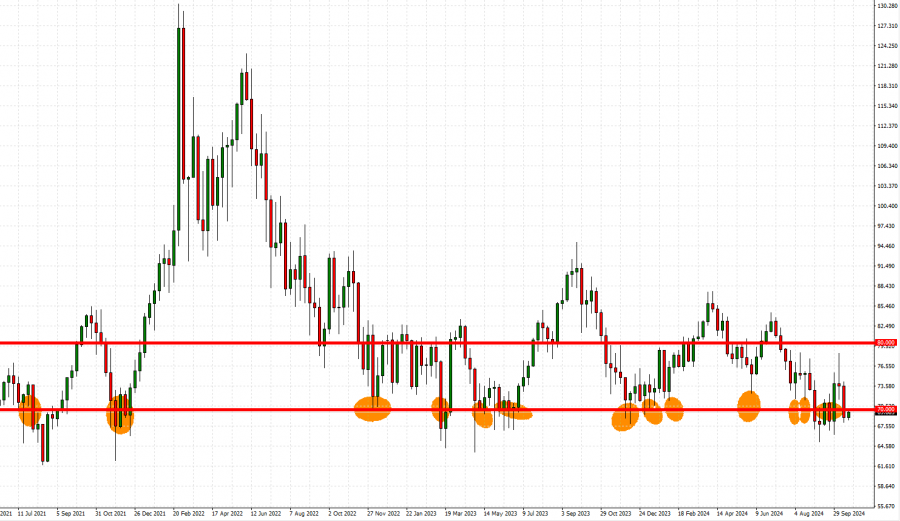

TECHNICAL ANALYSIS:

- CRUDE OIL PRICES HAVE TESTED THE MARK OF $70 (OR NEAR) 13 TIMES SINCE 2021. This is the 14th time that Crude Oil prices are testing levels near the mark of $70.

GRAPH (Daily): July 2021 – October 2024

Please note that past performance does not guarantee future results

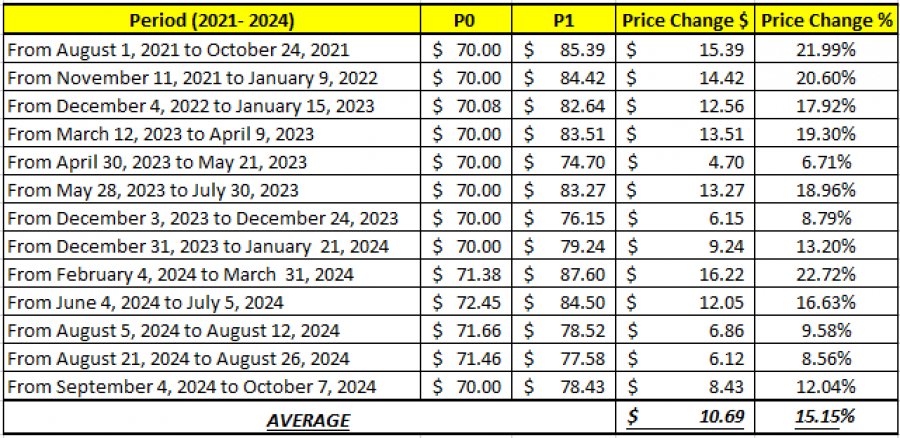

- 2021- 2024 STATISTICS: CRUDE OIL TENDS TO RECOVER BY AROUND 15% AFTER TESTING THE MARK OF $70 OR NEAR IT.

DATA SOURCE: Fortrade MetaTrader 4

Please note that past performance does not guarantee future results

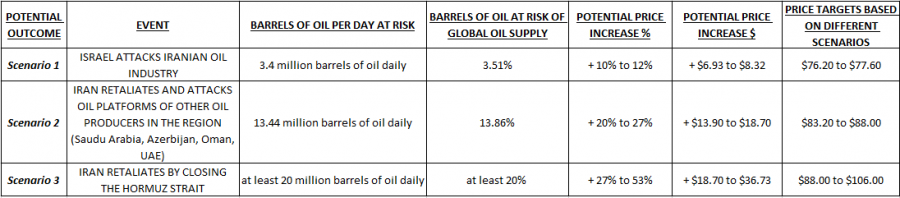

GEOPOLITICAL (MIDDLE EAST) TENSIONS: ISRAEL IS EXPECTED TO ATTACK TARGETS IN IRAN BY U.S. PRESIDENTIAL ELECTIONS ON NOVEMBER 5, 2024

- SCENARIOS: OIL PRICES EXPECTED TO REACT DIFFERENTLY UNDER DIFFERENT SCENARIOS. Scenario 1 assumes that an Israeli retaliatory attack against Iran could reduce global supply by near 3.5% of total global supply. Scenario 2 assumes that Iran will retaliate back by attacking the oil infrastructure of other countries in the region, such as Saudi Arabia, Azerbaijan, Oman, or the United Arab Emirates. Under this scenario, the global oil market could lose up to 13.86% of total global oil supply. Scenario 3 is the worst case scenario, and therefore least likely to occur, assuming that Iran could shut down the most important passage of oil, the Strait of Hormuz. The passage handles at least 20 million barrels a day of daily oil supply, which represents around at least 20% of total global supply.

- EXPECTED PRICE REACTIONS: The expected price reactions below in the table are derived by calculating the average oil price reaction when the Russia-Ukranian conflict broke out in 2022, when Yemen’s Houthis attacked Saudi Arabia’s oil platforms damaging 50% of Saudi Arabia’s oil production capacities in 2019, and when US Trump’s administration decided to pull out of the Nuclear Agreement to impose an additional oil sanction on Iran.

Data Source: Reuters, Bloomberg, CNBC; Potential Event Sources: Axios; Potential Price Reaction: Avearge Price From Previous Similar Events.

Please note that past performance does not guarantee future results

Crude Oil, October 21, 2024

Current Price: 69.30

|

Crude Oil |

Weekly |

|

Trend direction |

|

|

106 |

|

|

88 |

|

|

75 |

|

|

65 |

|

|

64 |

|

|

63 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

Crude Oil |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

36,700 |

18,700 |

5,700 |

-4,300 |

-5,300 |

-6,300 |

|

Profit or loss in €2 |

33,811 |

17,228 |

5,251 |

-3,962 |

-4,883 |

-5,804 |

|

Profit or loss in £2 |

28,185 |

14,361 |

4,378 |

-3,302 |

-4,070 |

-4,838 |

|

Profit or loss in C$2 |

50,687 |

25,827 |

7,872 |

-5,939 |

-7,320 |

-8,701 |

1. 1.00 lot is equivalent of 1000 units

2. Calculations for exchange rate used as of 10:00 (GMT+1) 21/10/2024

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than the suggested one.

- Trailing stop technique could protect the profit.