Crude Oil weekly special report based on 1.00 Lot Calculation:

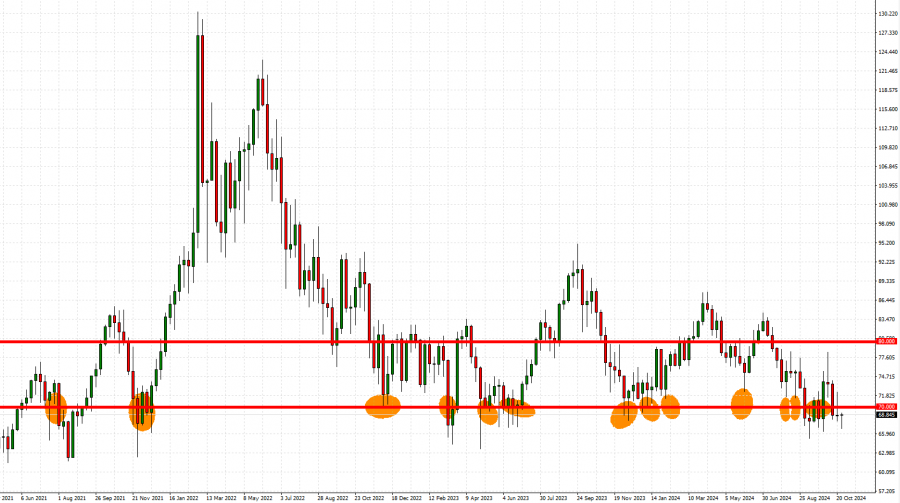

TECHNICAL ANALYSIS:

- CRUDE OIL PRICES HAVE TESTED THE MARK OF $70 (OR NEAR) 13 TIMES SINCE 2021. This is the 14th time that Crude Oil prices are testing levels near the mark of $70.

GRAPH (Daily): July 2021 – October 2024

Please note that past performance does not guarantee future results

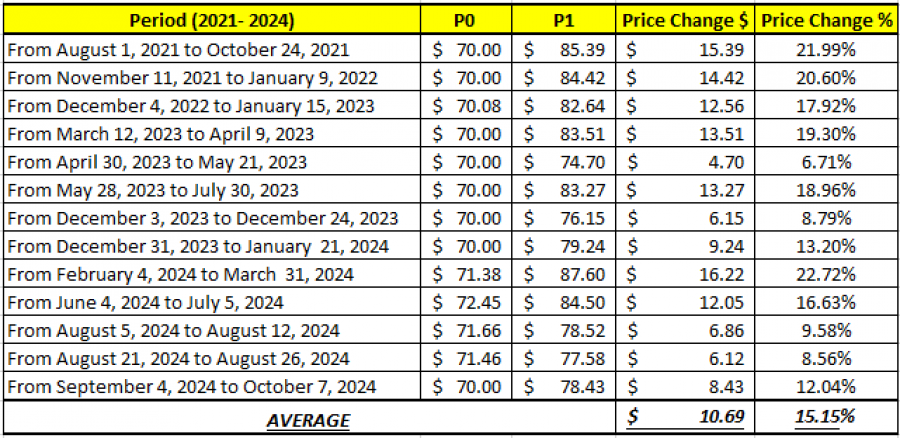

- 2021- 2024 STATISTICS: CRUDE OIL TENDS TO RECOVER BY AROUND 15% AFTER TESTING THE MARK OF $70 OR NEAR IT.

DATA SOURCE: Fortrade MetaTrader 4

Please note that past performance does not guarantee future results

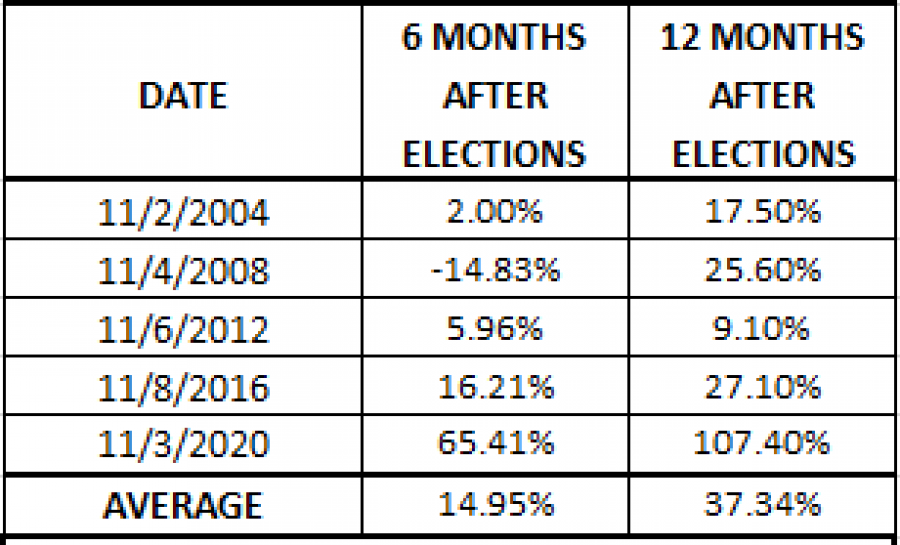

FUNDAMENTAL ANALYSIS:

- EVENT (NOVEMBER 5): US PRESIDENTIAL ELECTIONS. STATISTICS: Crude oil on average rose 14.95% 6 months after US Presidential Elections and rose 37.34% 12 months after US Presidential Elections. The analysis uses data since 2004 or last five elections.

Data Source: Bloomberg

Please note that past performance does not guarantee future results

- EXPECTED (NOVEMBER 8): CHINA COULD ANNOUNCE A NEW STIMULUS PACKAGE AS SOON AS NEXT WEEK. According to some reports, China could announce an additional stimulus package worth 1.4 trillion dollars. The package could include money raised via special sovereign bonds over the next few years.

- EVENT (DECEMBER 1): OPEC+ MEETING. The group could be once again expected to delay the start of its planned oil production increase, which was supposed to begin on December 1. If true, then Oil prices could see some recovery. A decision to postpone the increase could come as early as next week, two OPEC+ sources told Reuters.

Crude Oil, October 31, 2024

Current Price: 68.50

|

Crude Oil |

Weekly |

|

Trend direction |

|

|

80 |

|

|

76 |

|

|

73 |

|

|

65 |

|

|

64 |

|

|

63 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

Crude Oil |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

11,500 |

7,500 |

4,500 |

-3,500 |

-4,500 |

-5,500 |

|

Profit or loss in €2 |

10,576 |

6,898 |

4,139 |

-3,219 |

-4,139 |

-5,058 |

|

Profit or loss in £2 |

8,848 |

5,770 |

3,462 |

-2,693 |

-3,462 |

-4,232 |

|

Profit or loss in C$2 |

16,004 |

10,437 |

6,262 |

-4,871 |

-6,262 |

-7,654 |

1. 1.00 lot is equivalent of 1000 units

2. Calculations for exchange rate used as of 10:25 (GMT) 31/10/2024

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than the suggested one.

- Trailing stop technique could protect the profit.