Crude Oil weekly special report based on 1.00 Lot Calculation:

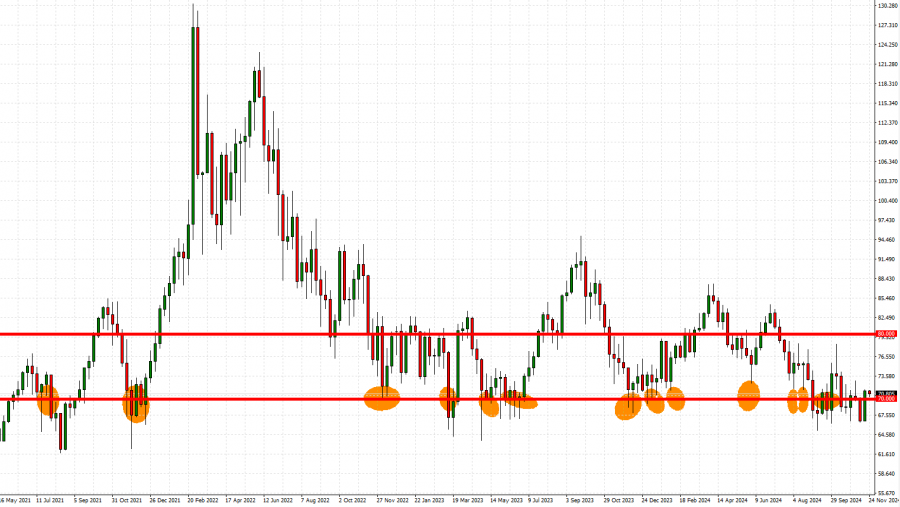

TECHNICAL ANALYSIS:

- CRUDE OIL PRICES HAVE TESTED THE MARK OF $70 (OR NEAR) 13 TIMES SINCE 2021. This is the 14th time that Crude Oil prices are testing levels near the mark of $70.

GRAPH (Weekly): July 2021 – November 2024

Please note that past performance does not guarantee future results

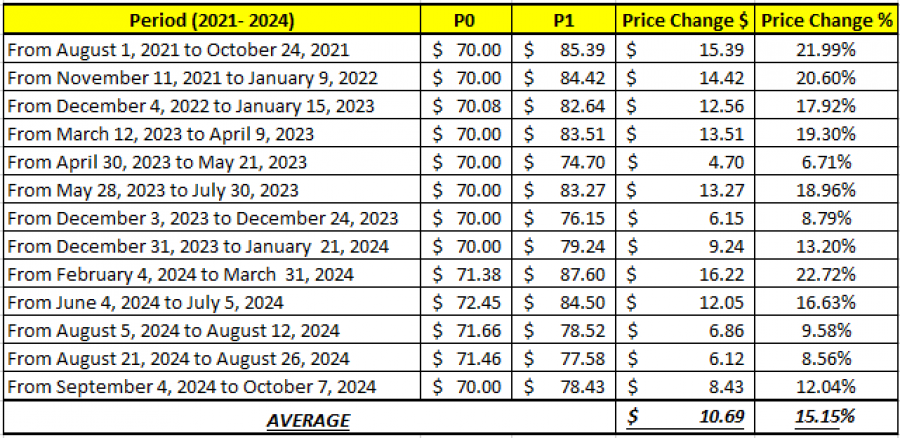

- 2021- 2024 STATISTICS: CRUDE OIL TENDS TO RECOVER BY AROUND 15% AFTER TESTING THE MARK OF $70 OR NEAR IT.

DATA SOURCE: Fortrade MetaTrader 4

Please note that past performance does not guarantee future results

GEOPOLITICS:

- RUSSIA TENSIONS WITH THE WEST RISE AS THE U.S. ALLOW UKRAINE TO USE THEIR LONG- RANGE MISSILE SYSTEMS TO STRIKE RUSSIAN TERRITORY INSIDE, WHILE RUSSIA USED HYPERSONIC INTERMEDIATE-RANGE BALLISTIC MISSILE (“ORESHNIK”) FOR THE FIRST TIME TO HIT TARGETS IN DNIPRO, UKRAINE. President Vladimir Putin said that the West would be directly fighting with Russia if it allowed Ukraine to strike Russian territory with Western-made long-range missiles, a move he said could alter the nature and scope of the conflict.

- OIL MARKETS AMIDST RISING TENSIONS REGARDING RUSSIA: This could increase worries over potential Russian oil supply disruptions, which could positively support oil prices as Russia is among the three largest oil producers in the world, along with the USA and Saudi Arabia and among the two largest oil exporters in the world along with Saudi Arabia.

EVENTS:

- TUESDAY, NOVEMBER 26 AT 21:30 GMT: AMERICAN PETROLEUM INSTITUTE (API) WEEKLY OIL INVENTORY DATA (USA). Last week data showed an unexpected increase in inventories of 4.753 million barrels. If data later this week shows that the trend is changing and a decline in inventory is reported, then oil prices could come under positive pressure as this could signal improving demand outlook in the USA.

- WEDNESDAY, NOVEMBER 27 AT 15:30 GMT: ENERGY INFORMATION ADMINISTRATION (EIA) WEEKLY OIL INVENTORY DATA (USA). Data last week showed an increase in inventories of around 0.5 million barrels, but it was still a lower than previous week’s increase of 2.089 million barrels. If data shows a decline in inventories, oil prices could be expected to react positively as this could signal stronger oil demand in the USA.

- EVENT (SUNDAY, DECEMBER 1): OPEC+ MEETING. The group could be expected to once again step up efforts to support the oil market, having in mind that oil price has recently fallen to levels near $66 a barrel. One thing they could do is once again delay the start of its planned oil production increase, which was supposed to begin on January 1, 2025. If true, then oil prices could see some recovery.

Crude Oil, November 25, 2024

Current Price: 70.40

|

Crude Oil |

Weekly |

|

Trend direction |

|

|

80 |

|

|

77 |

|

|

74 |

|

|

67 |

|

|

66 |

|

|

65 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

Crude Oil |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

9,600 |

6,600 |

3,600 |

-3,400 |

-4,400 |

-5,400 |

|

Profit or loss in €2 |

9,156 |

6,294 |

3,433 |

-3,243 |

-4,196 |

-5,150 |

|

Profit or loss in £2 |

7,634 |

5,248 |

2,863 |

-2,704 |

-3,499 |

-4,294 |

|

Profit or loss in C$2 |

13,400 |

9,212 |

5,025 |

-4,746 |

-6,142 |

-7,537 |

1. 1.00 lot is equivalent of 1000 units

2. Calculations for exchange rate used as of 10:40 (GMT) 25/11/2024

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than the suggested one.

- Trailing stop technique could protect the profit.