Crude Oil weekly special report based on 1.00 Lot Calculation:

GEOPOLITICS:

- BREAKING NEWS (JANUARY 10): U.S.A., U.K. IMPOSE NEW OIL SANCTIONS ON RUSSIA TARGETING 183 VESSELS THAT HAVE SHIPPED RUSSIAN OIL AND 25% OF TOTAL RUSSIA’S EXPORTS (1.75 million barrels a day). The sanctions are targeting 183 vessels that shipped 530 million barrels of oil last year, which is 42% of Russia's seaborne crude exports and 25% of its total exports. Many of the newly targeted vessels, part of a "shadow fleet", have been used to ship oil to India and China, while some of them have also shipped oil from Iran, which is also under sanctions. Russia is among the world's largest oil producers, and any reduction in its market presence could significantly influence and potentially drive up global oil prices.

- EVENT (AFTER JANUARY 20, 2025): US PRESIDENT-ELECT DONALD TRUMP IS EXPECTED TO INCREASE PRESSURE ON IRAN AFTER HE TAKES OFFICE ON JANUARY 20, 2025. President Trump is expected to impose new sanctions on Iranian oil, to slash Iranian oil exports to a minimum from the current near 1.6 million barrels a day.

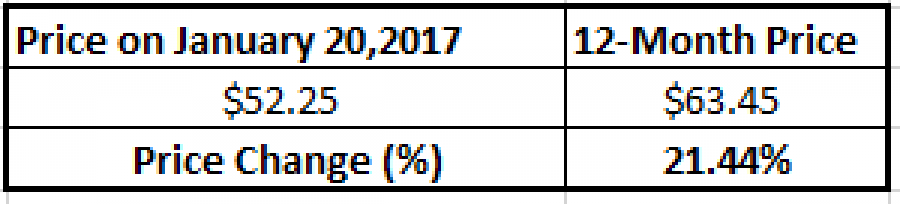

STATISTICS: CRUDE OIL ROSE 21.44% DURING TRUMP’S FIRST YEAR OF PRESIDENCY (JANUARY 20, 2017 – JANUARY 20, 2018)

Data Source: MetaTrader 4 Platform

Please note that past performance does not guarantee future results

FUNDAMENTAL REVIEW: DEMAND EXPECTED TO RISE AND POSSIBLY EXCEED SUPPLY IN Q1 OF 2025:

- DEMAND SIDE EXPECTED TO STRENGTHEN DUE TO ADDITIONAL ECONOMIC STIMULUS IN CHINA, SUPPORTING CHINA OIL CONSUMPTION AND OIL IMPORTS. China remained the largest oil importer in the world and the second largest oil consumer in the world after the US economy. According to Reuters, China will issue a record 3 trillion yuan ($411 billion) in special treasury bonds in 2025 to bolster its economy, in addition to more than 400 billion dollars of previous monetary and fiscal measures already announced earlier in 2024.

- SUPPLY SIDE EXPECTED TO REMAIN STEADY IN Q1 OF 2025. On December 5, OPEC+, which controls almost 50% of global oil markets, agreed to extend current cuts (around 5.7 million barrels a day) by April 2025, meaning that their oil output would remain unchanged in Q1 of 2025.

EVENTS (Economic Calendar):

- EVENT: The American Petroleum Institute Weekly Crude Oil Stock (January 14 at 21:30 GMT). According to reports from the American Petroleum Institute, U.S. crude oil inventories have been declining for the past four weeks. The latest report indicated a drop of 4.022 million barrels. If this trend continues, it could positively impact further increases in oil prices.

- EVENT: The Energy Information Administration's (EIA) Crude Oil Inventories (January 15 at 16:00 GMT). According to reports from the U.S. government, oil inventories have been declining over the past two weeks, signaling an increase in demand. The latest report indicated a drop of 0.96 million barrels. If this trend persists, it could contribute to additional increases in oil prices.

Crude Oil, January 14, 2025

Current Price: 77.10

|

Crude Oil |

Weekly |

|

Trend direction |

|

|

90.00 |

|

|

86.00 |

|

|

82.00 |

|

|

73.00 |

|

|

72.00 |

|

|

71.00 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

Crude Oil |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

12,900 |

8,900 |

4,900 |

-4,100 |

-5,100 |

-6,100 |

|

Profit or loss in €² |

12,561 |

8,666 |

4,771 |

-3,997 |

-4,972 |

-5,947 |

|

Profit or loss in £² |

10,553 |

7,281 |

4,009 |

-3,360 |

-4,179 |

-4,999 |

|

Profit or loss in C$² |

18,528 |

12,783 |

7,038 |

-5,892 |

-7,329 |

-8,766 |

1. 1.00 lot is equivalent of 1000 units

2. Calculations for exchange rate used as of 09:00 (GMT) 14/01/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than the suggested one.

- Trailing stop techniques could protect the profit.