Crude Oil weekly special report based on 1.00 Lot Calculation:

TECHNICAL ANALYSIS:

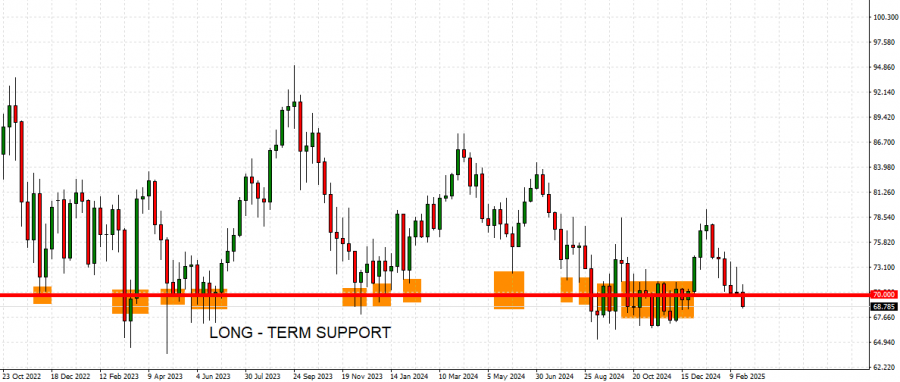

- CRUDE OIL PRICES HAVE TESTED THE MARK OF $70 (OR NEAR) 12 TIMES SINCE OCTOBER 2022. This is the 13th time that Crude Oil prices are testing levels near or below the mark of $70. However, there is also a risk of further decline if market conditions change.

GRAPH (Weekly): October 2022 – February 2025

Please note that past performance does not guarantee future results

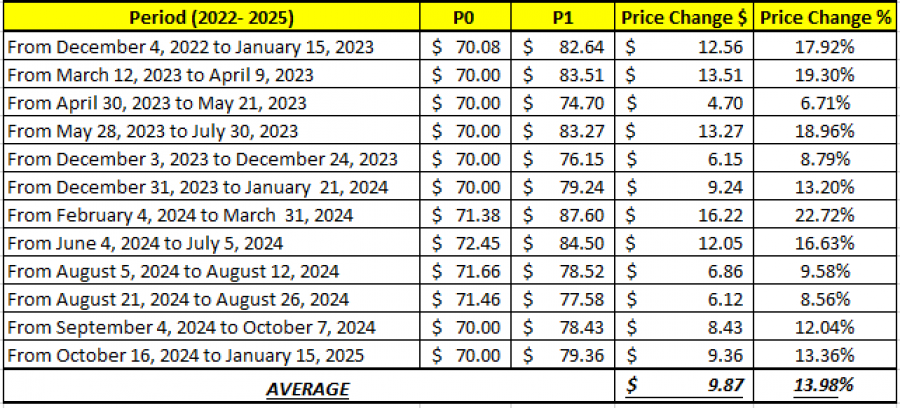

- 2022- 2025 STATISTICS: CRUDE OIL TENDS TO RECOVER BY AROUND 14% AFTER TESTING THE MARK OF $70 OR NEAR IT. However, there is also a risk of further decline if market conditions change.

DATA SOURCE: Fortrade MetaTrader 4

Please note that past performance does not guarantee future results

GEOPOLITICS:

- GOLDMAN SACHS SAYS OPEC+ WILL DELAY ITS GRADUAL OIL OUTPUT INCREASE FROM APRIL TO JULY. OPEC+ is expected to postpone once again its 120,000 barrel-a-day increase. If so, it will be the fourth time the plan has been delayed. Currently OPEC+ aims to restore 2.2 million barrels a day total, in monthly increments.

- USA GO AHEAD WITH NEW SANCTIONS ON IRAN. The sanctions, announced by the Treasury Department, aim to intensify economic pressure on Iran by targeting over 30 entities and individuals involved in the country's oil supply chain, including brokers and tanker operators in the United Arab Emirates, Hong Kong, and China. The action is part of President Donald Trump's "maximum pressure" campaign, explicitly aiming to halt Iran's petroleum exports, particularly to major consumers like China.

EVENTS:

- WEDNESDAY, FEBRUARY 26 AT 15:30 GMT: ENERGY INFORMATION ADMINISTRATION (EIA) WEEKLY OIL INVENTORY DATA (USA). If data showed a declining inventory for the past week, then positive support for the oil price could be expected.

- TUESDAY, MARCH 4 AT 21:30 GMT: AMERICAN PETROLEUM INSTITUTE (API) WEEKLY OIL INVENTORY DATA (USA). If data showed a declining inventory for the past week, then positive support for the oil price could be expected. Data for the previous week showed a decline of 0.64 million barrels, compared to expected increase of 2.3 million barrel.

Crude Oil, February 26, 2024

Current Price: 68.70

|

Crude Oil |

Weekly |

|

Trend direction |

|

|

75.00 |

|

|

73.50 |

|

|

72.00 |

|

|

66.50 |

|

|

66.00 |

|

|

65.50 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

Crude Oil |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

6,300 |

4,800 |

3,300 |

-2,200 |

-2,700 |

-3,200 |

|

Profit or loss in €² |

6,004 |

4,575 |

3,145 |

-2,097 |

-2,573 |

-3,050 |

|

Profit or loss in £² |

4,976 |

3,792 |

2,607 |

-1,738 |

-2,133 |

-2,528 |

|

Profit or loss in C$² |

9,036 |

6,885 |

4,733 |

-3,156 |

-3,873 |

-4,590 |

1. 1.00 lot is equivalent of 1000 units

2. Calculations for exchange rate used as of 13:20 (GMT) 26/02/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than the suggested one.

- Trailing stop techniques could protect the profit.