Crude Oil weekly special report based on 1.00 Lot Calculation:

TECHNICAL ANALYSIS:

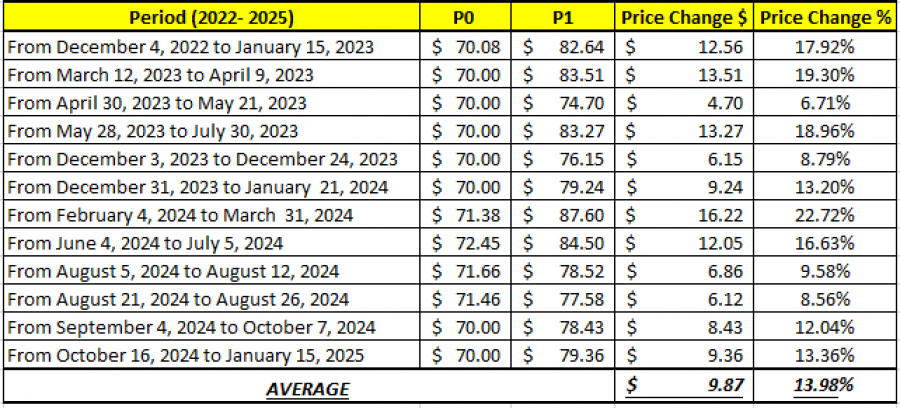

- CRUDE OIL PRICES HAVE TESTED THE MARK OF $70 (NEAR OR BELOW) 12 TIMES SINCE OCTOBER 2022. This is the 13th time that Crude Oil prices are testing levels near or below the mark of $70. However, there is also a risk of further decline if market conditions change.

- CRUDE OIL HAS TESTED ITS LOWEST PRICE SINCE APRIL 2023: $65.205. Crude oil has earlier this month tested its lowest price in almost two years. However, the price could change.

GRAPH (Weekly): October 2022 – March 2025

Please note that past performance does not guarantee future results

- 2022- 2025 STATISTICS: CRUDE OIL TENDS TO RECOVER BY AROUND 14% AFTER TESTING THE MARK OF $70 OR NEAR IT. However, there is also a risk of further decline if market conditions change.

DATA SOURCE: Fortrade MetaTrader 4

Please note that past performance does not guarantee future results

GEOPOLITICS:

- MIDDLE EAST TENSIONS RISE AFTER U.S. AIRSTRIKES ON IRAN-BACKED HOUTHIS IN YEMEN. The United States will keep attacking Yemen's Houthis until they end attacks on shipping, the U.S. defense secretary said, as the Iran-aligned group signaled it could escalate in response to deadly U.S. strikes the day before. (Source: Reuters)

- U.S.A. KEPT “MAXIMUM PRESSURE” ON IRAN aiming to cut its oil exports to zero to prevent Tehran from developing a nuclear weapon. The U.S. imposed sanctions on Iran’s Oil Minister Mohsen Paknejad and is set to introduce further measures to reduce Iranian oil exports from 1.6 million barrels per day.

EVENTS:

- TUESDAY, MARCH 18 at 20:30 GMT: US AMERICAN PETROLEUM INSTITUTE (API) WEEKLY OIL INVENTORIES. If inventory growth comes in lower than expected or figures show inventory declines, it could indicate tighter supply, supporting higher oil prices. Conversely, higher-than-expected growth may exert downward pressure on prices.

- WEDNESDAY, MARCH 19 at 14:30 GMT: US GOVERNMENT (EIA) WEEKLY OIL INVENTORIES. Similar to the API’s report, if inventory growth comes in lower than expected or figures show inventory declines, it could indicate tighter supply, supporting higher oil prices. Conversely, higher-than-expected growth may exert downward pressure on prices.

- WEDNESDAY, MARCH 19 at 18:00 GMT: US FEDERAL RESERVE INTEREST RATE DECISION. PRESS CONFERENCE AT 18:30 GMT. The U.S. Federal Reserve is expected to keep interest rates unchanged at 4.5%, with Chair Jerome Powell addressing the press afterwards. Rates may drop to 4.0% or lower by late 2025, and any hint of a cut could weaken the USD, boosting commodity prices, including crude oil.

Crude Oil, March 17, 2025

Current Price: 67.50

|

Crude Oil |

Weekly |

|

Trend direction |

|

|

75.00 |

|

|

73.00 |

|

|

71.00 |

|

|

65.00 |

|

|

64.50 |

|

|

64.00 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

Crude Oil |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

7,500 |

5,500 |

3,500 |

-2,500 |

-3,000 |

-3,500 |

|

Profit or loss in €² |

6,881 |

5,046 |

3,211 |

-2,294 |

-2,752 |

-3,211 |

|

Profit or loss in £² |

5,782 |

4,240 |

2,698 |

-1,927 |

-2,313 |

-2,698 |

|

Profit or loss in C$² |

10,822 |

7,936 |

5,050 |

-3,607 |

-4,329 |

-5,050 |

1. 1.00 lot is equivalent of 1000 units

2. Calculations for exchange rate used as of 11:50 (GMT) 17/03/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than the suggested one.

- Trailing stop techniques could protect the profit.