Crude Oil weekly special report based on 1.00 Lot Calculation:

TECHNICAL ANALYSIS:

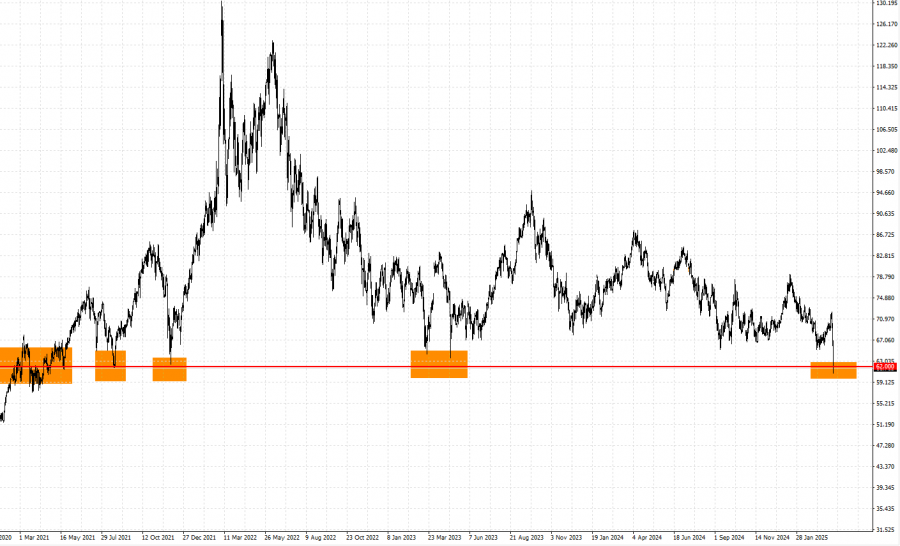

- LONG-TERM SUPPORT AT $62: Crude oil price has recently tested the mark of $62, for the first time since 2021.

- CRUDE OIL PRICES HAVE TESTED THE MARK OF $62 (OR NEAR) 4 TIMES SINCE MARCH 2021. This is the 5th time that Crude Oil prices are testing levels near $62.

GRAPH (Daily): March 2021 – April 2025

Please note that past performance does not guarantee future results

GEOPOLITICS:

- MIDDLE EAST TENSIONS RISE AS US TRUMP’S “ULTIMATUM” TO IRAN APPROACHES ITS DEADLINE (Early to Mid-May). According to Reuters, President Trump's letter to Iran's Supreme Leader Ali Khamenei included a two-month deadline (until early to mid-May) for reaching a new nuclear deal. In addition, Trump threatened to bomb Iran if Iran did not make a deal on the nuclear program. These developments increased chances for a potential military action in the Middle East, rich in oil and responsible for 20% to 30% of total global supply.

- RUSSIA-UKRAINE WAR: US PRESIDENT TRUMP THREATENED SANCTIONS ON RUSSIAN OIL. According to Reuters, President Donald Trump said he was angry at Russian President Vladimir Putin and will impose secondary tariffs of 25% to 50% on buyers of Russian oil if he feels Moscow is blocking his efforts to end the war in Ukraine.

- VENEZUELA OIL EXPORTS UNDER PRESSURE: US PRESIDENT TRUMP IMPOSED 25% SECONDARY IMPORT TARIFFS FOR COUNTRIES THAT BUY OIL FROM VENEZUELA. According to Reuters, U.S. President Donald Trump issued an executive order declaring that any country buying oil or gas from Venezuela will pay a 25% tariff on trades with the U.S.

EVENTS (OIL):

- TUESDAY, APRIL 8 AT 21:30 GMT+1: AMERICAN PETROLEUM INSTITUTE (API) WEEKLY OIL INVENTORY DATA (USA). If data shows a declining inventory for the past week, then positive support for the oil price could be expected. Data for the previous week showed an increase of 6.04 million barrels, compared to the previous week’s expected decrease of 4.6 million barrels.

- WEDNESDAY, APRIL 9 AT 15:30 GMT+1: ENERGY INFORMATION ADMINISTRATION (EIA) WEEKLY OIL INVENTORY DATA (USA). If data shows a declining inventory for the past week, then positive support for the oil price could be expected.

OTHER EVENTS (ECONOMIC):

- FRIDAY, APRIL 4 AT 16:25 GMT+1: US FED CHAIR JEROME POWELL SPEAKS. Mr. Powell speaks on Economic Outlook at the Society for Advancing Business Editing and Writing (SABEW) Annual Conference, Arlington, Virginia.

- THURSDAY, APRIL 10, AT 13:30 GMT+1: U.S. INFLATION (CPI) (MARCH): This index measures the change in the price of the goods and services from the perspective of the consumer. Inflation in February came in at 2.8%, which was lower than analysts’ expectations of 2.9%.

Crude Oil, April 4, 2024

Current Price: 61.80

|

Crude Oil |

Weekly |

|

Trend direction |

|

|

75 |

|

|

71 |

|

|

67 |

|

|

57 |

|

|

56 |

|

|

55 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

Crude Oil |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

13,200 |

9,200 |

5,200 |

-4,800 |

-5,800 |

-6,800 |

|

Profit or loss in €² |

11,968 |

8,341 |

4,715 |

-4,352 |

-5,259 |

-6,165 |

|

Profit or loss in £² |

10,152 |

7,076 |

3,999 |

-3,692 |

-4,461 |

-5,230 |

|

Profit or loss in C$² |

18,753 |

13,070 |

7,388 |

-6,819 |

-8,240 |

-9,661 |

1. 1.00 lot is equivalent of 1000 units

2. Calculations for exchange rate used as of 14:20 (GMT+1) 04/04/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than the suggested one.

- Trailing stop techniques could protect the profit.