EUR/USD Weekly Special Report based on 1.00 Lot Calculation:

GEOPOLITICS: TRADE WAR

- BREAKING (APRIL 2): US PRESIDENT DONALD TRUMP ANNOUNCES RECIPROCAL TARIFFS. US President Trump unveiled a comprehensive tariff package labeled “Liberation Day,” targeting countries with high tariffs on US goods. A 10% baseline tariff will take effect on April 5 for several US allies, while custom tariffs up to 54% will take effect April 9 on “worst offenders.” The EU will face a 20% tariff, justified by its 39% average tariff on US exports. This move marks a sharp escalation in US-UE trade tensions.

- INCREASING TENSIONS BETWEEN THE U.S. AND EUROPE: The new tariffs raised investor uncertainty, pushing demand for the U.S. dollar, and weakening the euro.

EVENTS:

- THURSDAY, APRIL 10, AT 13:30 GMT+1: US CONSUMER PRICE INDEX (CPI): A higher-than-expected rating is expected to be supportive for the US dollar. This index measures the change in the price of goods and services from the perspective of the consumer. This index stood at 2.8% last month, which was lower than the expected 2.9%.

TECHNICAL ANALYSIS:

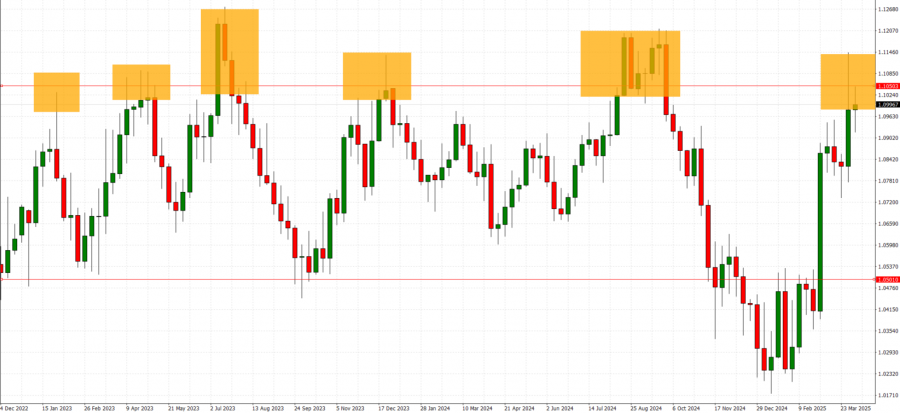

- EURUSD has been moving between the range of 1.105 and 1.05 since December 2022.

- EURUSD HAS TESTED THE MARK OF 1.105 (OR NEAR) 5 TIMES SINCE DECEMBER 2022. This is the 6th time that EURUSD prices are testing levels of 1.105. However, there remains a risk of a potential breakout below this level if market conditions change.

GRAPH (Daily): December 2022 – April 2025

Please note that past performance does not guarantee future results

EURUSD, APRIL 7, 2025

Current Price: 1.1005

|

EUR/USD |

Weekly |

|

Trend direction |

|

|

1.1200 |

|

|

1.1160 |

|

|

1.1120 |

|

|

1.0870 |

|

|

1.0700 |

|

|

1.0500 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

EUR/USD |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

-1,950.00 |

-1,550.00 |

-1,150.00 |

1,350.00 |

3,050.00 |

5,050.00 |

|

Profit or loss in €² |

-1,774.95 |

-1,410.85 |

-1,046.76 |

1,228.81 |

2,776.20 |

4,596.65 |

|

Profit or loss in £² |

-1,515.70 |

-1,204.78 |

-893.87 |

1,049.33 |

2,370.70 |

3,925.26 |

|

Profit or loss in C$² |

-2,779.50 |

-2,209.35 |

-1,639.19 |

1,924.27 |

4,347.42 |

7,198.19 |

1. 1.00 lot is equivalent of 100.000 units

2. Calculations for exchange rate used as of 10:00 (GMT+1) 07/04/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.