Gasoline weekly special report based on 1.00 Lot Calculation:

GEOPOLITICS:

- PRESIDENT TRUMP SIGNED AN EXECUTIVE ORDER TO PUT “MAXIMUM PRESSURE” ON IRAN: U.S. President Donald Trump restored his "maximum pressure" campaign on Iran that includes efforts to drive its oil exports down to zero in order to stop Tehran from obtaining a nuclear weapon. REMINDER: President Trump is expected to impose new sanctions on Iranian oil in order to slash exports to a minimum, down from the current nearly 1.6 million barrels a day.

EVENTS:

- WEDNESDAY, FEBRUARY 19 AT 21:30 GMT: AMERICAN PETROLEUM INSTITUTE (API) WEEKLY OIL AND GASOLINE INVENTORY DATA. If inventory growth comes in lower than expected, it could signal tighter supply, supporting higher oil and gasoline prices.

- THURSDAY, FEBRUARY 20 AT 16:00 GMT: US EIA (ENERGY INFORMATION AGENCY) WEEKLY OIL AND GASOLINE INVENTORY DATA. If inventory growth comes in lower than expected, it could signal tighter supply, supporting higher oil and gasoline prices.

TECHNICAL ANALYSIS:

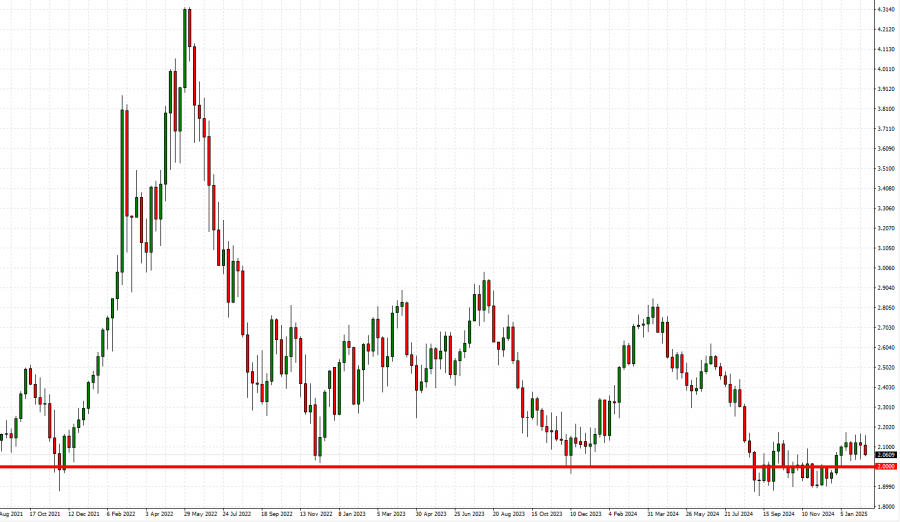

- STRONG SUPPORT AT $2.00: Gasoline has maintained strong support around the mark of $2.00 since 2021.

GRAPH (Weekly): 2021 - 2025

Please note that past performance does not guarantee future results

Gasoline, February 13, 2025

Current Price: 2.0600

|

Gasoline |

Weekly |

|

Trend direction |

|

|

2.220 |

|

|

2.180 |

|

|

2.120 |

|

|

2.000 |

|

|

1.980 |

|

|

1.960 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

GASOLINE |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

16,000 |

12,000 |

6,000 |

-6,000 |

-8,000 |

-10,000 |

|

Profit or loss in €2 |

15,361 |

11,521 |

5,760 |

-5,760 |

-7,680 |

-9,600 |

|

Profit or loss in £2 |

12,817 |

9,612 |

4,806 |

-4,806 |

-6,408 |

-8,010 |

|

Profit or loss in C$2 |

22,869 |

17,152 |

8,576 |

-8,576 |

-11,434 |

-14,293 |

1. 1.00 lot is equivalent of 100.000 units

2. Calculations for exchange rate used as of 10:30 (GMT) 13/2/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.