GOLD weekly special report based on 1.00 Lot Calculation:

GEOPOLITICS TO SUPPORT DEMAND FOR SAFE-HAVEN INSTRUMENTS

- RUSSIA TENSIONS WITH THE WEST RISE AS U.S. ALLOW UKRAINE TO USE THEIR LONG- RANGE MISSILE SYSTEM “ATACMS” TO STRIKE RUSSIAN TERRITORY INSIDE. President Vladimir Putin said that the West would be directly fighting with Russia if it allowed Ukraine to strike Russian territory with Western-made long-range missiles, a move he said would alter the nature and scope of the conflict.

- UKRAINE HIT RUSSIA WITH U.S. “ATACMS” MISSILES FOR FIRST TIME. Ukraine used U.S. ATACMS missiles to strike Russian territory, taking advantage of newly granted permission from the outgoing administration of U.S. President Joe Biden.

- DEMAND FOR GOLD TO RISE: This could increase worries over potential broader escalation in the region after two and a half years of mainly isolated conflict. This in turn could increase demand for safe- haven instruments such as Gold, which rose more than 160 dollars back in February 2022, when the Ukrainian- Russian conflict began first.

US FEDERAL RESERVE HAS BEGUN YET ANOTHER INTEREST RATE CUT CYCLE:

- BREAKING (NOVEMBER 7): FEDERAL RESERVE ANNOUNCED ITS SECOND INTEREST RATE CUT IN 2024. US Federal Reserve decided to cut its benchmark interest rate by 0.50% points in September and 0.25% points in November. The bank expects to cut rates one more time in 2024 to slash its benchmark rate to 4.5% by the end of 2024. The bank expects rates to fall to 3.5% in 2025 and further down to 2.9% in 2026.

- NEXT FED INTEREST RATE DECISION: December 18, 2024 at 19:00 GMT. As of November 21, the market sees high chances for 25 basis points interest rates cut. This could bring current rates of 4.75% down to 4.50%.

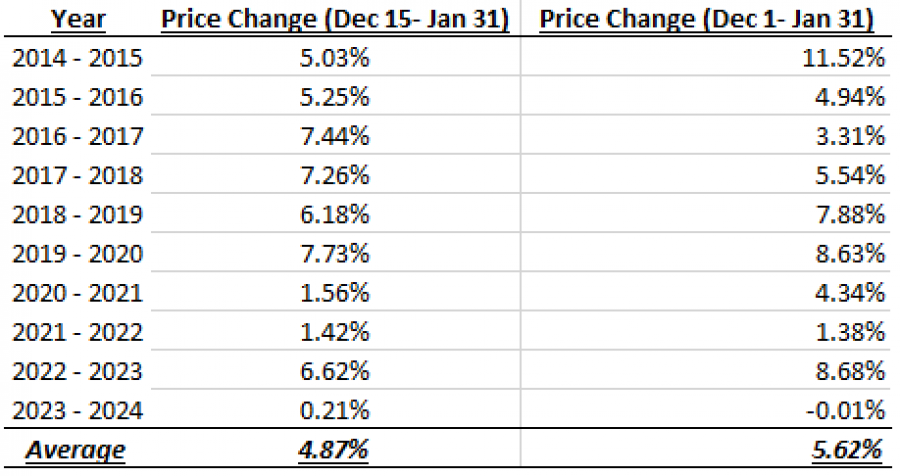

SEASONAL TRADE: DECEMBER - JANUARY (2014- 2024)

- STATISTICS: GOLD ROSE 5.62% ON AVERAGE BETWEEN DECEMBER AND JANUARY (2014- 2024)

Data Source: MetaTrader 4 Platform

Please note that past performance does not guarantee future results

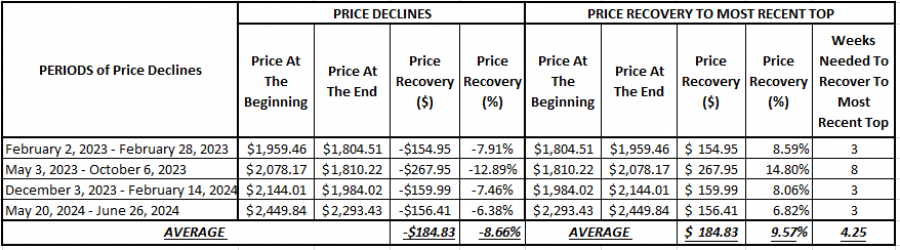

STATISTICS (2022 – 2024): PRICE RECOVERY AFTER CORRECTION LARGER THAN 150 DOLLARS

- PRICE DECLINES: WHEN PRICE CORRECTION HAPPENS, GOLD TENDS TO LOSE 8.66% ON AVERAGE

- PRICE RECOVERY: GOLD TENDS TO RECOVER TO ITS MOST RECENT TOPS WITHIN 4.25 WEEKS ON AVEARGE

- PRICE RECOVERY: GOLD TENDS TO RECOVER BY 9.57% ON AVERAGE

Data Source: MetaTrader 4 Platform

Please note that past performance does not guarantee future results

ANALYST OPINION:

- Citigroup targets $3,000; Bank of America targets $3,000; UBS targets $2,900. Goldman Sachs targets $2,900.

GOLD, November 21, 2024

Current Price: 2660

|

GOLD |

Weekly |

|

Trend direction |

|

|

3000 |

|

|

2900 |

|

|

2730 |

|

|

2600 |

|

|

2580 |

|

|

2550 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

Pivot Points |

||||||

|

Profit or loss in $ |

34,000 |

24,000 |

7,000 |

-6,000 |

-8,000 |

-11,000 |

|

Profit or loss in €2 |

32,323 |

22,816 |

6,655 |

-5,704 |

-7,605 |

-10,457 |

|

Profit or loss in £2 |

26,926 |

19,007 |

5,544 |

-4,752 |

-6,336 |

-8,711 |

|

Profit or loss in C$2 |

47,503 |

33,531 |

9,780 |

-8,383 |

-11,177 |

-15,369 |

1. 1.00 lot is equivalent of 100 units

2. Calculations for exchange rate used as of 09:30 (GMT) 21/11/2024

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.