GOLD weekly special report based on 1.00 Lot Calculation:

GEOPOLITICS:

- MIDDLE EAST TENSIONS REMAIN HIGH AFTER SYRIA’S CIVIL WAR. The government of President Bashar al-Assad of Syria, which had kept rebel forces at bay for more than a decade with Iranian and Russian military support, collapsed with astonishing speed on Sunday morning after an advance by opposition forces on the capital, Damascus (Source: Reuters).

- CHINA-TAIWAN TENSIONS RISE. A senior Taiwan security official said China had nearly 90 navy and coast guard ships near Taiwan, the southern Japanese islands, and the East and South China Seas, of which around two-thirds were naval, in a move not seen in decades. China claims Taiwan as its own territory (Source: Reuters).

CHINA RESUMED BUYING GOLD AFTER A SIX-MONTH PAUSE:

- REPORT: Data released by the People's Bank of China revealed that it has resumed buying gold. The People’s Bank of China said it bought 160,000 fine troy ounces in November (around 5 tons), ending a six-month pause in purchases. The PBOC had been a major buyer of bullion since late-2022 as it looked to be headed on a multi-year effort to diversify out of US dollars. That changed this year as officials seemingly became price sensitive as buying stopped in May. China’s gold holdings rose to 72.96 million troy ounces at the end of November, up from 72.80 million a month earlier. China was the largest official sector buyer of gold in 2023 with net purchases of 7.23 million ounces, according to the World Gold Council, the most for a single year since at least 1977.

- STATISTICS: GOLD ROSE AROUND 40% FROM JANUARY 2023 TO APRIL 2024. China stopped buying gold in May 2024, but before that China was adding gold for 18 consecutive months (From January 2023 to April 2024). Within this time period, Gold rose from $1,632.07 in January 2023 to $2,289.60 in April 2024. It marked an increase of around 40% (Source I: YahooFinance; Source II: MetaTrader 4 Platform).

EVENTS:

- WEDNESDAY, DECEMBER 11, AT 13:30 GMT: U.S INFLATION (CPI) (NOVEMBER): The U.S is scheduled to report its CPI figure for the month of November. The CPI inflation data from the last month of October came out at 2.6%, up from the 2.4% in September. If it comes below the recent 2.6%, then Gold could be expected to rise in value.

US FEDERAL RESERVE HAS BEGUN YET ANOTHER INTEREST RATE CUT CYCLE:

- BREAKING (NOVEMBER 7): FEDERAL RESERVE ANNOUNCED ITS SECOND INTEREST RATE CUT IN 2024. The US Federal Reserve decided to cut its benchmark interest rate by 0.50% points in September and 0.25% points in November. The bank expects to cut rates one more time in 2024 to slash its benchmark rate to 4.5% by the end of 2024. The bank expects rates to fall to 3.5% in 2025 and further down to 2.9% in 2026.

- NEXT FED INTEREST RATE DECISION: December 18, 2024 at 19:00 GMT. As of December 11, the market sees high chances for 25 basis point interest rate cut. This could bring current rates of 4.75% down to 4.50%.

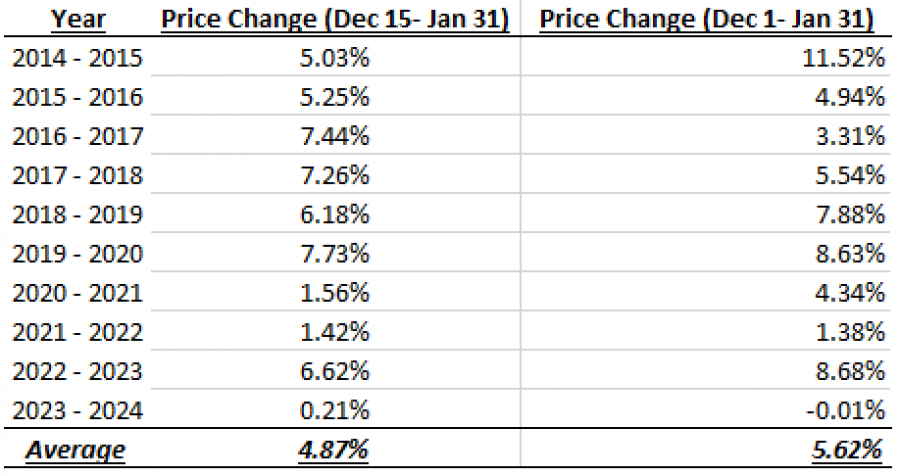

SEASONAL TRADE: DECEMBER - JANUARY (2014- 2024)

- STATISTICS: GOLD ROSE 5.62% ON AVERAGE BETWEEN DECEMBER AND JANUARY (2014- 2024)

Data Source: MetaTrader 4 Platform

Please note that past performance does not guarantee future results

ANALYST OPINION:

- Citigroup targets $3,000; Bank of America targets $3,000; UBS targets $2,900. Goldman Sachs targets $2,900.

GOLD, December 11, 2024

Current Price: 2695

|

GOLD |

Weekly |

|

Trend direction |

|

|

3000 |

|

|

2900 |

|

|

2750 |

|

|

2650 |

|

|

2625 |

|

|

2600 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

Pivot Points |

||||||

|

Profit or loss in $ |

30,500 |

20,500 |

5,500 |

-4,500 |

-7,000 |

-9,500 |

|

Profit or loss in €2 |

29,069 |

19,538 |

5,242 |

-4,289 |

-6,672 |

-9,054 |

|

Profit or loss in £2 |

23,977 |

16,116 |

4,324 |

-3,538 |

-5,503 |

-7,468 |

|

Profit or loss in C$2 |

43,262 |

29,077 |

7,801 |

-6,383 |

-9,929 |

-13,475 |

1. 1.00 lot is equivalent of 100 units

2. Calculations for exchange rate used as of 10:10 (GMT) 11/12/2024

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.