GOLD weekly special report based on 1.00 Lot Calculation:

US FEDERAL RESERVE HAS PROCEEDED WITH THEIR INTEREST RATE CUT CYCLE:

- BREAKING (DECEMBER 18): FEDERAL RESERVE CUT RATES TO 4.50% FROM 4.75% PREVIOUSLY. The FED has cut the interest rate by 25 bps as expected (from 4.75% to 4.50%). The bank has so far cut rates three times this year, slashing rates from initial 5.5% in September down to the current 4.50%. Lower interest rates exert positive pressure on gold.

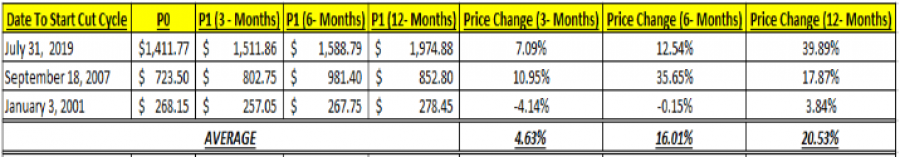

- STATISTICS: GOLD TENDS TO RISE BY 20.53% ON AVERAGE WITHIN THE FIRST 12 MONTHS AFTER A RATE CUT CYCLE IN THE U.S.A. BEGINS.

Data Source: MetaTrader 4 Platform

EVENTS:

- THURSDAY, DECEMBER 19 at 13:30 GMT: U.S. GROSS DOMESTIC PRODUCT - GDP (Q3). GDP measures the quarterly change in all goods and services produced by the economy. A weaker than expected result is generally supportive for gold because it increases the odds for further interest rate cuts by the FED. For the third quarter a growth rate of 2.8% is expected.

- FRIDAY, DECEMBER 20 at 13:30 GMT PCE (PERSONAL CONSUMPTION EXPENDITURES) PRICE INDEX (NOVEMBER). This is an indicator of the average increases in prices for all domestic personal consumption. A lower-than-expected result is generally supportive for gold because it makes it easier for the FED to lower interest rates, which in turn supports gold. The price index for the previous month was 2.3%. The core price index (PCE minus food and energy prices) was 2.8% for the previous month.

CHINA RESUMED BUYING GOLD AFTER A SIX-MONTH PAUSE:

- REPORT: Data released by the People's Bank of China revealed that it has resumed buying gold. The People’s Bank of China said it bought 160,000 fine troy ounces in November (around 5 tons), ending a six-month pause in purchases. The PBOC had been a major buyer of bullion since late 2022 as it looked to be headed on a multi-year effort to diversify out of US dollars. That changed this year as officials seemingly became price sensitive as buying stopped in May. China’s gold holdings rose to 72.96 million troy ounces at the end of November, up from 72.80 million a month earlier. China was the largest official sector buyer of gold in 2023 with net purchases of 7.23 million ounces, according to the World Gold Council, the most for a single year since at least 1977. Furthermore, it is expected that other Central Banks will remain active buyers of gold in the following year with 850 tons of expected gold purchases in the year 2025.

- STATISTICS: GOLD ROSE AROUND 40% FROM JANUARY 2023 TO APRIL 2024. China stopped buying gold in May 2024, but before that China was adding gold for 18 consecutive months (From January 2023 to April 2024). Within this time period, Gold rose from $1,632.07 in January 2023 to $2,289.60 in April 2024. It marked an increase of around 40% (Source I: YahooFinance; Source II: MetaTrader 4 Platform).

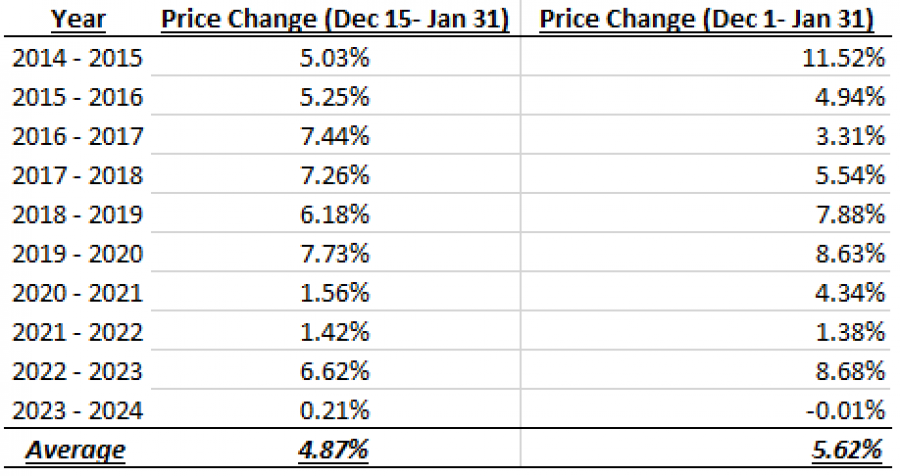

SEASONAL TRADE: DECEMBER - JANUARY (2014- 2024)

- STATISTICS: GOLD ROSE 5.62% ON AVERAGE BETWEEN DECEMBER AND JANUARY (2014- 2024)

Data Source: MetaTrader 4 Platform

Please note that past performance does not guarantee future results

ANALYST OPINION:

- Citigroup targets $3,000; Bank of America targets $3,000; UBS targets $2,900. Goldman Sachs targets $3,000.

GOLD, December 19, 2024

Current Price: 2615

|

GOLD |

Weekly |

|

Trend direction |

|

|

3000 |

|

|

2900 |

|

|

2680 |

|

|

2560 |

|

|

2550 |

|

|

2540 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

Pivot Points |

||||||

|

Profit or loss in $ |

38,500 |

28,500 |

6,500 |

-5,500 |

-6,500 |

-7,500 |

|

Profit or loss in €2 |

37,000 |

27,390 |

6,247 |

-5,286 |

-6,247 |

-7,208 |

|

Profit or loss in £2 |

30,433 |

22,528 |

5,138 |

-4,348 |

-5,138 |

-5,928 |

|

Profit or loss in C$2 |

55,426 |

41,030 |

9,358 |

-7,918 |

-9,358 |

-10,797 |

1. 1.00 lot is equivalent of 100 units

2. Calculations for exchange rate used as of 11:15 (GMT) 19/12/2024

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

Trailing stop technique could protect the profit.