GOLD weekly special report based on 1.00 Lot Calculation:

GEOPOLITICS: US PRESIDENT- ELECT DONALD TRUMP TAKES OFFICE ON JANUARY 20, 2025

- US PRESIDENT-ELECT DONALD TRUMP IS EXPECTED TO INCREASE PRESSURE ON IRAN AFTER HE TAKES OFFICE ON JANUARY 20, 2025. Earlier reports would also suggest that Trump could allow the US army to conduct airstrikes on Irania nuclear facilities as fears and concerns have grown that Iran is approaching capacity to produce a nuclear weapon. This could see a surge in Middle East tensions, which could, on the other hand, increase demand for the safe- haven Gold.

- TRADE WAR: President Trump has on several occasions said that he will increase tariffs on countries that have trade surpluses with the US, including Canada, Mexico, China and the European Union. This will increase global economic uncertainties, which in turn, could increase demand for the safe- haven Gold.

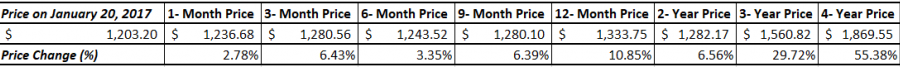

- STATISTICS: GOLD ROSE 10.85% DURING TRUMP’S FIRST YEAR OF PRESIDENCY (JANUARY 20, 2017 – JANUARY 20, 2018). In addition, Gold rose 55.38% during the entire first presidential term of Donald Trump (January 20, 2017 – January 20, 2021)

Data Source: MetaTrader 4 Platform

Please note that past performance does not guarantee future results

EVENTS:

- FRIDAY, JANUARY 10 AT 13:30 GMT: US NONFARM PAYROLL (NFP) AND UNEMPLOYMENT RATE (DECEMBER). US Unemployment Rate has remained high, and above the mark of 4%, coming at 4.2% in November. This will keep the US Fed attentive and more inclined towards further interest rate cuts in 2025.

- FRIDAY, JANUARY 15, AT 13:30 GMT: U.S INFLATION (CPI) (DECEMBER): The CPI inflation data from the last month of November came out at 2.6%, up from the 2.3% in November. If it comes below the recent 2.6%, then Gold could be expected to rise in value.

US FEDERAL RESERVE HAS BEGUN YET ANOTHER INTEREST RATE CUT CYCLE:

- BREAKING (DECEMBER 18, 2024): FEDERAL RESERVE ANNOUNCED ITS THIRD INTEREST RATE CUT IN 2024 TO 4.50%, DOWN FROM INITIAL 5.50%. The US Federal Reserve decided to cut its benchmark interest rate by 0.50% points in September, 0.25% points in November and by another 0.25% points in December. The bank expects to cut rates at least two more times in 2026 to slash its benchmark rate to 4% by the end of 2025. The bank expects rates to fall to 3.4% in 2026 and further down to 3.1% in 2027.

- NEXT FED INTEREST RATE DECISION: January 29, 2025 at 19:00 GMT. As of January 3, the market sees high chances rates to remain unchanged at the current 4.50%.

TECHNICAL REVIEW

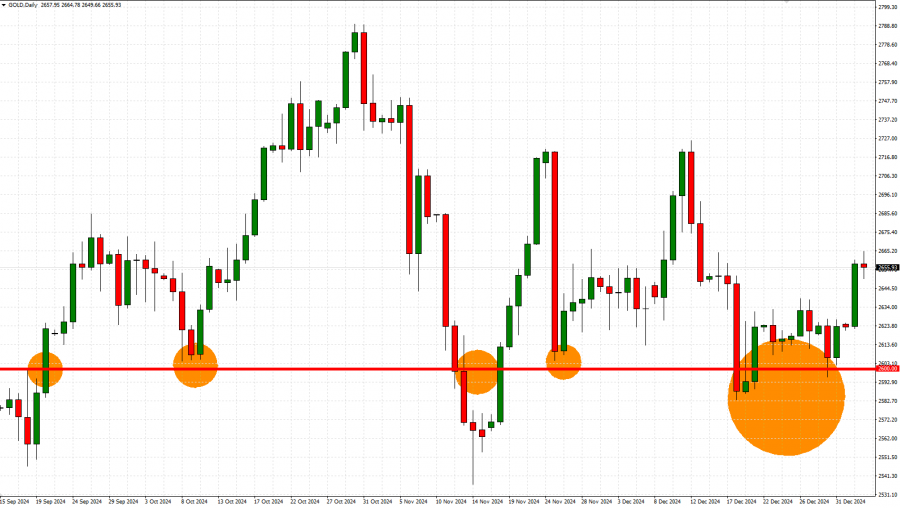

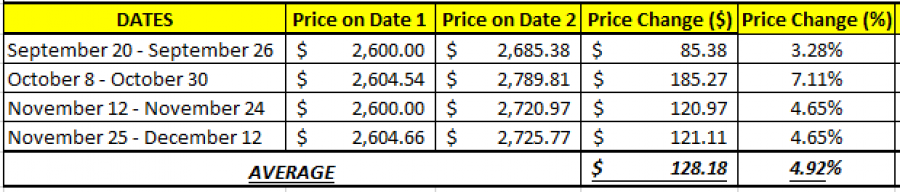

- STRONG SUPPORT AT $2,600 IN PLACE SINCE SEPTEMBER 2024. Gold has tested the mark of $2,600 five times since September 2024.

Graph (Daily): September 2024 – January 2025

- STATISTICS: GOLD TENDS TO RECOVER BY AROUND 128 DOLLARS AFTER TESTING THE SUPPORT OF $2,600.

Data Source: MetaTrader4 Platform

Please note that past performance does not guarantee future results

GOLD, January 3, 2025

Current Price: 2650

|

GOLD |

Weekly |

|

Trend direction |

|

|

3000 |

|

|

2900 |

|

|

2700 |

|

|

2610 |

|

|

2600 |

|

|

2590 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

Pivot Points |

||||||

|

Profit or loss in $ |

35,000 |

25,000 |

5,000 |

-4,000 |

-5,000 |

-6,000 |

|

Profit or loss in €2 |

34,037 |

24,312 |

4,862 |

-3,890 |

-4,862 |

-5,835 |

|

Profit or loss in £2 |

28,229 |

20,163 |

4,033 |

-3,226 |

-4,033 |

-4,839 |

|

Profit or loss in C$2 |

50,369 |

35,978 |

7,196 |

-5,756 |

-7,196 |

-8,635 |

1. 1.00 lot is equivalent of 100 units

2. Calculations for exchange rate used as of 10:10 (GMT) 01/03/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.