GOLD weekly special report based on 1.00 Lot Calculation:

GEOPOLITICS: TRADE WAR

- TRADE WAR: US President Trump announced that he intends to impose 25% tariffs on cars and probably 25% or more on pharmaceuticals and chip (semiconductor) imports. Furthermore, Trump has implemented 10% tariffs on all goods from China. In return, China has retaliated with tariffs of their own – 10% to 15% on select U.S. products starting February 10th. The tariffs of 25% on Mexico and Canada have been delayed for a month but have not been called off, and the possibility of a worldwide trade war is still on the table. In the meantime, the U.S. has announced another 25% tariff on all steel and aluminium imports into the country. A worldwide trade war always increases geopolitical uncertainty, which in turn always increases the demand for safe haven gold (Source: Reuters).

US PRESIDENT DONALD TRUMP AND GOLD DURING TRUMP’S FIRST PRESIDENCY

- PRESIDENT TRUMP WAS INAUGURATED AS 47TH PRESIDENT OF THE USA ON JANUARY 20, 2025. As soon as he took office, President Trump signed more than 200 executive orders, in line with his promises. He also signed orders to slap tariffs on products imported into the USA, initiating a new episode of trade war with some countries.

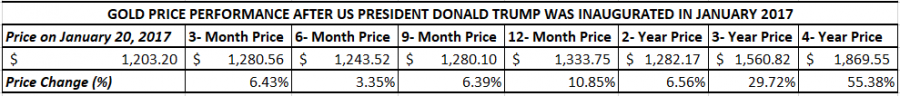

- DONALD TRUMP AND HIS FIRST PRESIDENCY (JANUARY 20, 2017 – JANUARY 20, 2021): Donald Trump used to be as unpredictable as during his current term, initiating trade wars with China, the EU, the UK, Canada, Mexico, etc. Meanwhile, he pulled the USA out of the nuclear deal with Iran as well. All of that raises a lot of worries for many investors, pushing demand for the safe haven Gold higher.

- STATISTICS: GOLD ROSE 10.85% DURING TRUMP’S FIRST YEAR OF PRESIDENCY (JANUARY 20, 2017 – JANUARY 20, 2018). In addition, Gold rose 55.38% during the entire first presidential term of Donald Trump (January 20, 2017 – January 20, 2021)

Data Source: MetaTrader 4 Platform

Please note that past performance does not guarantee future results

EVENTS:

- THURSDAY, FEBRUARY 20, AT 13:30 GMT: U.S. INITIAL JOBLESS CLAIMS: A number higher-than-expected could point to the FED cutting interest rates more aggressively, which is always supportive for gold. Initial Jobless Claims measures the number of individuals who filed for unemployment insurance for the first time during the past week. The projected number of newly unemployed stands at 214K.

- THURSDAY, FEBRUARY 20, AT 13:30 GMT: PHILADELPHIA FED MANUFATURING INDEX (FEB): A lower-than-expected number should be regarded as supportive for gold prices as it will increase the odds a FED rate cut. This index rates the relative level of general business conditions in Philadelphia. A number above zero indicates improving conditions, a number below indicates worsening ones. The forecasted number for February is 19.4.

- FRIDAY, FEBRUARY 21, AT 14:45 GMT: S&P U.S. MANUFACTURING PURCHASING MANAGERS INDEX (PMI) (FEB): A number lower-than-expected should be regarded as supportive for gold. The PMI index measures the activity level of purchasing managers in the manufacturing sector. A number above 50 indicates an expansion, while a number below 50 indicates a contraction in the sector. The forecasted number for February is 51.2.

ANALYSTS’ OPINION:

- GOLDMAN SACHS RAISED GOLD PRICE TARGE TO $3,100, WITH AN UPPER BOUNDERY AT $3,300. Goldman Sachs raised its year-end 2025 gold price forecast to $3,100. THE CASE OF $3,300: However, if policy uncertainty, including tariff concerns, remains high, Goldman sees the potential for gold to surge to $3,300 per ounce (Source: Reuters).

- UBS RAISED GOLD PRICE TARGET TO $3,200. UBS has upgraded its target price for gold, predicting it will reach $3,200 later this year due to strong demand and bullish sentiment.

- MORGAN STANLEY SETS A BULL-CASE GOLD PRICE TARGET AT $3,400. Its bull case is $3400 an ounce, although it reiterated the warning that slowing central bank demand for the metal could burst its price.

GOLD, February 19, 2025

Current Price: 2933

|

GOLD |

Weekly |

|

Trend direction |

|

|

3100 |

|

|

3050 |

|

|

3000 |

|

|

2870 |

|

|

2850 |

|

|

2825 |

Example of calculation base on weekly trend direction for 1.00 Lot1

GOLD

|

Pivot Points |

||||||

|

Profit or loss in $ |

16,700 |

11,700 |

6,700 |

-6,300 |

-8,300 |

-10,800 |

|

Profit or loss in €2 |

16,015 |

11,220 |

6,425 |

-6,041 |

-7,959 |

-10,357 |

|

Profit or loss in £2 |

13,270 |

9,297 |

5,324 |

-5,006 |

-6,595 |

-8,582 |

|

Profit or loss in C$2 |

23,732 |

16,627 |

9,521 |

-8,953 |

-11,795 |

-15,348 |

1. 1.00 lot is equivalent of 100 units

2. Calculations for exchange rate used as of 12:25 (GMT) 19/02/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.