GOLD weekly special report based on 1.00 Lot Calculation:

GEOPOLITICS:

- TRADE WAR: Trade wars increase global insecurity, increasing demand for safe-haven instruments such as Gold. US President Trump has declared that he will implement tariffs on various countries that, according to him, have treated the US unfairly in trade.

- US – Canada: Tariffs of 25% have been implemented on Canadian imports and 10% on Canadian energy imports on March 4th. Canada has implemented retaliatory tariffs of 25% on $30 billion worth of American imports and has introduced a 25% surcharge on electricity exports to the U.S.

- US – Mexico: Tariffs of 25% have also been implemented on March 4th.

- US – China: Tariffs of 10% have been implemented on Chinese imports. China has retaliated with tariffs of their own (10 – 15% on select US goods). An additional 10% in tariffs on Chinese imports has also been added on top of earlier tariffs by Trump. Further retaliatory measures are considered by Chinese authorities.

- US – EU: Tariffs of 25% are set to be implemented on the EU countries. The date for the implementation of tariffs is April 2, 2025.

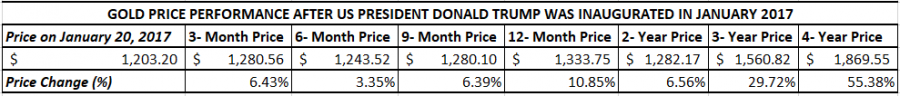

US PRESIDENT DONALD TRUMP AND GOLD DURING TRUMP’S FIRST PRESIDENCY

- STATISTICS: GOLD ROSE 10.85% DURING TRUMP’S FIRST YEAR OF PRESIDENCY (JANUARY 20, 2017 – JANUARY 20, 2018). In addition, Gold rose 55.38% during the entire first presidential term of Donald Trump (January 20, 2017 – January 20, 2021).

Data Source: MetaTrader 4 Platform

Please note that past performance does not guarantee future results

ANALYSTS’ OPINION:

- GOLDMAN SACHS RAISED GOLD PRICE TARGE TO $3,100, WITH AN UPPER BOUNDARY AT $3,300.

- UBS RAISED GOLD PRICE TARGET TO $3,200.

- MORGAN STANLEY SET A BULL-CASE GOLD PRICE TARGET AT $3,400.

- CITIGROUP TARGETS $3,000.

- BANK OF AMERICA TARGETS $3,000.

- JPMORGAN TARGETS $3,000.

Source: Reuters, Bloomberg, CNBC

EVENTS:

- WEDNESDAY, MARCH 12 AT 12:30 GMT: US CONSUMER PRICE INDEX (CPI) (FEBRUARY): A lower-than-expected result should be supportive for Gold, because low inflation will leave room for the FED to lower interest rates. This index measures the change in the prices of goods and services from the perspective of the consumer. Inflation in January came in at 3%, exceeding analyst expectations for a figure of 2.9%.

- THURSDAY, MARCH 13, AT 12:30 GMT: US PRODUCER PRICE INDEX (PPI): A lower-than-expected result should be supportive for Gold, because low inflation will leave room for the FED to lower interest rates. This index measures the change in the price of goods sold by manufacturers.

- THURSDAY, MARCH 13, AT 12:30 GMT: US WEEKLY INITIAL JOBLESS CLAIMS: A result higher-than-expected will be supportive for gold, because it could increase the odds of the FED cutting interest rates more aggressively. This data measures the number of individuals who filled for unemployment insurance for the first time during the past week.

- MONDAY, MARCH 17, AT 12:30 GMT: US RETAIL SALES (FEBRUARY): A lower-than-expected reading could be taken as positive for Gold, because it will motivate the FED to lower interest rates more aggressively in order to stimulate the economy. Retail sales measure the change in the total value of sales at the retail level. The figure for the previous month was -0.9%.

GOLD, March 11, 2025

Current Price: 2910

|

GOLD |

Weekly |

|

Trend direction |

|

|

3100 |

|

|

3050 |

|

|

2960 |

|

|

2865 |

|

|

2850 |

|

|

2835 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

GOLD |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

19,000 |

14,000 |

5,000 |

-4,500 |

-6,000 |

-7,500 |

|

Profit or loss in €2 |

17,419 |

12,835 |

4,584 |

-4,126 |

-5,501 |

-6,876 |

|

Profit or loss in £2 |

14,697 |

10,829 |

3,868 |

-3,481 |

-4,641 |

-5,801 |

|

Profit or loss in C$2 |

27,393 |

20,185 |

7,209 |

-6,488 |

-8,651 |

-10,813 |

1. 1.00 lot is equivalent of 100 units

2. Calculations for exchange rate used as of 10:00 (GMT) 11/03/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.