GOLD weekly special report based on 1.00 Lot Calculation:

GEOPOLITICS: TRADE WAR

- WEDNESDAY, APRIL 2: US PRESIDENT TRUMP TO REVEAL RECIPROCAL TARIFF PLAN. The plan will include countries that will be charged higher tariffs for products that they are exporting to the USA.

- TRADE WARS AND SAFE-HAVEN INSTRUMENTS: Trade wars increase global insecurity, increasing demand for safe-haven instruments such as Gold and Silver. US President Trump has declared that he will implement tariffs on various countries that, according to him, have treated the US unfairly in trade.

US PRESIDENT DONALD TRUMP AND GOLD DURING TRUMP’S FIRST PRESIDENCY

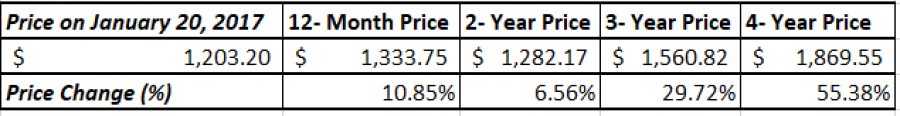

- STATISTICS: GOLD ROSE 10.85% DURING TRUMP’S FIRST YEAR OF PRESIDENCY (JANUARY 20, 2017 – JANUARY 20, 2018). In addition, Gold rose 55.38% during the entire first presidential term of Donald Trump (January 20, 2017 – January 20, 2021).

Data Source: MetaTrader 4 Platform

Please note that past performance does not guarantee future results

OTHER EVENTS:

- TUESDAY, APRIL 1, AT 14:00 GMT: US ISM MANUFACTURING PMI (MARCH): A lower-than-expected rating should be considered positive for Gold, because the FED will then find it easier to cut interest rates. This index is based on data compiled from monthly replies to questions asked of purchasing and supply executives in over 400 companies. The data for the previous month stood at 50.3 which was lower than the forecasted number of 50.6.

- FRIDAY, APRIL 4, AT 12:30 GMT: US NONFARM PAYROLLS AND UNEMPLOYMENT RATE: A lower-than-expected rating should be considered positive for gold, because it will point to future rate cuts by the FED. This data measures the change in the number of people employed during the previous month, excluding the farming industry. The results for last month stood at 151K which was below expectations of 159K.

ANALYSTS’ OPINION:

- GOLDMAN SACHS RAISED GOLD PRICE TARGET TO $3,300, WITH A TARGET RANGE OF $3,250 AND $3,520. UNDER EXTREME SCENARIOS, GOLD COULD RISE TO $4,200 BY THE END OF 2025.

- BANK OF AMERICA RAISED ITS PRICE TARGET AT $3,350. IF INVESTMENT DEMAND RISES JUST 10%, GOLD COULD RISE TO $3,500.

- UBS RAISED GOLD PRICE TARGET TO $3,200.

- MORGAN STANLEY SET A BULL-CASE GOLD PRICE TARGET AT $3,400.

Source: Reuters, Bloomberg, CNBC

GOLD, March 27, 2025

Current Price: 3050

|

GOLD |

Weekly |

|

Trend direction |

|

|

3,400 |

|

|

3,300 |

|

|

3,100 |

|

|

3,000 |

|

|

2,980 |

|

|

2,960 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

GOLD |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

35,000 |

25,000 |

5,000 |

-5,000 |

-7,000 |

-9,000 |

|

Profit or loss in €2 |

32,417 |

23,155 |

4,631 |

-4,631 |

-6,483 |

-8,336 |

|

Profit or loss in £2 |

27,017 |

19,298 |

3,860 |

-3,860 |

-5,403 |

-6,947 |

|

Profit or loss in C$2 |

50,014 |

35,725 |

7,145 |

-7,145 |

-10,003 |

-12,861 |

1. 1.00 lot is equivalent of 100 units

2. Calculations for exchange rate used as of 10:00 (GMT) 27/03/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.