INTEL(#INTEL) weekly special report based on 1 Lot Calculation:

INTEL: THE COMPANY

- Intel, a pioneer in chip manufacturing, is best known for its CPUs and also produces graphics cards and flash memory. Once a leader in the semiconductor industry, its stock has dropped 68% since 2020 due to delays in chip advancements and missed industry trends, allowing competitors like Nvidia and AMD to surpass it. Losing its place in the Dow Jones Industrial Average to Nvidia highlighted Intel’s struggles.

- STOCK INDEX PARTICIPATION: Intel stock is a part of NASDAQ 100 (USA 100) index, S&P500 (USA500)

INTEL: EVENTS

- EVENT (THURSDAY, JANUARY 30, AFTERMARKET): Q4 EARNINGS REPORT. Intel is expected to publish $13.8 billion in revenues, up 4% from Q3 ($13.28 billion). The company is expected to release $524 million in net income, returning back to profit after printing losses for two consecutive quarters (Q2 and Q3 of 2024).

- STATISTIC (LAST 8 QUARTERS): HISTORICAL PERFORMANCE SHOWS THAT INTEL TENDS TO BEAT ANALYSTS’ EXPECTATIONS. Intel has beat Earnings Per Share (EPS) estimates 5 and revenues 6 times over the past 8 quarters.

INTEL: COMPANY NEWS

- ELON MUSK REPORTEDLY INTERESTED IN ACQUIRING INTEL: Reports suggest that Qualcomm and Global Foundries could also be involved in the deal. According to SemiAnalysis, there is a 90% likelihood of Intel being acquired, with Elon Musk emerging as a central figure in the potential transaction. Speculation points to negotiations possibly taking place at Mar-a-Lago, Donald Trump’s residence.

- U.S.A. CANNOT AFFORD TO LET INTEL GO UNDER? Industry insiders warn that Intel’s failure could pose geopolitical risks, increasing U.S. reliance on foreign chipmakers like Taiwan’s TSMC or South Korea’s Samsung. As semiconductors are vital for military, telecommunications, and critical infrastructure, Intel’s decline could impact U.S. national security, the economy, and global technological leadership.

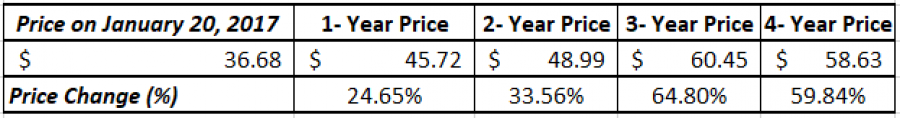

INTEL: HOW DOES THE STOCK PERFORM UNDER DONALD TRUMP AS PRESIDENT OF THE USA

- HISTORICAL PERFORMANCE: THE STOCK ROSE 24.65% DURING THE FIRST YEAR OF TRUMP’S FIRST PRESIDENTIAL TERM (JANUARY 20, 2017 – JANUARY 20, 2018). In addition, the stock rose 59.84% during the entire first term of Trump between January 20, 2017 and January 20, 2021.

Data Source: Bloomberg Terminal; Meta Trader 4 Platform;

Please note that past performance does not guarantee future results

INTEL: TECHNICAL ANALYSIS

- STOCK HAS TESTED ITS LOWEST RATE SINCE 2010 ($18.45). In 2024, the stock fell to its lowest rate since 2010, becoming a target by other companies to buy. Apple, Qualcomm and also Elon Musk have been rumored to be interested in acquiring Intel as one of the most renowned brands in the USA.

GRAPH: 2008 – 2025; SOURCE: Bloomberg Terminal;

INTEL: PRICE ACTION

- THE STOCK HIT THE HIGHEST LEVEL SINCE 2001 OF $69.19 ON JANUARY 24, 2020. Intel stock is currently trades at around $21.8 and if fully recovered this could be an upside of around 220%. However, the price could also decline.

- ANALYSTS OPINION: JP Morgan forecasts $26, Berstein forecasts $25. Wells Fargo forecasts $28

#INTEL, January 23, 2025

Current Price: 21.8

|

Intel |

Weekly |

|

Trend direction |

|

|

69 |

|

|

50 |

|

|

27 |

|

|

18 |

|

|

16 |

|

|

15 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

Intel |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

47,200 |

28,200 |

5,200 |

-3,800 |

-5,800 |

-6,800 |

|

Profit or loss in €² |

45,368 |

27,105 |

4,998 |

-3,650 |

-5,571 |

-6,531 |

|

Profit or loss in £² |

38,366 |

22,922 |

4,227 |

-3,083 |

-4,706 |

-5,517 |

|

Profit or loss in C$² |

67,895 |

40,564 |

7,480 |

-5,469 |

-8,348 |

-9,787 |

- 1.00 lot is equivalent of 1000 units

- Calculations for exchange rate used as of 09:15 (GMT) 23/01/2025

There is a possibility to use Stop-Loss and Take-Profit

- You may wish to consider closing your position in profit, even if it is lower than the suggested one.

- Trailing stop technique could protect the profit