J.P. MORGAN (#JP_MORGAN) weekly special report based on 1 Lot Calculation:

J.P. MORGAN: THE COMPANY

- LARGEST U.S. BANK BY TOTAL ASSETS: J.P. Morgan is the largest bank in the US by assets, owning around $3.58 trillion dollars.

- LIST OF LARGEST US BANKS BY ASSETS: 1. J.P. Morgan; 2. Bank of America; 3.Citibank; 4.Wells Fargo; 5. U.S. BANK; 6. Goldman Sachs.

- THE 5TH LARGEST BANK IN THE WORLD BY ASSETS: J.P.Morgan is the 5th largest bank in the world by assets, behind the Chinese Industrial and Comercial Bank of China, Agricultural Bank of China, China Construction Bank and the Bank of China.

J.P. MORGAN: EVENTS

- EVENT (WEDNESDAY, JANUARY 15, PREMARKET): Q4 EARNINGS REPORT. JM Morgan is expected to print $41.94 billion in revenue, up 8.4% from the same period last year ($38.67 billion). The bank is expected to print $11.62 billion in Net Income, up 27.8% from the same period last year ($9.1 billion).

- STATISTICS (LAST 8 QUARTERS): HISTORICAL PERFORMANCE SHOWS THAT JP_MORGAN TENDS TO BEAT ANALYSTS’ EXPECTATIONS. JP_Morgan has beat revenue estimates 7 times over the past 8 quarters, and it has managed to beat Earnings Per Share (EPS) estimates 8 times over the past 8 quarters.

- LAST TIME (Q3 EARNINGS RELEASED ON OCTOBER 11, 2024): JP_Morgan beat revenue estimates of 41.63 billion dollars printing a figure of 43.32 billion dollars for Q3 of 2024. Meanwhile, the company printed Earnings Per Share of $4.37, beating analysts’ estimates for $4.01. STOCK PERFORMANCE ON OCTOBER 11, 2024: The stock rose 6.02% to hit a session high of $224.51, up from its open price of $211.75.

Please note that past performance does not guarantee future results

J.P. MORGAN: HOW DOES THE BANK PERFORM UNDER DONALD TRUMP AS PRESIDENT OF THE USA (2017 – 2021)

- PRESIDENTIAL ELECTION 2024: DONALD TRUMP WON HIS SECOND TERM AND WILL TAKE OFFICE ON JANUARY 20, 2025.

- DEREGULATION: TRUMP TO ELIMINATE 10 REGULATIONS IN THE BANKING INDUSTRY. This will offer a more attractive environment for banks. He also promised to overhaul key regulatory bodies. During his first term (2017 - 2021), Donald Trump signed the biggest rollback of bank regulations since the global financial crisis into law

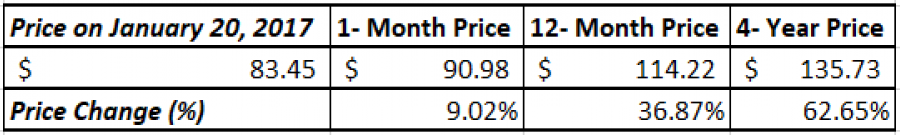

- HISTORICAL PERFORMANCE: THE STOCK ROSE 62.65% DURING THE FIRST TERM OF DONALD TRUMP (JANUARY 20, 2017).

Data Source: Bloomberg Terminal; Meta Trader 4 Platform;

Please note that past performance does not guarantee future results

J.P. MORGAN: RECENT PRICE ACTION

- J.P.MORGAN STOCK HIT AN ALL-TIME HIGH: J.P. Morgan hit an all-time high of $251.69 (November 29, 2024). In 2024, the stock rose by around 41%.

- ANALYST OPINION: Barclays forecasts $304; Goldman Sachs forecasts $273; Wells Fargo forecasts $270;

#JP_MORGAN, January 8, 2025

Current Price: 242

|

JP_MORGAN |

Weekly |

|

Trend direction |

|

|

330 |

|

|

304 |

|

|

266 |

|

|

220 |

|

|

210 |

|

|

200 |

Example of calculation based on weekly trend direction for 1 Lot1

|

JP_MORGAN |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

88,000 |

62,000 |

24,000 |

-22,000 |

-32,000 |

-42,000 |

|

Profit or loss in €2 |

85,578 |

60,294 |

23,339 |

-21,395 |

-31,119 |

-40,844 |

|

Profit or loss in £2 |

70,975 |

50,005 |

19,357 |

-17,744 |

-25,809 |

-33,874 |

|

Profit or loss in C$2 |

126,641 |

89,224 |

34,538 |

-31,660 |

-46,051 |

-60,442 |

1. 1.00 lot is equivalent of 1000 units

2. Calculations for exchange rate used as of 10:30 (GMT) 08/01/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.