Natural Gas weekly special report based On 1 Lot Calculation:

FUNDAMENTAL FACTORS:

- GEOPOLITICAL TENSIONS: The war between Russia and Ukraine is critical to global natural gas prices. Europe’s efforts to reduce dependence on Russian gas have driven increased reliance on U.S. LNG exports. This shift has created higher global demand, particularly as Europe builds its energy security amid the conflict.

- TRUMP PRESIDENCY: A POTENTIAL POLICY SHIFT- Donald Trump’s return to the presidency on January 20, 2025, could significantly change the natural gas sector. Among the expected shifts is a possible lifting of LNG export restrictions imposed during the Biden administration.

Potential implications:

- Removing export bans would enable U.S. producers to meet surging international LNG demand, particularly from Europe, which continues its transition away from Russian gas.

- While expanded exports could boost U.S. energy dominance, they may also tighten domestic supplies, leading to upward pressure on natural gas prices.

- A proenergy Trump administration may also accelerate investments in pipelines and LNG export terminals, enhancing long-term market growth.

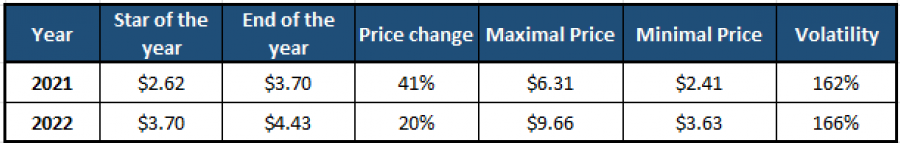

- NATURAL GAS PRICE REACTION ON INCREASED EXPORT IN THE PAST: The expansion of liquefied natural gas (LNG) export capacity in 2021 and 2022, in the United States drove a significant rise in natural gas prices. By mid-2022, the U.S. became the largest LNG exporter, capturing over 20% of the global market. Prices surged by 41% in 2021 and an additional 20% in 2022, reaching a record $9.66 in June 2022.

In January 2024, President Joe Biden's administration implemented a ban on approving new LNG export projects. Following this policy, natural gas prices dropped significantly and remained low for most of 2024. However, after Donald Trump’s election victory in November 2024, prices climbed, reaching $3.63 on November 22.

Please note that past performance does not guarantee future results

WEATHER:

- HIGHER DEMAND DURING WINTER MONTHS: With the arrival of winter, demand for natural gas is expected to climb sharply as homes and businesses increase heating usage. This seasonal surge typically tightens supplies and drives prices higher. At the same time, heightened global competition for liquefied natural gas (LNG), particularly from Europe and Asia, could further strain the market and contribute to price increases.

CONTRACT ROLLOVER ANALYSIS:

- STATISTICS (2023- 2024): NATURAL GAS TENDS TO CLOSE UP ITS ROLLOVER GAPS WITHIN 16 DAYS. In the past two years (2023–2024), the average gap in natural gas prices following contract rollovers was $0.178. Historical data indicates that, on average, these gaps were filled within the subsequent 16 days (Data Source: MetaTrader 4 Platform).

- RECENT ROLLOVER (DECEMBER 15): NATURAL GAS UNDERWENT A ROLLOVER OF NEGATIVE -$0.175. The price opened lower on Monday (December 16), as the new contract that replaced the previous one had a lower price.

Please note that past performance does not guarantee future results

NATURAL GAS, December 16, 2024

Current Price: 2.98

|

NATURAL GAS |

Weekly |

|

Trend direction |

|

|

4.50 |

|

|

4.00 |

|

|

3.50 |

|

|

2.50 |

|

|

2.30 |

|

|

2.10 |

Example of calculation based on weekly trend direction for 1 Lot1

|

Pivot Points |

||||||

|

Profit or loss in $ |

15,200.00 |

10,200.00 |

5,200.00 |

-4,800.00 |

-6,800.00 |

-8,800.00 |

|

Profit or loss in €² |

14,473.52 |

9,712.49 |

4,951.47 |

-4,570.58 |

-6,474.99 |

-8,379.40 |

|

Profit or loss in £² |

12,018.14 |

8,064.80 |

4,111.47 |

-3,795.20 |

-5,376.54 |

-6,957.87 |

|

Profit or loss in C$² |

21,634.09 |

14,517.61 |

7,401.13 |

-6,831.82 |

-9,678.41 |

-12,525.00 |

- 1.00 lot is equivalent of 10 000 units

- Calculations for exchange rate used as of 10:20 (GMT) 16/12/2024

There is a possibility to use Stop-Loss and Take-Profit

- You may wish to consider closing your position in profit, even if it is lower than the suggested one.

- Trailing stop technique could protect the profit