Natural Gas weekly special report based On 1 Lot Calculation:

FUNDAMENTAL FACTORS:

- TRUMP PRESIDENCY: A POTENTIAL POLICY SHIFT- Donald Trump’s return to the presidency could significantly change the natural gas sector. Among the expected shifts is a possible lifting of Liquefied Natural Gas (LNG) export restrictions imposed during the Biden administration with potential implications:

- This would enable U.S. producers to meet surging international Liquefied Natural Gas (LNG) demand, particularly from Europe.

- While expanded exports could boost U.S. energy dominance, they could also tighten domestic supplies, leading to upward pressure on natural gas prices.

- A proenergy Trump administration could also accelerate investments in pipelines and Liquefied Natural Gas (LNG) export terminals, enhancing long-term market growth.

- TRUMP EFFECT: Following Donald Trump’s election victory on November 5 2024, prices have surged, reaching $4.322 by January 17, marking an increase of around 67%.

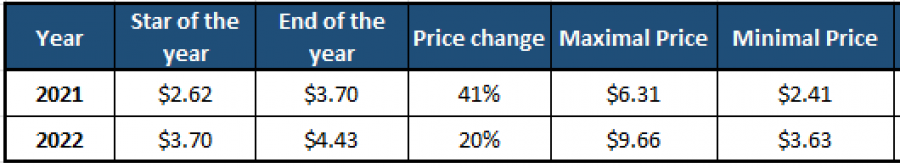

- NATURAL GAS PRICE REACTION ON INCREASED EXPORT IN THE PAST: The expansion of Liquefied Natural Gas (LNG) export capacity in 2021 and 2022, in the United States drove a significant rise in natural gas prices. By mid-2022, the U.S. became the largest LNG exporter, capturing over 20% of the global market. Prices surged by 41% in 2021 and an additional 20% in 2022, reaching a record $9.66 in June 2022.

Data Source: MetaTrader 4 Platform

Please note that past performance does not guarantee future results

- FEARS OVER NATURAL GAS SUPPLIES IN EUROPE:

- THE US AND UK IMPOSED NEW SANCTIONS ON RUSSIA TARGETING SHADOW FLEET USED FOR SHIPPING RUSSIAN LNG (Liquefied Natural Gas) AND OIL. The measures are expected to significantly limit LNG imports from Russia into Europe, which have continued to flow despite previous restrictions.

- UKRAINE’S TRANSIT AGREEMENT FOR RUSSIAN GAS EXPIRED. On January 1, 2025, Ukraine's transit agreement for Russian gas, supplying 8% of Europe’s imports, expired. The end of the transit deal has caused serious tensions with Slovakia, which was the main entry point of Russian gas into the EU.

- EU MUST BUY MORE US OIL AND GAS OTHERWISE IT IS “TARIFFS ALL THE WAY”: U.S. Presidentelect Donald Trump has demanded that EU countries increase purchases of American gas or face trade tariffs.

NATURAL GAS INVENTORIES IN THE US:

- The EIA reported that natural gas inventories for the week ended January 10 fell -258 bcf, a much larger draw than the five-year average for this time of year of -128 bcf. Baker Hughes reported that the number of active US natural gas drilling rigs in the week ending January 17 fell by -2 to 98 rigs.

WEATHER:

- COLDER WEATHER TO PERSIST UNTIL THE END OF JANUARY: With the arrival of winter, demand for natural gas is expected to climb sharply as homes and businesses increase heating usage.

NATURAL GAS, January 20, 2025

Current Price: 3.39

|

NATURAL GAS |

Weekly |

|

Trend direction |

|

|

5.00 |

|

|

4.50 |

|

|

4.00 |

|

|

2.90 |

|

|

2.80 |

|

|

2.70 |

Example of calculation based on weekly trend direction for 1 Lot1

|

Pivot Points |

||||||

|

Profit or loss in $ |

16,100 |

11,100 |

6,100 |

-4,900 |

-5,900 |

-6,900 |

|

Profit or loss in €² |

15,611 |

10,763 |

5,915 |

-4,751 |

-5,721 |

-6,690 |

|

Profit or loss in £² |

13,207 |

9,106 |

5,004 |

-4,020 |

-4,840 |

-5,660 |

|

Profit or loss in C$² |

23,297 |

16,062 |

8,827 |

-7,090 |

-8,537 |

-9,984 |

- 1.00 lot is equivalent of 10 000 units

- Calculations for exchange rate used as of 11:00 (GMT) 20/01/2025

There is a possibility to use Stop-Loss and Take-Profit

- You may wish to consider closing your position in profit, even if it is lower than the suggested one.

- Trailing stop technique could protect the profit