Nvidia (#NVDA) Weekly Special Report based on 1 Lot Calculation:

THE COMPANY:

- NVIDIA develops and produces three-dimensional graphics processors and other related software. The company also produces graphics processing units, which are critical components when developing artificial intelligence and self-driving autonomous vehicles.

- STOCK INDEX PARTICIPATION (USA100, USA500, USA30): NVIDIA stock belongs to the three most important US stock indices, including the NASDAQ 100 (USA100) index, the S&P 500 (USA500) index, and the DOW JONES INDUSTRIAL 30 (USA30).

- NVIDIA’S LATEST PRODUCT PIPELINE FOR THE AI CHIP SECTOR: Nvidia’s CEO said the company plans to release a new family of AI chips yearly, accelerating its prior release schedule of roughly every two years. The current pipeline includes the Blackwell chip, released in 2024; The Blackwell Ultra, set for release in 2025; The Rubin chip, set for 2026; and the Rubin Ultra, set for 2027.

NVIDIA MAKES HISTORY BY REPORTING RECORD-BREAKING QUARTERLY FINANCIAL RESULTS:

- Q4 EARNINGS REPORT (WEDNESDAY, FEBRUARY 26, 2025, AFTERMARKET). Nvidia is expected to print $38.294 billion in revenue (a new record high), up 9.1% from Q3’s $35.08 billion, and up around 73% from the same period last year ($22.103 billion). Nvidia is expected to print $20.98 billion in net income (a new record high), up around 8% from Q3’s $19.3 billion and up around 72% from the same period last year ($12.21 billion)

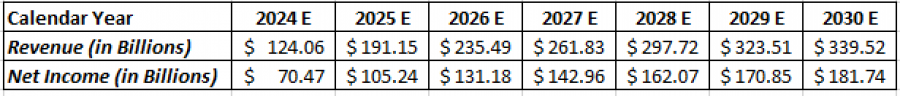

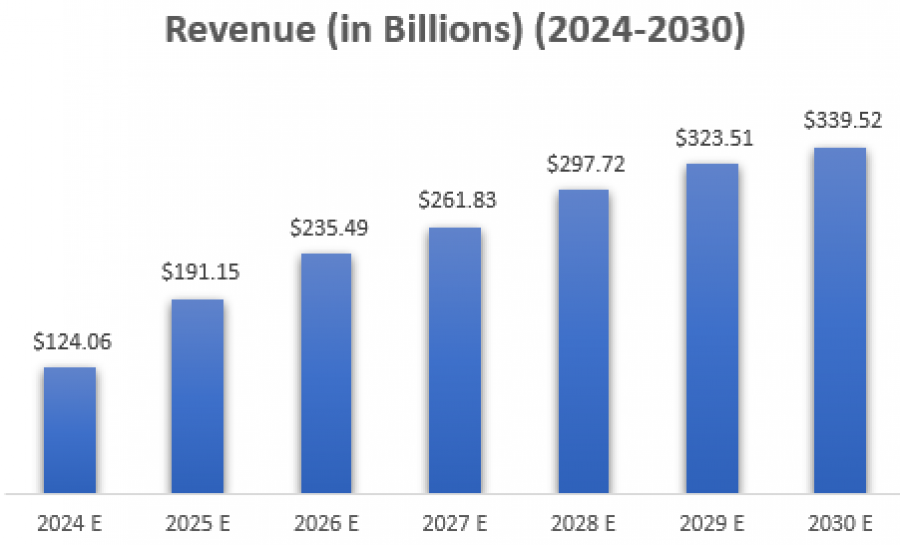

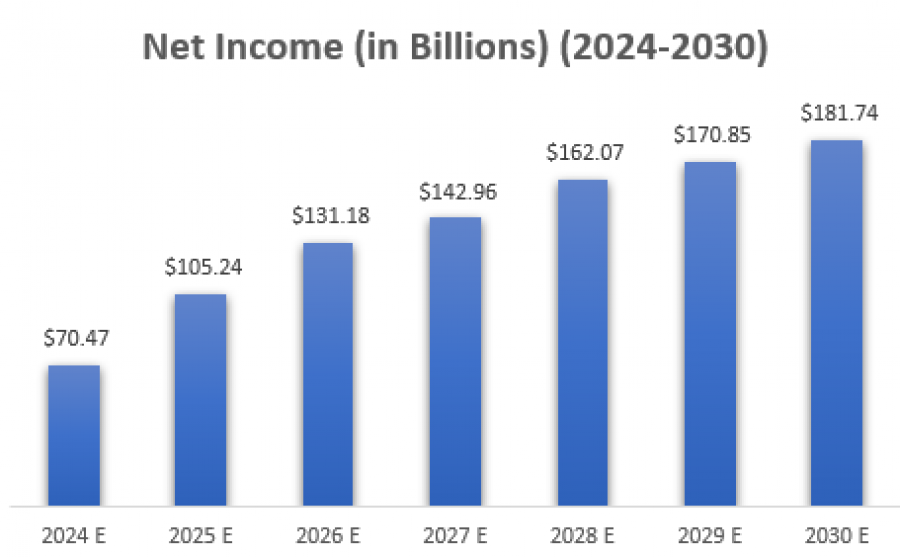

- NVIDIA IS EXPECTED TO KEEP GROWING UNTIL 2030: Nvidia is expected to print an annual revenue figure of $124.06 billion in 2024 and that number is expected to grow to $339.52 billion in 2030, an increase of 173.67%. Nvidia’s net income is expected to grow from $70.47 billion in 2024 to $181.74 billion in $181.74 in 2030, marking an increase of 157.90%. (Data Source: Bloomberg Terminal).

Source: Bloomberg Terminal

Source: Bloomberg Terminal

NVIDIA: NEWS

- MORGAN STANLEY (PRICE TARGET ON NVIDIA: $152): Morgan Stanley’s analyst Joseph Moore has reaffirmed his optimistic stance on Nvidia, expecting strong results in the near future. (Source: Bloomberg).

- JPMORGAN (PRICE TARGET ON NVIDIA: $170): NVIDIA IS EXPECTED TO BENEFIT FROM DEEPSEEK SITUATION. JPMorgan U.S. Equity Research analysts said in a new report that DeepSeek is expected to have a positive impact on companies such as chipmaking leader Nvidia (NVDA). DeepSeek’s demonstration of cost-efficiency and AI innovation could lead to strong demand for higher performance graphics processing units (GPUs), JPMorgan analysts said. (Source: Bloomberg)

- US PRESIDENT DONALD TRUMP PRESENTED THE “STARGATE”, A $500 BILLION A.I. INVESTMENT THAT TEAMS UP ORACLE, OPENAI, AND SOFTBANK. Three top tech firms announced that they will create a new company, called Stargate, to grow artificial intelligence infrastructure in the United States.

- META (FACEBOOK), ALPHABET (GOOGLE), MICROSOFT, AND AMAZON ARE TO SPEND MORE THAN $250 BILLION ON A.I. IN 2025. The four companies are some of the largest customers of Nvidia, which could increase projected Nvidia sales for 2025.

NVIDIA: PRICE ACTIONS

- NVIDIA HIT AN ALL-TIME HIGH OF $152.63 ON NOVEMBER 21, 2024. The stock currently trades at $135 and if a full recovery takes place, the stock could see an upside of around 13%. However, the stock price could also decline.

- ANALYST OPINION: Wells Fargo forecasts $185, JPMorgan forecasts $170, Rosenblatt forecasts $220, Goldman Sachs forecasts $165, HSBC forecasts $185.

#NVDA, February 14, 2025

Current Price: 135

|

NVIDIA |

Weekly |

|

Trend direction |

|

|

200 |

|

|

180 |

|

|

153 |

|

|

120 |

|

|

115 |

|

|

110 |

Example of calculation based on weekly trend direction for 1 Lot1

|

NVIDIA |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

65,000 |

45,000 |

18,000 |

-15,000 |

-20,000 |

-25,000 |

|

Profit or loss in €2 |

62,063 |

42,966 |

17,187 |

-14,322 |

-19,096 |

-23,870 |

|

Profit or loss in £2 |

51,660 |

35,765 |

14,306 |

-11,922 |

-15,895 |

-19,869 |

|

Profit or loss in C$2 |

92,089 |

63,754 |

25,502 |

-21,251 |

-28,335 |

-35,419 |

- 1.00 lot is equivalent of 1000 units

- Calculations for exchange rate used as of 09:00 (GMT) 14/02/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.