Nvidia (#NVDA) Weekly Special Report based on 1 Lot Calculation:

THE COMPANY:

- NVIDIA develops and produces three-dimensional graphics processors and other related software. The company also produces graphics processing units, which are critical components when developing artificial intelligence and self-driving autonomous vehicles.

- STOCK INDEX PARTICIPATION (USA100, USA500, USA30): NVIDIA stock belongs to the three most important US stock indices, including the NASDAQ 100 (USA100) index, the S&P 500 (USA500) index, and the DOW JONES INDUSTRIAL 30 (USA30).

- NVIDIA’S LATEST PRODUCT PIPELINE FOR THE AI CHIP SECTOR: Nvidia’s CEO said the company plans to release a new family of AI chips yearly, accelerating its prior release schedule of roughly every two years. The current pipeline includes the Blackwell chip, released in 2024; The Blackwell Ultra, set for release in 2025; The Rubin chip, set for 2026; and the Rubin Ultra, set for 2027.

NVIDIA: FINANCIALS

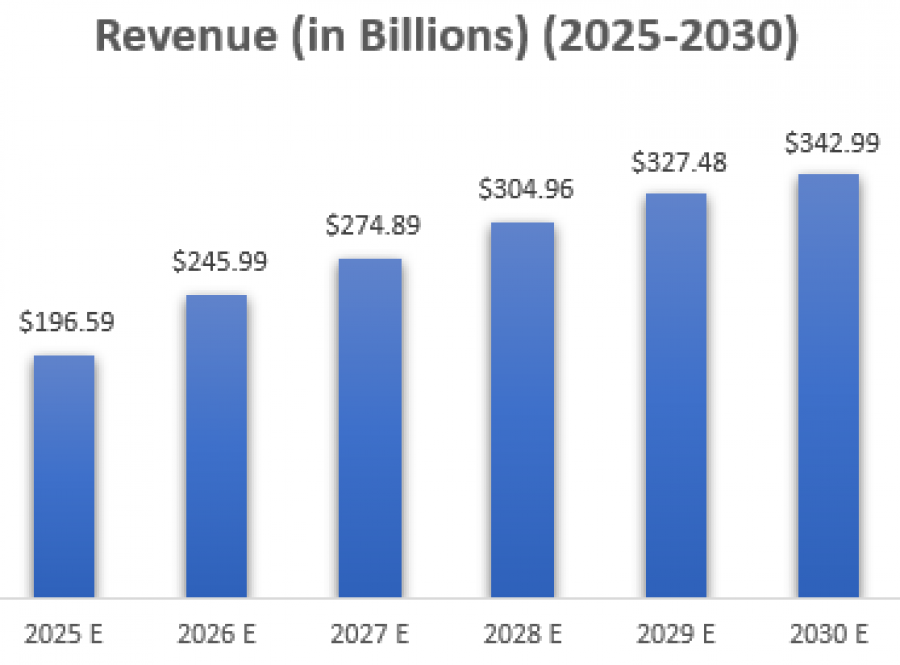

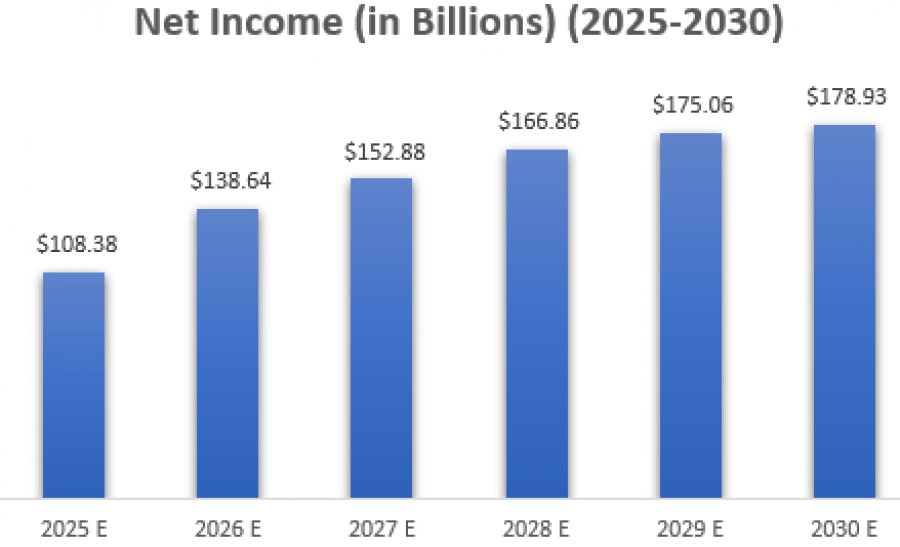

- NVIDIA IS EXPECTED TO KEEP GROWING UNTIL 2030: Nvidia is expected to print an annual revenue figure of $196.59 billion in 2025 and that number is expected to grow to $342.99 billion in 2030, an increase of 74.47%. Nvidia’s net income is expected to grow from $108.38 billion in 2025 to $178.93 billion in $181.74 in 2030, marking an increase of 65% (Data Source: Bloomberg Terminal).

Source: Bloomberg Terminal

Source: Bloomberg Terminal

NVIDIA: EVENTS

- EVENT (MARCH 17-21): GTC A.I. CONFERENCE. Nvidia GTC (GPU Technology Conference) is a global artificial intelligence (AI) conference for developers that brings together developers, engineers, researchers, inventors, and IT professionals.

- CEO JENSEN HUANG SPEECH (MARCH 18 at 18:00 GMT): NVIDIA CEO Jensen Huang’s keynote is happening at the SAP Center in San Jose on March 18, 2025 at 18:00 GMT.

NVIDIA: PRICE ACTIONS

- NVIDIA HIT AN ALL-TIME HIGH OF $152.63 ON NOVEMBER 21, 2024. The stock currently trades at $107 (its lowest since September 2024) and if a full recovery takes place, the stock could see an upside of around 43%. However, the stock price could also decline.

- ANALYST OPINION: Wells Fargo forecasts $185, JPMorgan forecasts $170, Rosenblatt forecasts $220, Citigroup forecasts $163, HSBC forecasts $175.

#NVDA, March 11, 2025

Current Price: 107

|

NVIDIA |

Weekly |

|

Trend direction |

|

|

185 |

|

|

165 |

|

|

130 |

|

|

90 |

|

|

87 |

|

|

85 |

Example of calculation based on weekly trend direction for 1 Lot1

|

NVIDIA |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

78,000 |

58,000 |

23,000 |

-17,000 |

-20,000 |

-22,000 |

|

Profit or loss in €2 |

71,458 |

53,135 |

21,071 |

-15,574 |

-18,323 |

-20,155 |

|

Profit or loss in £2 |

60,324 |

44,856 |

17,788 |

-13,148 |

-15,468 |

-17,014 |

|

Profit or loss in C$2 |

112,399 |

83,579 |

33,143 |

-24,497 |

-28,820 |

-31,702 |

- 1.00 lot is equivalent of 1000 units

- Calculations for exchange rate used as of 10:00 (GMT) 11/03/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.