Platinum weekly special report based on 1.00 Lot Calculation:

TECHNICAL ANALYSIS:

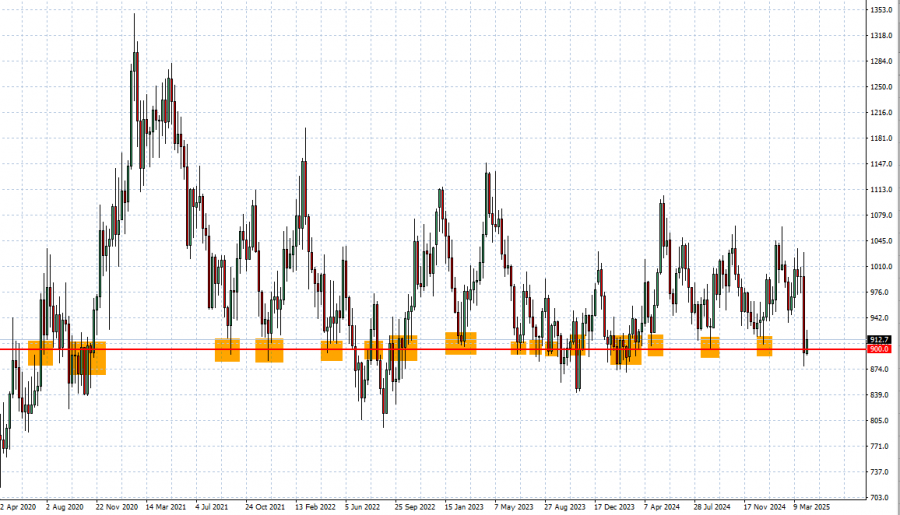

- PLATINUM PRICES HAVE TESTED THE MARK OF $900 (NEAR OR BELOW) 16 TIMES SINCE APRIL 2020. This is the 17th time that Platinum prices are testing levels near or below the mark of $900. However, there is also a risk of further decline if market conditions change.

- PLATINUM HAS TESTED THIS WEEK ITS LOWEST PRICE SINCE MARCH 2024: $876.

GRAPH (Weekly): April 2020 – April 2025

Please note that past performance does not guarantee future results

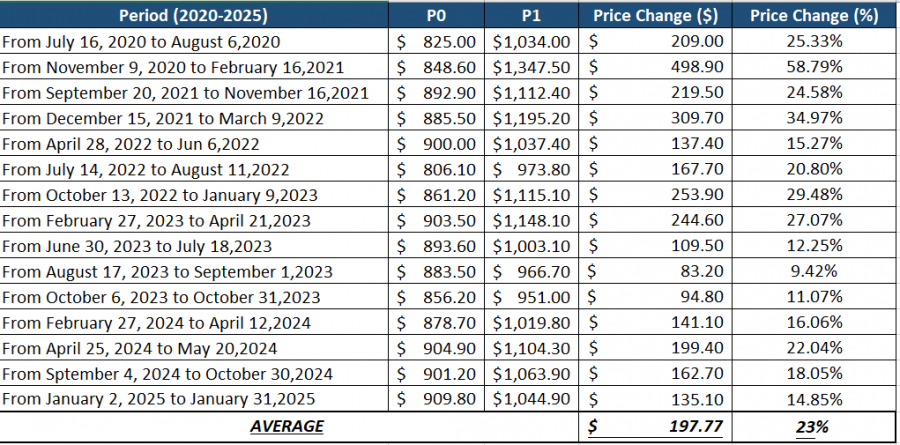

- 2020- 2025 STATISTICS: PLATINUM TENDS TO RECOVER BY AROUND 23% AFTER TESTING THE MARK OF $900 OR NEAR IT. However, there is also a risk of further decline if market conditions change.

DATA SOURCE: Fortrade MetaTrader 4

Please note that past performance does not guarantee future results

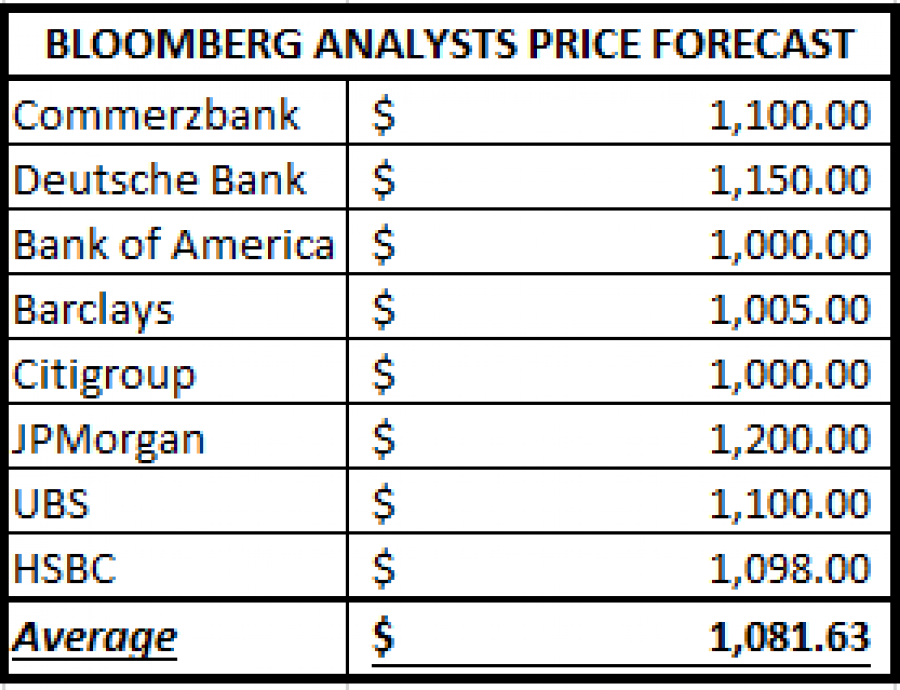

ANALYSTS OPINION:

- ANALYSTS OPINION: According to the Bloomberg Terminal, Commerzbank forecasts $1,100; Citigroup forecasts $1,000; JPMorgan forecasts $1,200; UBS forecasts $1,100; etc.

Source: Bloomberg Terminal

EVENTS (CHINA):

- THURSDAY, APRIL 10 AT 02:30 GMT+1: CHINA INFLATION (CPI) (MARCH) (PREVIOUS: -0.7%). Stronger-than expected CPI and PPI data could signal an expanding Chinese economy and industrial activity, supporting higher platinum prices.

EVENTS (USA):

- THURSDAY, APRIL 10, AT 13:30 GMT+1: US CONSUMER PRICE INDEX (CPI) (MARCH): A decline in the CPI index could indicate that the Fed may cut interest rates sooner than previously planned or make more cuts this year, both of which typically support platinum prices. February’s reading was 2.8%, down from 3% in January.

Platinum, April 7, 2025

Current Price: 908.00

|

PLATINUM |

Weekly |

|

Trend direction |

|

|

1,100.00 |

|

|

1,000.00 |

|

|

950.00 |

|

|

870.00 |

|

|

860.00 |

|

|

850.00 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

PLATINUM |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

19,200 |

9,200 |

4,200 |

-3,800 |

-4,800 |

-5,800 |

|

Profit or loss in €² |

17,521 |

8,395 |

3,833 |

-3,468 |

-4,380 |

-5,293 |

|

Profit or loss in £² |

14,975 |

7,175 |

3,276 |

-2,964 |

-3,744 |

-4,524 |

|

Profit or loss in C$² |

27,372 |

13,116 |

5,988 |

-5,417 |

-6,843 |

-8,269 |

1. 1.00 lot is equivalent of 100 units

2. Calculations for exchange rate used as of 12:50 (GMT+1) 07/04/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than the suggested one.

- Trailing stop techniques could protect the profit.