Platinum weekly special report based on 1.00 Lot Calculation:

TECHNICAL ANALYSIS:

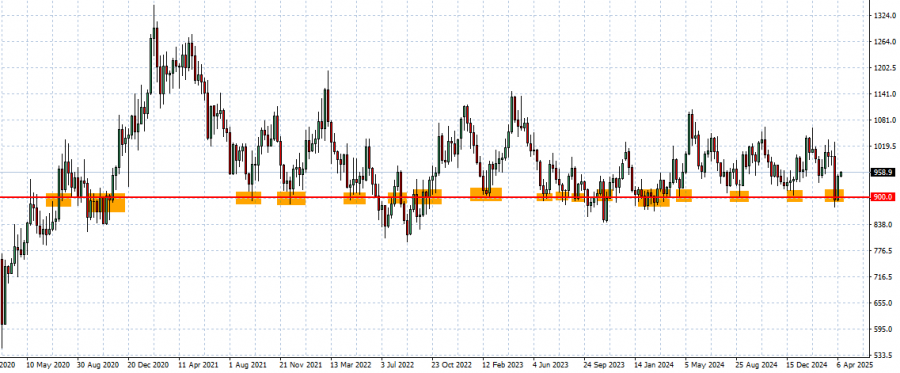

- PLATINUM PRICES HAVE TESTED THE MARK OF $900 (NEAR OR BELOW) 16 TIMES SINCE APRIL 2020. This is the 17th time that PLATINUM prices are testing levels near or below the mark of $900. However, there is also a risk of further decline if market conditions change.

- PLATINUM HAS TESTED THIS WEEK ITS LOWEST PRICE SINCE MARCH 2024: $876.

GRAPH (Weekly): April 2020 – April 2025

Please note that past performance does not guarantee future results

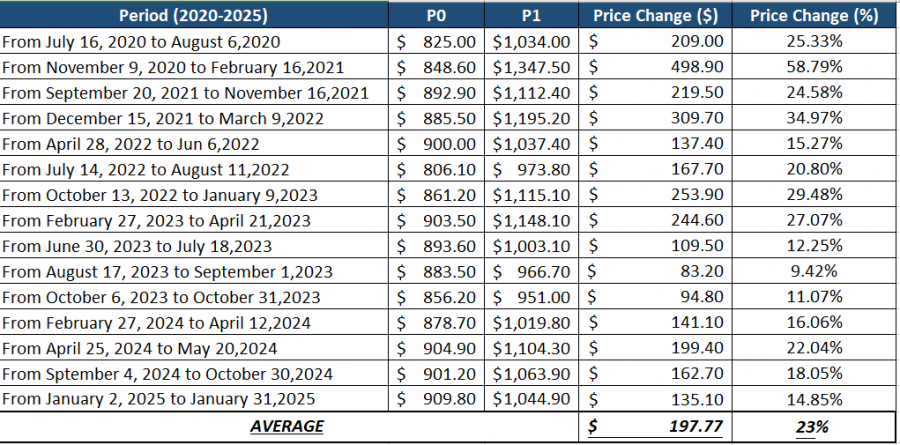

- 2020- 2025 STATISTICS: PLATINUM TENDS TO REBOUND BY AROUND 23% AFTER TESTING THE MARK OF $900 OR NEAR IT. However, there is also a risk of further decline if market conditions change.

DATA SOURCE: Fortrade MetaTrader 4

Please note that past performance does not guarantee future results

PATINUM USE AND MARKET SHARE:

- PLATINUM has been a key element in autocatalysts for over forty years, with the automotive sector being its largest consumer, accounting for about 40% of annual demand.

- MARKET SHARE (PRODUCERS): BIGGEST PLATINUM PRODUCERS IN THE WORLD: South Africa is the largest producer holding 72.8% of the global market share while Russia is the second with 8-10% of the market. Zimbabwe is third with 5%.

- MARKET SHARE (CONSUMERS): China is the world's largest platinum consumer with 34%, while Europe holds 22% and North America's 16% share of the platinum consumed worldwide.

EVENTS (CHINA):

- WEDNESDAY, APRIL 16 AT 03:00 GMT+1: CHINA GROSS DOMESTIC PRODUCT (GDP) (Q1). (PREVIOUS: +5.4%). Economists expect a 5.2% increase. Stronger-than-expected gross domestic product (GDP) data could indicate rising economic activity in China, the world's largest consumer of platinum, potentially supporting higher platinum prices.

EVENTS (USA):

- THURSDAY, APRIL 16, AT 18:15 GMT+1: FED CHAIR JAROME POWELL SPEECH. Fed Chair Jerome Powell will deliver a speech on the U.S. economic outlook at the Economic Club of Chicago.

Platinum, April 14, 2025

Current Price: 958.50

|

PLATINUM |

Weekly |

|

Trend direction |

|

|

1,150.00 |

|

|

1,050.00 |

|

|

1,000.00 |

|

|

920.00 |

|

|

910.00 |

|

|

900.00 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

PLATINUM |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

19,150 |

9,150 |

4,150 |

-3,850 |

-4,850 |

-5,850 |

|

Profit or loss in €² |

16,822 |

8,038 |

3,646 |

-3,382 |

-4,260 |

-5,139 |

|

Profit or loss in £² |

14,534 |

6,944 |

3,150 |

-2,922 |

-3,681 |

-4,440 |

|

Profit or loss in C$² |

26,540 |

12,681 |

5,752 |

-5,336 |

-6,722 |

-8,108 |

1. 1.00 lot is equivalent of 100 units

2. Calculations for exchange rate used as of 11:30 (GMT+1) 14/04/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than the suggested one.

- Trailing stop techniques could protect the profit.