RIVIAN (#RIVIAN) weekly special report based on 1 Lot Calculation:

INDUSTRY: ELECTRIC VEHICLES (EV)

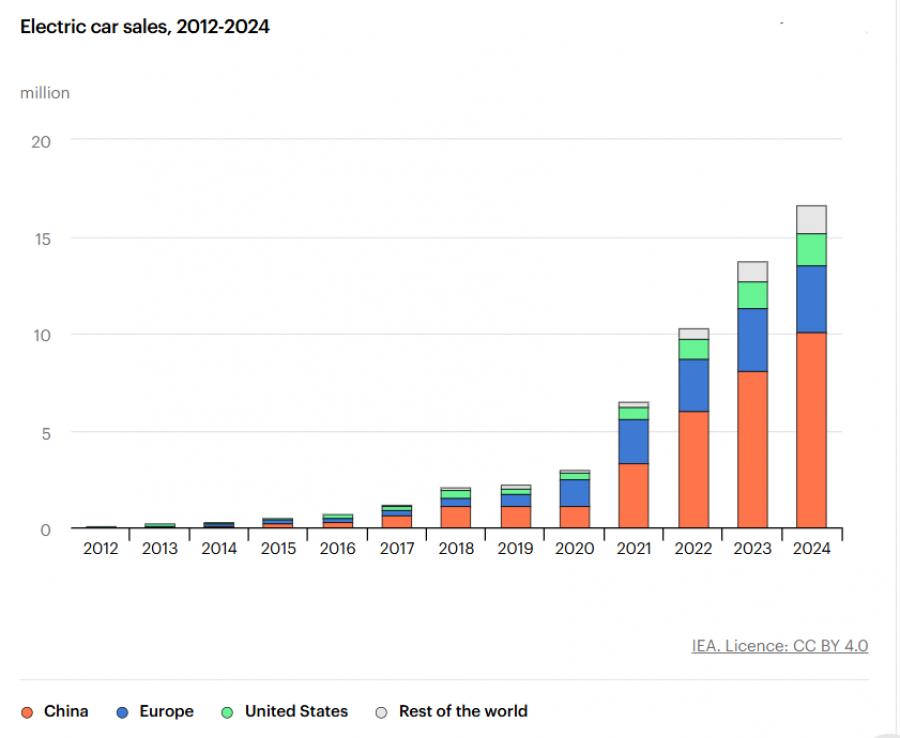

- EV SALES GROWTH (2019 – 2024): 50% OF AN AVERAGE ANNUAL GROWTH RATE. The global EV market has sustained remarkable growth, achieving an average annual growth rate of approximately 50% between 2019 and 2023. In 2023, global EV sales rose by 35%, reaching 14 million units. In 2024, EV sales are estimated to have grown by an additional 33%, surpassing 18.5 million units. This is driven by strong momentum in China (leading with over 45% of global EV sales), steady growth in Europe, and accelerating adoption in North America. After a small pause this year, U.S. EV production is expected to improve in 2025 and further accelerate in 2026 to 2027, as average selling prices come down and the charging infrastructure is built out.

DATA SOURCE: www.iea.org (International Energy Agency)

RIVIAN: ABOUT THE COMPANY

- RIVIAN produces electric Sport Utility Vehicles (SUV) and PickUp trucks. They also deliver Vans (Rivian EDV) for Amazon. For the time being, Rivian is delivering the R1T PickUp and the R1S SUV. They will soon start delivering more advanced SUVs, R2 and R3.

- CAR DELIVERY: Rivian produced 13,157 vehicles and delivered 10,018 in Q3 2024, impacted by a shortage in the Enduro motor system component.

- PRODUCTION CAPACITY: Rivian maintains production capacity of 150,000 vehicles a year. This is expected to expand to 215,000 by the end of 2026.

- FIRST GROSS PROFIT EXPECTED: Q4 2024. During its first “Investor Day”, Rivian gave an insight into the company’s future. Rivian reaffirmed it expects its first gross profit in Q4 2024.

RIVIAN: EVENTS AND ANALYSIS

- EVENT (Thursday, November 7): Q3 EARNINGS REPORT. Rivian’s gross profit for Q3 2024 was $(392) million, an improvement over Q3 2023’s $(477) million. Rivian remains on track to hit positive gross margin by Q4 2024, aided by second-generation R1 cost reductions. Rivian’s focus on efficiency paid off, with operating expenses down to $777 million compared to $963 million in Q3 2023. Also, Rivian ended Q3 with $6.7 billion in cash. This healthy liquidity position is expected to support Rivian’s roadmap as it scales production and continues R&D investments.

- EVENT (Monday, December 9) : RIVIAN LAUNCHED A NETWORK OF EV CHARGERS: Rivian launched a network of EV chargers that can be used by owners of other brands' cars and come with upscale lounge areas. The company is planning up to 3,500 chargers in 600 sites near travel hubs, and, in keeping with Rivian's rugged image, locations popular with off-roaders. More locations will open as Rivian builds out the network.

- RIVIAN AND AMAZON PARTNERSHIP: Around 20% of current revenue comes from selling the Rivian EDV to Amazon. Rivian has a deal with Amazon to deliver 100,000 commercial EVs by 2030, and so far about 15,000 have been delivered, according to Benchmark's estimates. Amazon had a 15.8% stake in Rivian as of Sept. 30.

- AMAZON: THE LARGEST SHAREHOLDER OF RIVIAN WITH 16.6% OF STAKE IN THE COMPANY. Amazon has remained a supporter of Rivian, which is positive for the rest of the shareholders, having in mind that Amazon is one of largest company in the world with annual revenue of more than 500 billion dollars.

RIVIAN: NEWS

- RIVIAN AND VOLKSWAGEN JOINT VENTURE. Volkswagen Group and Rivian Automotive launched their joint venture on Nov. 13, creating a new company called “Rivian and VW Group Technology.” The new company will focus on developing a electrical architecture and software for electric vehicles that each automaker will utilize. In the long-term, the total deal’s size is now expected to reach $5.8 billion by 2027 — 16% larger than the $5 billion by 2026 initially estimated.

RIVIAN: STOCK PRICE ACTION

- THE STOCK HAS TRADED AROUND 92% BELOW ITS ALL- TIME HIGH OF $179.47 (2021). Rivian was last trading around $13.7, and if a full recovery follows to its all- time highs, the stock could see an upside of around 1200%. Rivian hit an all-time low of $7.77 on April 14, 2024. However, the stock price could decline.

- ANALYSTS OPINION: Stifel forecasts $16. BNP Paribas forecasts $18. Piper Sandler forecasts $19. Wedbush forecasts $20.

#RIVIAN, December 12, 2024

Current Price: 13.70

|

RIVIAN |

Weekly |

|

Trend direction |

|

|

40 |

|

|

30 |

|

|

20 |

|

|

11 |

|

|

10 |

|

|

9 |

Example of calculation based on weekly trend direction for 1 Lot1

|

RIVIAN |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

26,500.00 |

16,500.00 |

6,500.00 |

-2,500.00 |

-3,500.00 |

-4,500.00 |

|

Profit or loss in €2 |

25,242.18 |

15,716.83 |

6,191.48 |

-2,381.34 |

-3,333.87 |

-4,286.41 |

|

Profit or loss in £2 |

20,801.18 |

12,951.68 |

5,102.18 |

-1,962.38 |

-2,747.33 |

-3,532.28 |

|

Profit or loss in C$2 |

37,496.11 |

23,346.63 |

9,197.16 |

-3,537.37 |

-4,952.32 |

-6,367.26 |

1. 1.00 lot is equivalent of 1000 units

2. Calculations for exchange rate used as of 11:30 (GMT) 12/12/2024

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.