Silver Weekly Special Report based on 1.00 Lot Calculation:

GEOPOLITICS TO SUPPORT DEMAND FOR SAFE-HAVEN INSTRUMENTS

- U.S. PRESIDENTIAL ELECTIONS (NOVEMBER 5): UNCERTAINTIES RISE AS POLLS SHOW NEITHER DONALD TRUMP NOR KAMALA HARRIS AS A CLEAR FAVORITE TO WIN THE ELECTIONS. Gold kept testing fresh all-time highs, while silver trades at the highest in 12 years. Gold has risen more than 30% in 2024, while Silver has gained more than 37% in 2024.

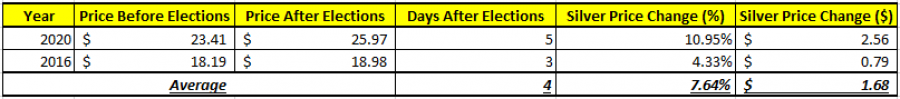

- STATISTICS: SILVER ROSE ON AVEARGE 7.64% AFTER ELECTIONS WHEN DONALD TRUMP OR KAMALA HARRIS ARE INVOLVED. Donald Trump was elected 45th President of the USA in 2016, while Kamala Harris was elected Vice President in the Biden administration in 2020.

Data Source: Bloomberg Terminal; MetaTrader 4 Platform

Please note that past performance does not guarantee future results

CENTRAL BANKS: INTEREST RATE CUT DECISION

- BREAKING (SEPTEMBER 18): FEDERAL RESERVE ANNOUNCED ITS FIRST INTEREST RATE CUT SINCE 2020. US Federal Reserve decided to cut its benchmark interest rate by 0.50% points on September 18, to 5.00% from the previous 5.50%. The bank expects to cut rates two more times in 2024 to slash its benchmark rate to 4.5% by the end of 2024. The bank expects rates to fall to 3.5% in 2025 and further down to 2.9% in 2026.

- NEXT FED INTEREST RATE DECISION: November 7, 2024 at 19:00 GMT. As of November 4, the market sees higher chances for 25 basis points interest rates cut. This could bring current rates of 5.00% down to 4.75%.

ANALYST EXPECTATIONS

- UBS: The bank targets a price of $36.

- CITIGROUP: The bank targets a price of $40.

- JP Morgan: The bank targets a price of $34.

PRICE ACTION

- ALL-TIME HIGH PRICE: $49.80. Silver jumped to $49.80 in 2011, during the debt crisis in Europe. Currently, Silver trades around $32.70 and if full recovery is made this could offer an upside potential of around 53%.

Silver, November 4, 2024

Current Price: 32.70

|

SILVER |

Weekly |

|

Trend direction |

|

|

49.80 |

|

|

40.00 |

|

|

34.00 |

|

|

31.70 |

|

|

31.30 |

|

|

31.00 |

Example of calculation based on trend direction for 1.00 Lot*

|

SILVER |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

171,000.00 |

73,000.00 |

13,000.00 |

-10,000.00 |

-14,000.00 |

-17,000.00 |

|

Profit or loss in €2 |

156,913.84 |

66,986.61 |

11,912.73 |

-9,176.25 |

-12,846.75 |

-15,599.62 |

|

Profit or loss in £2 |

131,812.73 |

56,270.93 |

10,015.79 |

-7,708.35 |

-10,791.69 |

-13,104.19 |

|

Profit or loss in C$2 |

237,891.53 |

101,556.03 |

18,066.22 |

-13,911.79 |

-19,476.50 |

-23,650.04 |

1. 1.00 lot is equivalent of 10.000 units

2. Calculations for exchange rate used as of 12:55 (GMT) 04/11/2024

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.