Tesla (#TSLA) weekly special report based On 1 Lot Calculation:

GLOBAL EV MARKETS:

- ELECTRIC VEHICLES (EV) MADE ONLY AROUND 9.0% OF TOTAL CAR SALES, WORTH 66.7 MILLION CARS IN 2022: The total global car market grew just 4.5% in 2021, by around 66.7 million cars. In 2020, the world sold around 63.8 million cars. The estimates say that around 6.5 million electric vehicles (EVs) were sold worldwide in 2021, up 109% from 2020. EV sales represent around 9% of all passenger car sales in 2021. The EV sector increased its market share from 4.11% in 2021 to around 9.00% off the global car sales.

- MARKET POTENTIAL: ELECTRIC VEHICLES (EV) COULD BE EXPECTED TO TAKE UP AROUND 50% OF GLOBAL CAR SALES BY 2030. The 2021 figures of 287.36 billion dollars are an increase of around 76% from 2020’s 160.01 billion dollars. Expecting this number to grow to 823.75 billion dollars, the EV market could be growing annually on average by 18.6%.

TESLA: EVENTS AND ANALYSIS

- EVENT (CONFIRMED: JULY 19, AFTERMARKET): Q2 EARNINGS REPORT. Tesla is expected to post a revenue figure of 24.55 billion dollars for Q2 of 2023. This could be up 45% from the same period last year (16.934 billion dollars). The company could also be expected to post a net income of 2.849 billion dollars. This would be up around 20% from the same period last year (2.371 billion dollars).

- NEWS (JULY 2): Q2 CAR DELIVERY (NEW QUARTERLY RECORD: 466,140). Tesla delivered a new quarterly record when it released 466,140 cars been delivered in Q2, beating Q1 2023 record of 422,875. Still the company is expected to deliver 1.8-1.9 million cars in 2023, which would be 37% to 44.6% up from 2022.

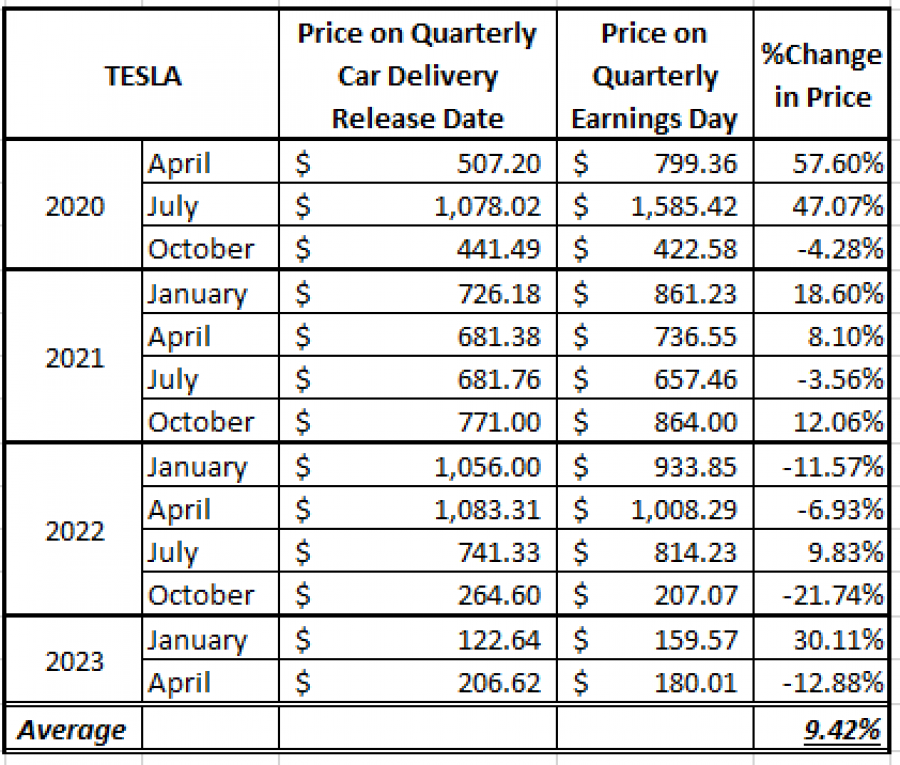

- STATISTICS (2020- 2023) (TABLE I): TESLA STOCK RISES ON AVERAGE 9.42% BETWEEN QUARTERLY DELIVERY DATE AND QUARTERLY EARNINGS DATE.

TABLE I: TESLA STOCK PRICE ACTION BETWEEN DELIVERY AND EARNINGS DATES (2020- 2023) *

DATA SOURCE 1: BLOOMBERG

DATA SOURCE 2: FORTRADE METATRADER 4

Please note that past performance does not guarantee future results.

_______________________________________________________________________________________________

*- Note that prices are not adjusted for stock splits

TESLA: OTHER ANALYSIS

- TESLA AGAIN CONSIDERING TO ENTER THE INDIAN MARKET: Reportedly, the company is in talks with the Indian officials to build a factory there.

- TESLA CONSIDERING TO BUILD A GIGAFACTORY IN SPAIN: Tesla is reportedly considering building a new factory in Valencia, Spain, that could be worth close to 5 billion dollars.

- NEXT GIGA-FACTORY: MEXICO AND INDONESIA. Tesla is close to a deal to start building new Gigafactories in Indonesia and Mexico, with a capacity of more than 2 million vehicles. All that will be in addition to current factories in Berlin (Germany), Shanghai (China), Fermont and Austin (USA). Including Indonesia and Mexico, Tesla could reach a production capacity of more than 4 million vehicles yearly.

- CYBERTRUCK (PICK-UP) COMING IN THE SECOND HALF OF 2023. Elon Musk said he expects the Tesla Cybertruck to sell between 250,000 and 500,000 units per year once production is fully ramped.

TESLA: PRICE ACTION

- THE STOCK HAS TRADED AROUND 41% BELOW ITS ALL- TIME HIGH OF $414.4 (November 4, 2021). Tesla was last trading around $275, and if a full recovery follows to recent all- time highs, the stock could see an upside of around 51%, however the price could decline further.

- ANALYSTS OPINIONS: Wedbush forecasts $300. New Street Research forecasts $300. RBC Capital forecasts $305.

#TSLA, July 5, 2023

Current Price:275

|

Tesla |

Weekly |

|

Trend direction |

|

|

414.40 |

|

|

350.00 |

|

|

320.00 |

|

|

230.00 |

|

|

215.00 |

|

|

200.00 |

Example of calculation based on weekly trend direction for 1 Lot1

|

Tesla |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

139,400 |

75,000 |

45,000 |

-45,000 |

-60,000 |

-75,000 |

|

Profit or loss in €2 |

127,989 |

68,860 |

41,316 |

-41,316 |

-55,088 |

-68,860 |

|

Profit or loss in £2 |

109,665 |

59,002 |

35,401 |

-35,401 |

-47,202 |

-59,002 |

|

Profit or loss in C$2 |

172,428 |

92,770 |

55,662 |

-55,662 |

-74,216 |

-92,770 |

1. 1.00 lot is equivalent of 1000 units

2. Calculations for exchange rate used as of 11:00 (GMT+1) 05/07/2023

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Senior Account ManagerClient Manager regarding their use.

- You may wish to consider closing your position in profit, even if it is lower than suggested one

- Trailing stop technique can protect the profit – Ask your Senior Account ManagerClient Manager for more detail