Tesla (#TSLA) weekly special report based On 1 Lot Calculation:

GLOBAL EV MARKETS:

- ELECTRIC VEHICLES (EV) MADE ONLY AROUND 9.0% OF TOTAL CAR SALES, WORTH 66.7 MILLION CARS IN 2022: The EV sector increased its market share from 4.11% in 2021 to around 9.00% off the global car sales in 2022.

- MARKET POTENTIAL: ELECTRIC VEHICLES (EV) COULD BE EXPECTED TO TAKE UP AROUND 50% OF GLOBAL CAR SALES BY 2030. The 2021 figures of 287.36 billion dollars are an increase of around 76% from 2020’s 160.01 billion dollars. Expecting this number to grow to 823.75 billion dollars, the EV market could be growing annually on average by 18.6%.

TESLA: EVENTS AND ANALYSIS

- EVENT (NOVEMBER 30): CYBERTRUCK LAUNCH. Tesla is aiming to make 200,000 units of its electric pickup truck, Cybertruck, per year, Chief Executive Officer Elon Musk said. The company had earlier said that Tesla had the capacity to make more than 125,000 Cybertrucks annually, with Musk adding there was potential to lift it to 250,000 in 2025. The deliveries of the much-awaited pickup truck will begin on November 30. According to some sources, Tesla may already have around 2 million reservations. The starting prices of this vehicle is thought to be from $50,000 to $70,000 for single- motor model and dual- motor model, respectively.

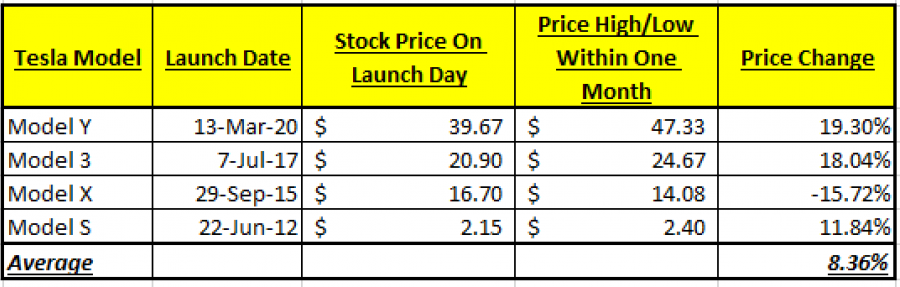

- STATISTICS: TESLA STOCK PRICE WITHIN A MONTH AFTER A NEW MODEL LAUNCHED.

Data Source: Bloomberg

*- Prices Have Been Adjusted For Recent Stock Splits

Please note that past performance does not guarantee future results.

- Q3 CAR DELIVERY (October 2). Tesla delivered 435,059 cars in Q3. This was down from its Q2 record when it released 466,140 cars, beating Q1 2023 record of 422,875. Still the company is expected to deliver 1.8-1.9 million cars in 2023, which would be 37% to 44.6% up from 2022.

TESLA: PRICE ACTION

- THE STOCK HAS TRADED AROUND 50% BELOW ITS ALL- TIME HIGH OF $414.4 (November 4, 2021). Tesla was last trading around $209, and if a full recovery follows to recent all- time highs, the stock could see an upside of around 98%. However, the price could decline further.

- ANALYSTS OPINIONS: Morgan Stanley forecasts $380. Wedbush forecasts $310. Citigroup forecasts $255. Muziho forecasts $310. Barclays forecasts $260.

#TSLA, November 2, 2023

Current Price:209

|

Tesla |

Weekly |

|

Trend direction |

|

|

380 |

|

|

310 |

|

|

250 |

|

|

170 |

|

|

160 |

|

|

150 |

Example of calculation based on weekly trend direction for 1 Lot1

|

Tesla |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

171,000.00 |

101,000.00 |

41,000.00 |

-39,000.00 |

-49,000.00 |

-59,000.00 |

|

Profit or loss in €2 |

161,016.95 |

95,103.58 |

38,606.40 |

-36,723.16 |

-46,139.36 |

-55,555.56 |

|

Profit or loss in £2 |

140,394.09 |

82,922.82 |

33,661.74 |

-32,019.70 |

-40,229.89 |

-48,440.07 |

|

Profit or loss in C$2 |

236,116.80 |

139,460.80 |

56,612.80 |

-53,851.20 |

-67,659.20 |

-81,467.20 |

1. 1.00 lot is equivalent of 1000 units

2. Calculations for exchange rate used as of 08:56 (GMT) 11/02/2023

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Senior Account ManagerClient Manager regarding their use.

- You may wish to consider closing your position in profit, even if it is lower than suggested one

- Trailing stop technique can protect the profit – Ask your Senior Account ManagerClient Manager for more detail