Tesla (#TSLA) weekly special report based on 1 Lot Calculation:

TESLA: THE COMPANY

- Tesla produces several Electric Vehicles (EVs) including the Model 3, Model X, Model Y, Model S, and since recently, the Cybertruck. Tesla also delivers the Semi-Truck.

- STOCK INDEX PARTICIPATION: Tesla stock is part of both the NASDAQ 100 (USA100) index and the S&P 500 (USA500) index.

- “WE, ROBOT” EVENT (OCTOBER 10). CYBERCAB: Elon Musk reached the stage in a "Cybercab" which he said will go into production in 2026 and be priced at less than $30,000. He also said he expects Full Self-Driving (FDS) technology to be available on Tesla's popular Model 3 and Model Y vehicles in Texas and California next year. ROBOVAN: Musk also showcased a larger, self-driving vehicle - Robovan - capable of carrying up to 20 people. OPTIMUS HUMANOID ROBOT: The company showcased its black-and-white Optimus humanoid robots, which performed dance moves in a futuristic gazebo after walking a short distance. Musk estimated their price at $28,000 to $30,000, with capabilities like babysitting, mowing lawns, and fetching groceries (Source: Reuters).

- MARKET SHARE: Tesla is still the largest seller of pure battery-powered Electric Vehicles (EVs) in the world and an absolute leader in the US (taking up between 60%-70% market share).

TESLA: EVENTS

- EVENT (WEDNESDAY, JANUARY 29, AFTERMARKET): Q4 EARNINGS REPORT EXPECTED TO PRINT RECORD HIGH QUARTERLY REVENUES. The company is expected to print $27.33 billion in revenue (a new record high), up 8.5% from Q3’s $25.18 billion, and up around 8.6% from the same period last year ($25.16 billion). Tesla is expected to print $2.66 billion in net income, up around 20% from Q3’s $2.21 billion and up around 33.3% from the same period last year ($2 billion) (Source: Bloomberg).

- LAST TIME (Q3 EARNINGS RELEASED ON OCTOBER 23, 2024, AFTERMARKET): Tesla missed revenue estimates of $25.37 billion dollars printing a figure of $25.18 billion dollars for Q3 of 2024. Meanwhile, the company printed Earnings Per Share of $0.72, beating analysts’ estimates of $0.58. STOCK PERFORMANCE ON OCTOBER 24, 2024: The stock rose 22.64% to hit a session high of $261.61, up from its open price of $213.30.

Please note that past performance does not guarantee future results

TESLA: OTHER EVENTS AND ANALYSIS

- TESLA TO LAUNCH ITS AFFORDABLE “MODEL Q” IN THE FIRST HALF OF 2025. According to reports shared during a Deutsche Bank investor conference by Tesla’s Investor Relations head, Travis Axelrod, the company plans to release this entry-level electric vehicle in the first half of 2025. After subsidies in North America, the Model Q is expected to cost less than $30,000, making it Tesla’s most accessible model yet.

TESLA: HOW DOES THE COMPANY PERFORM UNDER DONALD TRUMP AS PRESIDENT OF THE USA

- PRESIDENTIAL ELECTION 2024: DONALD TRUMP WON HIS SECOND TERM AND WILL TAKE OFFICE ON JANUARY 20, 2025. The Tesla stock is expected to rise in volatility as CEO Elon Musk has openly supported Donald Trump. Analysts have agreed that in case Donald Trump won, then companies owned by Elon Musk, including Tesla, could see some benefits.

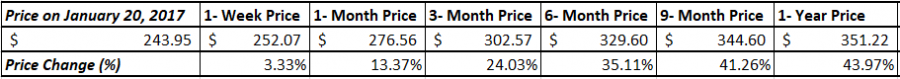

- HISTORICAL PERFORMANCE: THE STOCK ROSE 43.97% DURING THE FIRST YEAR OF TRUMP’S PRESIDENTIAL TERM (JANUARY 20, 2017 – JANUARY 20, 2018):

Data Source: Bloomberg Terminal; Meta Trader 4 Platform;

Please note that past performance does not guarantee future results

TESLA: RECENT PRICE ACTION

- TESLA STOCK HIT A NEW ALL-TIME HIGH IN LATE 2024: Tesla hit an all-time high of $487.99 (December 18, 2024). The stock currently trades around $397 and if a full recovery to its recent all-time highs takes place then it can offer an upside of around 23%. However, the stock price could decline as well.

- WEDBUSH DAN IVES RAISED ITS PRICE TARGET TO $515 A SHARE FROM $400 PREVIOUSLY. Bull case is $650 for 2025. According to them, A.I./autonomous segment is worth at least $1 trillion. The Trump White House would be a total game changer for the autonomous and A.I. story for Tesla and Musk over the coming years.

#TSLA, JANUARY 10, 2025

Current Price: 397

|

Tesla |

Weekly |

|

Trend direction |

|

|

650 |

|

|

515 |

|

|

450 |

|

|

350 |

|

|

320 |

|

|

300 |

Example of calculation based on weekly trend direction for 1 Lot1

|

Tesla |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

253,000 |

118,000 |

53,000 |

-47,000 |

-77,000 |

-97,000 |

|

Profit or loss in €2 |

245,560 |

114,530 |

51,441 |

-45,618 |

-74,736 |

-94,147 |

|

Profit or loss in £2 |

205,728 |

95,952 |

43,097 |

-38,218 |

-62,613 |

-78,876 |

|

Profit or loss in C$2 |

364,447 |

169,979 |

76,347 |

-67,704 |

-110,919 |

-139,729 |

1. 1.00 lot is equivalent of 1000 units

2. Calculations for exchange rate used as of 10:30 (GMT) 10/01/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.